The Gioi Di Dong JSC (coded MWG) has released its Q2 2024 financial report, posting impressive results. Net revenue reached VND 34,234 billion, a nearly 16% increase compared to the same period last year. Gross profit margin also improved significantly, climbing from 18.5% in Q2 2023 to 21.4%. Correspondingly, gross profit hit VND 7,308 billion, marking a remarkable 34% year-on-year surge.

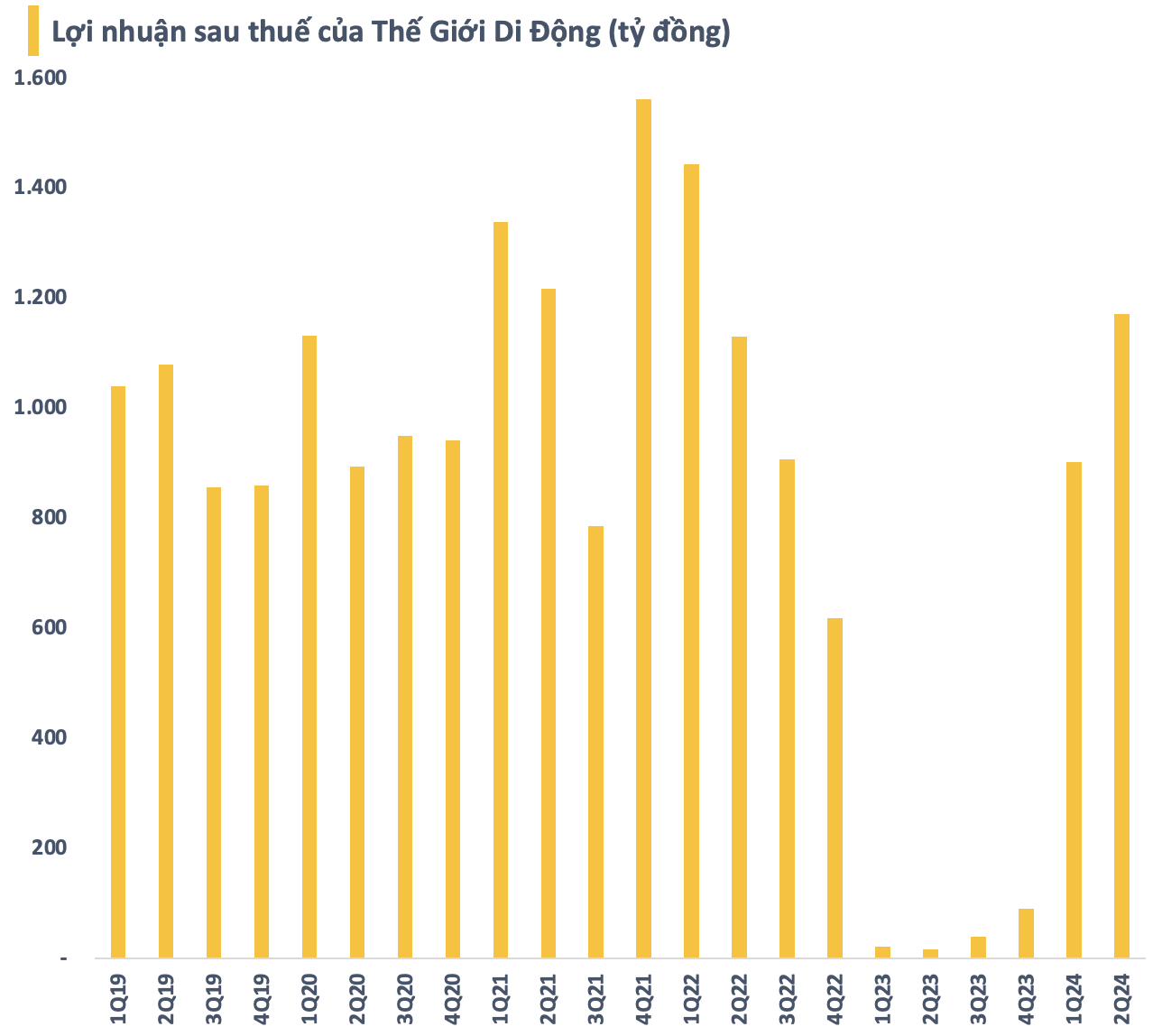

During this period, operating expenses witnessed a three-and-a-half-fold spike, surpassing VND 813 billion, primarily driven by employee-related costs. After accounting for expenses and recognizing losses from joint ventures, associates, and other sources, MWG’s net profit for Q2 stood at VND 1,172 billion. This represents a 69-fold increase (or 6,800%) compared to the same quarter in 2023. This is the fourth consecutive quarter of positive growth for the retail company, and the highest net profit in the last nine quarters.

For the first six months of the year, MWG recorded net revenue of VND 65,621 billion and a net profit of VND 2,075 billion, reflecting a 16% and 5,200% year-on-year increase, respectively. With these results, the company has achieved 52.5% of its annual revenue target and 86.5% of its net profit goal.

In the first half of 2024, the two chains, The Gioi Di Dong (TGDĐ) and Dien May Xanh (DMX), contributed a combined revenue of VND 44,200 billion, marking a over 6% increase compared to the same period and accounting for 67.5% of the total. In June alone, their revenue reached VND 7,300 billion, a 10% year-on-year increase, slightly down from the previous month as the peak season for air conditioners ended.

MWG attributed these positive results to strong performance across most product categories, particularly mobile phones, which continued to grow month-on-month, and TVs, which posted double-digit growth in June, benefiting from football-related events.

