In the international market, the DXY index dipped slightly by 0.05 points over the week, settling at 104.32.

Despite data releases last week indicating that the US economy grew faster than expected and inflation eased in Q2 2024, the US dollar saw only modest movements in the international market.

Specifically, the Q2 2024 gross domestic product (GDP) data for the US, released on July 25, showed a real growth rate of 2.8% after adjusting for seasonal and inflation factors. This figure exceeded the forecast of 2.1% by Dow Jones-surveyed economists and was significantly higher than the 1.4% growth in Q1.

In Q2 2024, the Personal Consumption Expenditures (PCE) price index – the Fed’s preferred inflation measure – rose 2.6% year-over-year, down from 3.4% in Q1. This indicates that inflationary pressures are cooling, a positive sign for both the economy and consumers.

The Fed’s July meeting will take place next week. Chairman Jerome Powell and his colleagues face a delicate balancing act: deciding between cutting interest rates too early or too late. However, with recent developments in inflation and the labor market, the likelihood of the Fed signaling a rate cut in September is becoming clearer.

Source: SBV

|

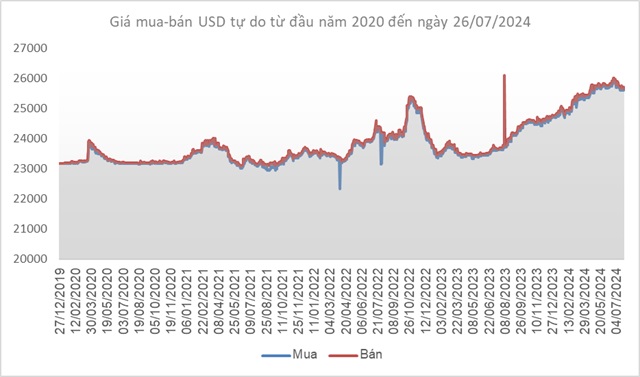

Domestically, the Vietnamese dong’s exchange rate center against the USD rose slightly by 3 VND/USD compared to the previous week (July 19), reaching 24,249 VND/USD in the July 26, 2024, session.

The State Bank of Vietnam (SBV) kept the immediate buying price unchanged at 23,400 VND/USD. Additionally, the immediate selling price remained at 25,450 VND/USD since April 19. This is the intervention selling price at which the SBV offers USD to banks with negative foreign currency positions to bring their positions back to zero.

Source: VietstockFinance

|

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…