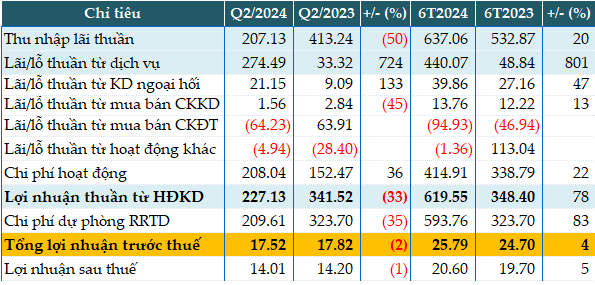

In Q2 2024 alone, core revenue plummeted by 50% compared to the same period last year, reaching just over VND 207 billion.

On the other hand, service revenue witnessed a remarkable eightfold increase, generating VND 274 billion. Foreign exchange operations also yielded profits of over VND 21 billion, more than doubling the figure from the previous year. Conversely, investment securities and other activities incurred losses.

Consequently, the bank’s net profit from business operations stood at over VND 227 billion, indicating a 33% decline year-on-year. Despite a 35% reduction in provisioning expenses, amounting to nearly VND 210 billion (accounting for 92% of net profit), BaoVietBank‘s pre-tax profit experienced a 2% dip, settling at VND 18 billion.

For the first six months of the year, the bank’s net profit from business operations climbed to nearly VND 620 billion, marking a substantial 78% increase from the previous year. However, with a significant 83% jump in provisioning for credit risks, totaling VND 594 billion, the bank’s pre-tax profit rose by a modest 4%, reaching nearly VND 26 billion.

|

BaoVietBank’s Q2 2024 Financial Results (in VND billions)

Source: VietstockFinance

|

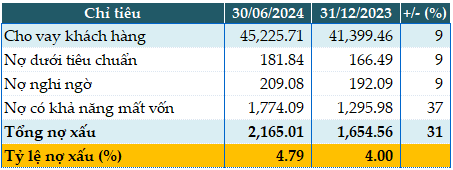

As of the end of Q2, the bank’s total assets had grown by 15% since the beginning of the year, reaching VND 97,062 billion. Customer loans and deposits also increased by 9% and 8%, respectively, with loans reaching VND 45,225 billion and deposits amounting to VND 56,880 billion.

|

BaoVietBank’s Loan Quality as of June 30, 2024 (in VND billions)

Source: VietstockFinance

|

BaoVietBank‘s loan quality continued to deteriorate, with total non-performing loans as of June 30, 2024, reaching VND 2,165 billion, a 31% increase since the start of the year. Consequently, the non-performing loan ratio climbed from 4% at the beginning of the year to 4.79%.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.