## Quarterly Business Results of QCG from 2019 onwards

| A look at QCG’s quarterly business results from 2019 onwards |

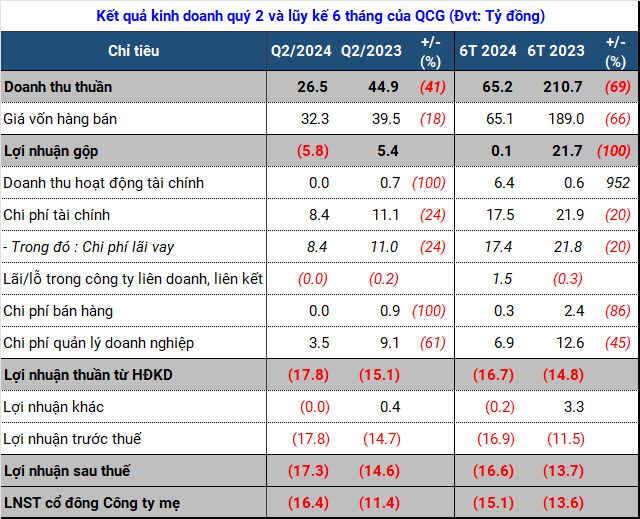

The second-quarter revenue stood at just over VND 26 billion, a 41% decrease year-on-year. With a cost of goods sold of VND 32 billion, the gross loss amounted to nearly VND 6 billion.

According to QCG, the decline in revenue can be attributed to the challenges faced by the real estate market as a whole. Additionally, the second quarter is typically before the rainy season, resulting in lower electricity production. Furthermore, rubber plantations only began operations in late May, contributing to the decrease in revenue compared to the previous year.

Specifically, electricity sales revenue reached nearly VND 15 billion, a reduction of more than half, while merchandise sales brought in almost VND 10 billion, a 15% drop. Real estate revenue, on the other hand, was a meager VND 2 billion, while there was no comparable figure for the previous year.

The real estate business also faced challenges due to depreciation and interest expenses, which remained constant regardless of production volume, leading to higher costs than revenue. Interest expenses for the period totaled VND 8.4 billion, a 24% decrease, while administrative expenses amounted to VND 3.5 billion, a 61% reduction.

Consequently, QCG incurred a net loss of VND 16.4 billion, a larger deficit compared to the VND 11.4 billion loss in the same period last year. For the first six months, the company recorded a net loss of VND 15 billion, while revenue decreased by 69%, amounting to over VND 65 billion.

Looking ahead to this year, QCG anticipates a pre-tax profit of VND 100 billion. The company aims for a revenue target of VND 1,300 billion, triple the amount achieved in 2023. However, after the first half, only 5% of the target has been accomplished.

To meet the projected profit, QCG will likely depend on the completion of the transfer of three hydropower plants in the last two quarters. Additionally, the company needs to finalize the adjustment of the 1/500 planning for the Marina Da Nang project and initiate procedures for sales in the fourth quarter.

Source: VietstockFinance

|

As of June 30, 2024, QCG’s total assets decreased by VND 192 billion compared to the beginning of the year, reaching VND 9,300 billion. Inventory remained largely unchanged, with a value of over VND 7,000 billion. This included VND 6,500 billion in real estate under construction. Advances to third parties amounted to VND 146 billion, reflecting an increase of VND 126 billion, with VND 122 billion added solely in the second quarter.

The scale of investments in joint ventures and associates decreased by VND 135 billion, settling at VND 547 billion. The main change during the first half was the divestment from Joint Stock Company Quoc Cuong Lien A.

At the end of the second quarter, QCG still had short-term payables of over VND 4,100 billion, accounting for nearly 90% of total liabilities. This included more than VND 2,800 billion received from Sunny Island for the Phuoc Kien project, VND 791 billion payable to third parties, and VND 476 billion payable to related parties.

According to the financial statement notes, the company is borrowing VND 272 billion from Joint Stock Company Real Estate Hiep Phuc (an associate company) and nearly VND 153 billion from Limited Company Construction and Housing Business Pham Gia (also an associate company). Additionally, they are borrowing nearly VND 24 billion from the Chairman of the Board of Directors, Mr. Lai The Ha, an increase of over VND 5 billion in the second quarter. The company is also borrowing VND 2 billion from Ms. Nguyen Thi Nhu Loan, a reduction from VND 78 billion at the end of the first quarter.

Short-term borrowings stood at VND 188 billion, almost halving due to a decrease in borrowings from individuals of VND 132 billion. Currently, QCG has short-term borrowings from the Vietnam-Russia Joint Venture Bank – Danang Branch, amounting to nearly VND 110 billion, to finance working capital. The company pays an interest rate of 8.5% per annum until the maturity date of May 25, 2025, and this loan is secured by land use rights and assets attached to land lots in Lien Chieu District, Da Nang City.

Long-term borrowings totaled VND 246 billion, a reduction of about VND 20 billion. This represents a loan from the Foreign Trade Joint Stock Bank (Vietcombank) – Gia Lai Branch to finance two hydropower projects, Iagrai 2 and Ayun Trung, which will mature in 2029.

| QCG’s Quarterly Debt Payment Situation from 2019 onwards |

Tu Kinh