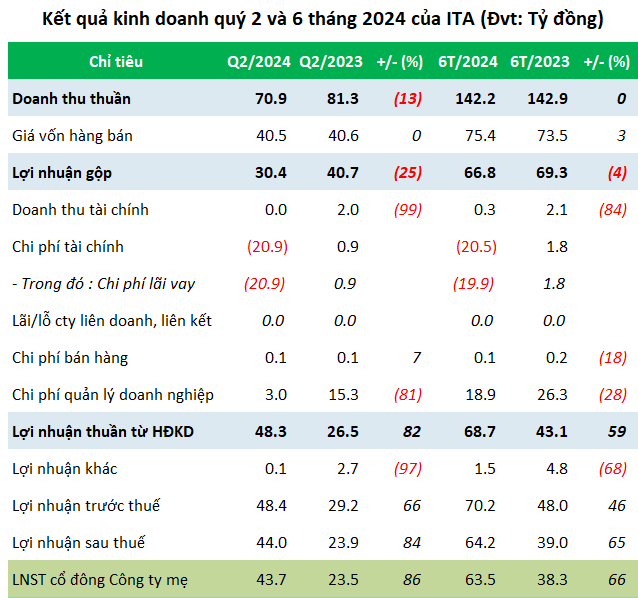

ITA recorded nearly VND 71 billion in net revenue in Q2 2024, a 13% decrease year-on-year. After deducting the cost of goods sold, gross profit declined by 25% to over VND 30 billion.

The company attributed the decrease in gross profit to the ongoing negative impact of the decision to initiate bankruptcy proceedings, made by the Ho Chi Minh City People’s Court on January 25, 2018, and the subsequent appointment of an asset management and liquidation official on April 15, 2022. These events have resulted in the company facing challenges in obtaining bank loans, and many investors have halted negotiations regarding the purchase, sale, or lease of land and factories.

However, the company recorded a net profit of nearly VND 44 billion, an increase of 86%, thanks to the reversal of provisions for doubtful accounts receivable and a reduction in bank interest expenses of nearly VND 21 billion. Additionally, a significant 81% decrease in selling and administrative expenses, totaling VND 3 billion, contributed to the improved bottom line.

Source: VietstockFinance

|

With positive results in Q2, ITA’s net profit for the first half of 2024 reached nearly VND 64 billion, a 66% increase. In comparison to the 2024 plan, the company achieved 27% and 36% of the targets for total revenue and net profit, respectively.

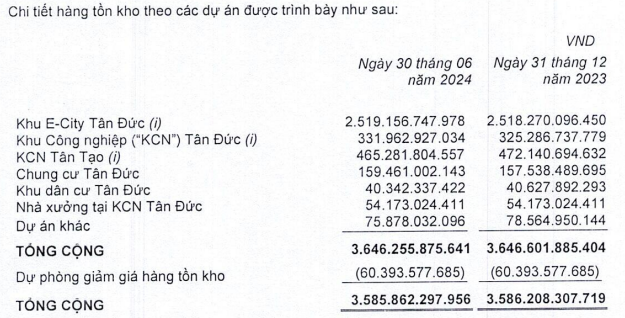

As of June 30, 2024, ITA’s total assets were valued at nearly VND 12,245 billion, a slight increase of 1% from the beginning of the year. This included over VND 100 billion in cash, double the amount at the start of the year, and short-term receivables of VND 1,923 billion, a 51% increase. Meanwhile, inventory remained unchanged at nearly VND 3,586 billion, accounting for 29% of total assets, with the majority concentrated in the E-City Tan Duc project, totaling over VND 2,519 billion.

ITA Receives Approval for Adjustment to Investment Policy for Another Project in Long An Province

Source: ITA

|

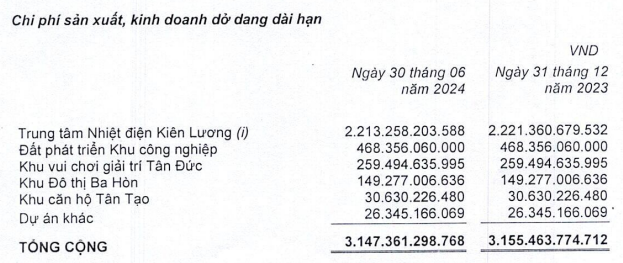

Long-term production and business expenses remained unchanged at VND 3,147 billion, accounting for 26% of total capital sources, with the majority attributed to the Kien Luong Thermal Power Center project, totaling over VND 2,213 billion.

Chairwoman Dang Thi Hoang Yen: ITA has been Sabotaged by Malicious Forces

Source: ITA

|

As of the reporting date, ITA’s total liabilities stood at nearly VND 1,879 billion, a 5% increase from the beginning of the year. Financial borrowings increased significantly to VND 129 billion, almost triple the amount at the start of the year.

Tan Tao: If ITA’s Shares are Delisted, the SSC and HOSE Must Take Responsibility

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.