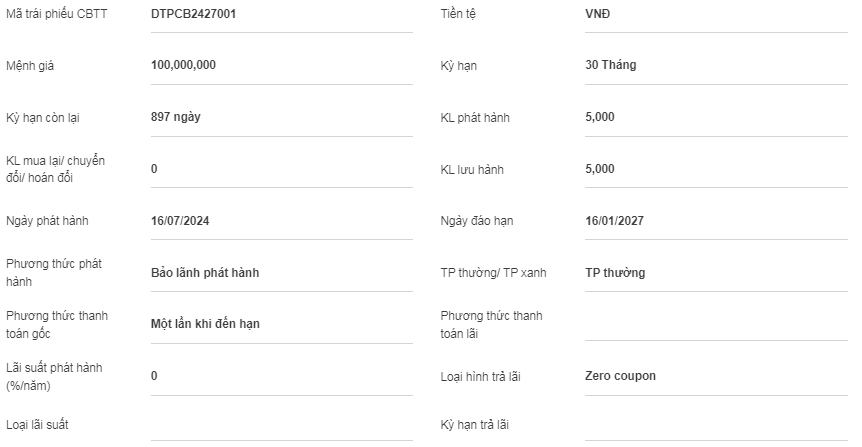

On July 22, Danang IT Park JSC announced the issuance of 5,000 bonds with the code DTPCB2427001, a face value of VND 100 million per bond, and a total issuance value of VND 500 billion at par.

The issuance was completed on July 16, 2024, with a maturity date of January 16, 2027, a term of 30 months, and a zero-coupon interest type.

Zero-coupon bonds are a type of bond that does not pay periodic interest. Zero-coupon bonds have two ways of paying interest: the interest can be paid in advance at the time of issuance (at a discount) or paid in a lump sum when the bond matures.

Discount bonds: when issued, the bonds are sold at a price lower than the face value. Bondholders do not receive periodic interest; they only receive the principal amount corresponding to the face value of the bond at maturity. Thus, the interest is the difference between the face value and the purchase price at the time of issuance, considered as interest received in advance.

Cumulative interest bonds: with this type, bond buyers will purchase the bonds at par. Interest accrues periodically, but bondholders do not receive periodic interest. Instead, the interest is added to the principal (face value) to calculate the interest for the next period. When the bond matures, the bondholder will receive a lump sum of both interest and principal, with the interest calculated cumulatively.

According to HNX data, this is Danang IT Park’s first bond offering, and the target audience for the offering includes professional individuals and organizations.

The bonds can be repurchased before maturity at the request of the issuing organization or the proposal of the bondholder. The repurchase price of each bond on the early repurchase date, as requested by the issuing organization, is determined by the issuance price plus accrued interest up to the early repurchase date, with an interest rate of 10%/year.

These bonds are non-convertible, do not have warrants attached, and are secured. The collateral is 100 million common shares issued by Trung Nam Renewable Energy JSC. Of these, nearly 79.6 million shares are owned by Trung Nam Investment and Energy Development JSC, and more than 20.4 million shares are owned by Mr. Nguyen Tam Tien – the authorized person to announce the bond issuance results.

It is known that Mr. Tien is the General Director of Trungnam Group, while Mr. Nguyen Tam Thinh is the Chairman of Trungnam Group’s Board of Directors. Mr. Nguyen Tam Thinh used to be the Chairman of the Board of Directors and legal representative of Danang IT Park. In early February of this year, this position changed from Mr. Nguyen Tam Thinh to Ms. Dao Thi Minh Hue. The company has a charter capital of VND 777 billion and one foreign shareholder, Paul Ta, holding 0.47%.

Established in 2012, Danang IT Park is the investor of the concentrated Danang Information Technology Park (DITP) phase 1. The DITP project has a planned area of 341 hectares and a total investment capital of VND 2,744 billion. Phase 1 covers an area of 131 hectares in Hoa Lien commune, Hoa Vang district.