Market liquidity increased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 685 million shares, equivalent to a value of more than 15.3 trillion VND. The HNX-Index reached over 45.9 million shares, equivalent to a value of more than 943 billion VND.

The VN-Index opened the afternoon session with a tug-of-war between buyers and sellers, but the buying side managed to keep the index in the green until the end of the session, despite selling pressure that weakened the previous uptrend. In terms of impact, VCB, VNM, GAS, and BID were the most positive influences on the VN-Index, contributing over 7.1 points to the index’s gain. On the other hand, HPG, HVN, PLX, and GVR were the most negative influences, taking away more than 2.3 points from the overall index.

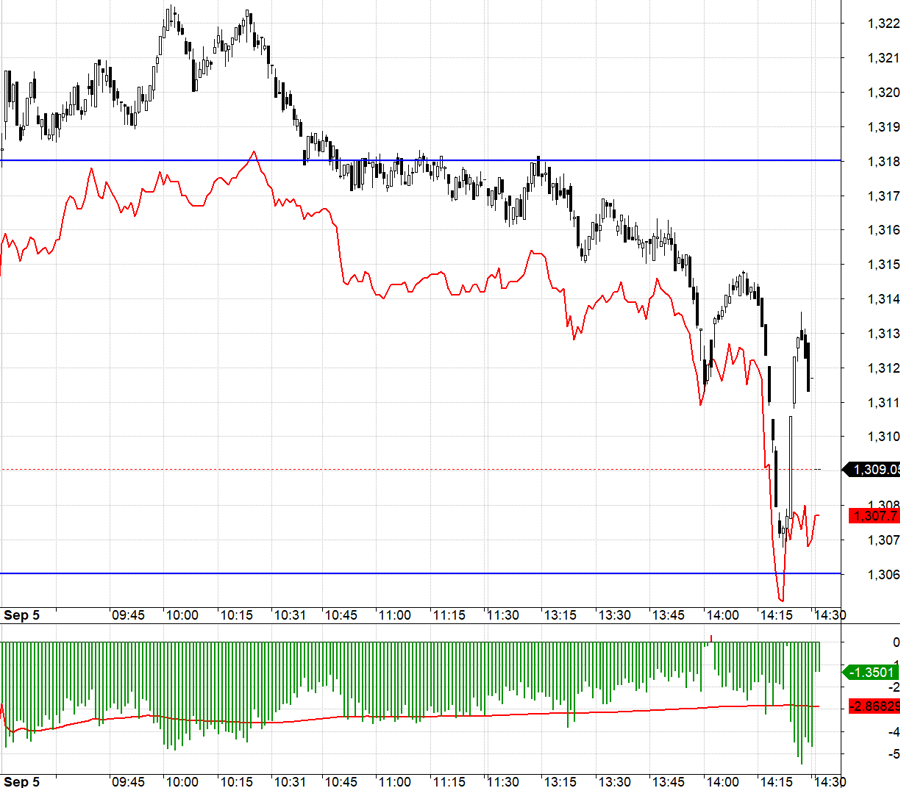

| Top 10 stocks impacting the VN-Index on July 31, 2024 |

In contrast, the HNX-Index had a less positive performance, impacted negatively by stocks such as DTK (-6.99%), VCS (-2.46%), SHS (-1.22%), and NTP (-1.76%), among others.

|

Source: VietstockFinance

|

The energy sector was the top performer, surging 3.18%, led by gains in BSR (+5.07%), PVD (+1.09%), and PVC (+0.73%). This was followed by the consumer staples and financial sectors, which rose 1.36% and 1.07%, respectively. On the flip side, the telecommunications services sector witnessed the steepest decline, plunging 4.41%, dragged down by losses in VGI (-5.48%), CTR (-3.45%), ELC (-0.21%), and FOX (-0.31%).

In terms of foreign trading activities, foreign investors continued to be net sellers on the HOSE, offloading over 653 billion VND worth of shares. The top stocks sold by foreign investors included VIC (898.3 billion VND), HSG (70.28 billion VND), CTG (56.77 billion VND), and TCB (41.21 billion VND). On the HNX, foreign investors net sold over 27 billion VND worth of shares, focusing on PVS (9.33 billion VND), IDC (6.55 billion VND), MBS (3.88 billion VND), and LAS (3.06 billion VND).

| Foreign Buying and Selling Activities |

Morning Session: Large-cap Stocks Surge, Propelling VN-Index Higher

The market witnessed a positive start to the session on July 31, with investor sentiment boosted by rising liquidity. Buying interest centered on large-cap stocks, driving the index higher. By the end of the morning session, the VN-Index stood at 1,255.02 points, up 9.96 points, or 0.8%. Meanwhile, the HNX-Index gained 0.28% to reach 236.53 points. Bullish momentum prevailed, with 342 stocks advancing and 273 declining. The VN30 basket outperformed, with 22 constituents rising and only 5 falling.

Trading volume on the VN-Index surged during the morning session, surpassing 357 million shares, while value exceeded 7.3 trillion VND. On the HNX-Index, volume and value reached nearly 27 million shares and almost 516 billion VND, respectively.

On the positive side, BID, VNM, and VCB were the top contributors to the VN-Index’s gain, adding over 5 points to the index. Conversely, HPG, BCM, and VIC went against the overall upward trend, dragging the index down by approximately 0.6 points.