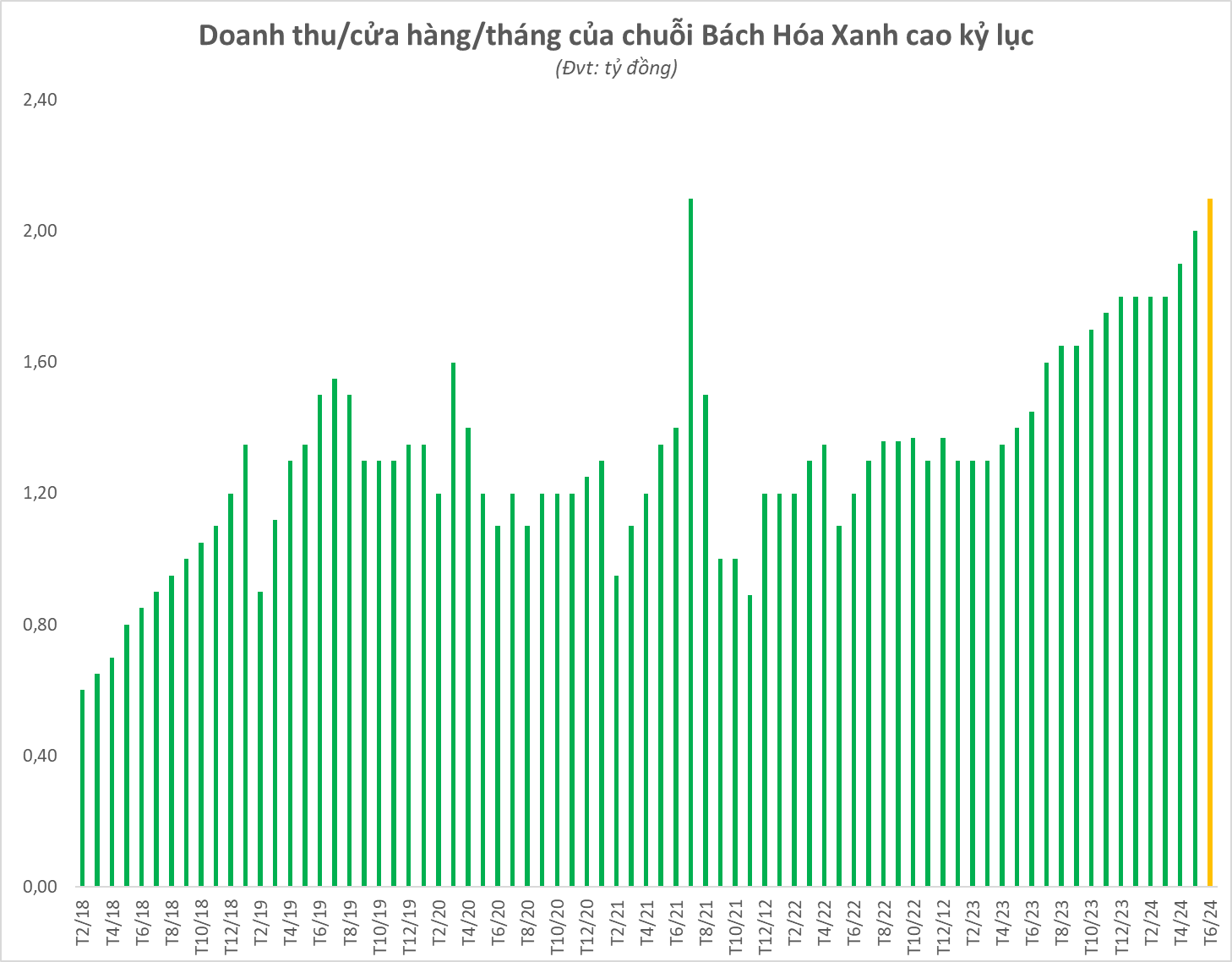

Turning to the Bach Hoa Xanh (BHX) chain, its six-month revenue reached VND 19,400 billion, surging by 42% year-on-year and contributing 29.7% to the total revenue—the highest proportion ever. In June, this supermarket chain generated nearly VND 3,600 billion in revenue, a nearly 5% increase compared to May, driven by growth in both key product categories: fresh produce and FMCGs.

Notably, in June, BHX set a new record with an average revenue of VND 2.1 billion per store per month. With these results, the MWG’s supermarket chain turned a profit of approximately VND 7 billion in Q2 2024, marking the first time it has reported a profit.

For the full year 2024, MWG has set ambitious targets, aiming for VND 125,000 billion in revenue, a 5% increase, and VND 2,400 billion in net profit, more than 14 times higher than the previous year. According to the company’s leadership, while consumer spending may remain flat or even decrease for non-essential items compared to 2023, MWG is well-positioned to navigate market fluctuations thanks to its healthy financial foundation and streamlined operations post-restructuring. Chairman of the Board, Nguyen Duc Tai, expressed confidence in the company’s ability to meet these targets.

As of June 30, MWG’s total assets stood at VND 65,870 billion, reflecting an increase of nearly VND 5,800 billion (or 10%) from the beginning of the year. Notably, cash and cash equivalents, along with short-term financial investments, amounted to nearly VND 31,000 billion, a VND 6,600 billion increase from the start of the year, representing 47% of total assets. In contrast, total financial borrowings decreased by approximately VND 2,000 billion compared to the beginning of the year, falling to VND 23,000 billion.

By the end of Q2, the number of TGDĐ stores (including Topzone) stood at 1,046, a reduction of 24 stores compared to the beginning of the month. Similarly, DMX also saw a decrease in store count, ending the month with 2,093 stores, 87 fewer than at the start of June. An Khang pharmacies also underwent a significant reduction, with 45 stores closing in June, bringing the total to 481.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.