Most sector indices traded in positive territory, with the energy sector taking the lead, surging 4.01%. This performance was mainly driven by strong gains in oil and gas stocks, including BSR (+5.99%), PVD (+2.01%), PVS (+0.49%), and PVC (+2.19%), among others.

The financial sector also shone brightly, climbing 1.17%. Within this sector, prominent “king” stocks witnessed robust upward momentum, such as BID (+3.31%), VCB (+1.03%), VPB (+2.16%), TCB (+0.65%), and MBB (+1.02%). Securities firms also joined the rally, with notable gainers including SSI (+0.63%), VND (+1.29%), VCI (+1.35%), FTS (+1.48%), and VIX (+6.64%).

On the flip side, the telecommunications services sector lagged, declining 1.73%. Most stocks within this sector were engulfed by a sea of red, including VGI (-1.43%), FOX (-1.78%), VNZ (-6.74%), and CTR (-2.76%), among others.

10:45 am: Financial Sector Supports VN-Index’s Recovery

Buoyed by optimistic investor sentiment, the main indices maintained their upward trajectory. As of 10:30 am, the VN-Index had climbed 5.68 points, hovering around the 1,250-point level. Meanwhile, the HNX-Index edged up 0.28 points, fluctuating around 236 points.

Money flowed into the VN30 basket, pushing most of its constituents into positive territory. Notably, HDB, VNM, MWG, and VPB contributed 1.98, 1.97, 1.36, and 1 points, respectively, to the overall index’s gain. Conversely, only a handful of stocks faced selling pressure, including FPT, VIC, HPG, and SSB, but their impact on the index was negligible.

Source: VietstockFinance

|

The energy sector continued to lead the market higher, advancing an impressive 1.2%. This performance was driven by gains in oil and gas stocks such as BSR, which rose 1.84%, PVD, up 0.73%, and PVC, climbing 0.73%.

Additionally, the financial sector attracted strong buying interest, reflecting its crucial role in the market’s recovery. Specifically, banks painted a positive picture, with notable gainers including MBB, which rose 0.82%, VPB, up 1.08%, TPB, climbing 1.39%, and TCB, advancing 1.09%. Moreover, securities firms also stood out, with VIX surging 6.64%, breaking free from its previous short-term downtrend. Other gainers in this sector included SSI, up 0.31%, SHS, rising 0.61%, and VCI, which climbed 1.57%.

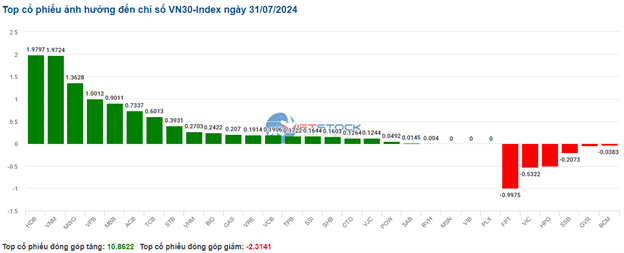

Riding the wave of the market’s recovery, the consumer staples sector also witnessed a positive performance. The sector’s price index has consistently outperformed the broader VN-Index for the past six months. Within this sector, several stocks attracted buying interest, including VNM, which rose 3.25%, DBC, climbing 0.77%, and VHC, advancing 1.13%.

Source: VietstockFinance

|

From a technical perspective, during the morning session of July 31, 2024, VNM stock continued its upward momentum, forming a Rising Window candlestick pattern. This upward movement was accompanied by rising trading volume, surpassing the 20-day average, indicating a return of optimistic investor sentiment after the stock successfully broke through its long-term downward trendline.

Furthermore, the MACD and Stochastic Oscillator indicators continued their upward trajectories, generating buy signals that further reinforced the stock’s ongoing recovery.

Source: VietstockFinance

|

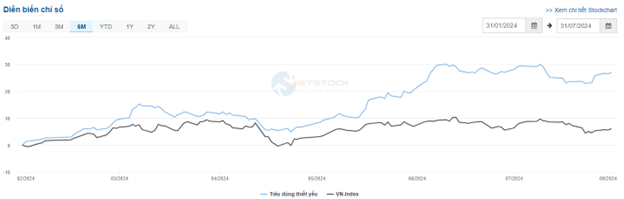

Compared to the opening of the session, the market breadth remained somewhat mixed, but buyers maintained their upper hand. There were 313 advancing stocks and 256 declining stocks.

Source: VietstockFinance

|

Market Open: Investors Remain Cautious

On July 31, at 9:40 am, the VN-Index opened over 6 points higher, hovering around the 1,250-point level. There were 18 stocks that hit the ceiling price, 290 advancing stocks, 1,097 stocks standing at the reference price, 195 declining stocks, and 9 stocks hitting the floor price.

The energy sector took the lead, with most of its constituents trading in positive territory. Notable gainers included BSR, which rose 1.84%, PVD, up 0.91%, PVC, climbing 0.73%, and PVS, advancing 0.25%. Meanwhile, the remaining stocks in this sector remained unchanged.

The utilities sector also witnessed a positive start, with most of its constituents recording gains. Specifically, GAS (+2.2%), NT2 (+0.5%), POW (+1.87%), VCP (+3.9%), SJD (+0.31%), and PPC (+0.36%) were among the top performers.

In contrast, the telecommunications services sector opened on a negative note, with most of its constituents trading in the red. Notable losers included VGI, which fell 1.83%, CTR, declining 1.53%, OCH, down 0.41%, and TTN, slipping 3.03%.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.