In May 2023, Mr. Pham Van Hai from Nam Dinh province, Vietnam, borrowed 5 taels of SJC gold bars from his relatives to sell and use the money to buy a car. At that time, gold buyers were purchasing gold bars at a rate of over 66 million VND per tael, so Mr. Hai’s borrowed gold amounted to over 330 million VND in cash.

With the additional cash he had on hand, Mr. Hai purchased a car worth more than 600 million VND to serve his business needs. He planned that if his business went well, he would buy back the 5 taels of gold to repay his debt within a year.

“At that time, the gold price had reached a peak of 66 million VND, and I thought it couldn’t go any higher as it had never been that expensive before. I predicted that within a year, the price would drop again, remain stable, or at worst, increase slightly. So, when I promised to repay the debt within a year, I wasn’t too worried,” Mr. Hai recalled.

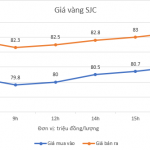

However, what Mr. Hai did not anticipate was that the gold price would not only fail to decrease but also soar continuously, causing his debt to balloon shortly after purchasing the car. There were times when the price exceeded 90 million VND per tael, filling Mr. Hai with utmost anxiety. At that point, his debt of 330 million VND had escalated to more than 460 million VND. Within a few months, Mr. Hai faced the risk of incurring a loss of up to 130 million VND.

Soaring gold prices leave many heavily indebted. (Illustrative image: Cong Hieu)

“Fortunately, the debt wasn’t due yet, but I lost sleep monitoring the gold price daily. Now that the government has intervened and stabilized the gold price, I feel a bit relieved. However, compared to a year ago, the amount I need to spend to buy back the 5 taels of gold to repay my debt is still much higher.”

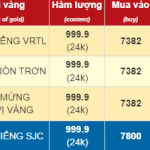

“Currently, the buying price for each tael is 78.3 million VND. So, my debt has increased to more than 390 million VND, which is 60 million VND higher than when I borrowed the gold. Indeed, you can never outsmart the market. I thought borrowing gold would help me avoid bank interest rates, but now I still have to spend tens of millions of dong to cover the price difference,” Mr. Hai said resignedly.

He added that just within a year, the value of his newly purchased car had depreciated by about 80 million VND, and the surge in gold prices had caused him a loss of over 60 million VND, resulting in a total loss of nearly 150 million VND from borrowing gold to buy a car.

Similarly, Mr. Quach Ha Duong from Thanh Tri, Hanoi, borrowed 8 taels of SJC gold bars and 1 tael of gold jewelry over a year ago to sell and use the money to buy a house. At that time, Mr. Duong sold the gold for nearly 600 million VND.

However, currently, the amount of money Mr. Duong needs to repurchase the 8 taels of gold bars and 1 tael of gold jewelry amounts to approximately 715 million VND. Meanwhile, his savings for this purpose total only about 200 million VND, leaving him in a very difficult situation.

“The amount of money I got from selling the gold was just under 600 million VND, but now the cost to buy back the gold to repay the debt has risen to 715 million VND. In just over a year, my debt has increased by 115 million VND. It’s hard to swallow such a bitter pill,” Mr. Duong said.

Moreover, although he now has the cash in hand, it is not easy for Mr. Duong to repurchase the 6 taels of gold bars to repay his debt. In recent days, he has registered to buy gold bars at the stabilized gold selling points of the State Bank of Vietnam but to no avail. The reason is that he is often too late when registering through the website, and each person is only allowed to purchase 1 tael of gold per registration. Meanwhile, large gold shops have temporarily stopped selling gold bars.

Anxious to repay his debt, Mr. Duong had to turn to the black market to find SJC gold bars. However, the price at these places is 4 million VND per tael higher than the stabilized rate. Therefore, by buying gold on the black market, Mr. Duong will again incur a loss of nearly 30 million VND.

“If I don’t buy from the black market, I don’t know when I’ll be able to buy enough gold to repay my debt, while the lender urges me daily as they also need the money and probably want to take advantage of the high prices to sell and make a profit. So, I have to bite the bullet and buy at a higher price to repay the debt and maintain my credibility with my relatives,” Mr. Duong said sadly.

Commenting on the significant losses incurred by those who borrowed gold and are now struggling to repay their debts due to the surge in gold prices, experts say that if it is an unavoidable situation, there is little choice but to accept it. However, for those who want to invest but lack a clear understanding of market mechanisms, this is an expensive lesson.

In reality, many people borrow or lend gold to invest in real estate, believing that real estate prices will always increase faster and higher than gold prices. So, they borrow gold, thinking they will profit from the investment. However, gold is a high-risk investment vehicle that can fluctuate unpredictably in the short term. On the other hand, real estate may not always be in high demand or easily liquidated.

Therefore, one should only invest after carefully considering their financial situation, anticipating potential risks, and formulating a plan to address those risks.

Economist Nguyen Tri Hieu shared his perspective: “Gold is an investment channel currently undergoing significant adjustments. If it’s not necessary, there’s no point in jumping into the gold market now and facing enormous risks beyond your control.”

According to the expert, borrowing gold should be avoided as, in recent years, gold prices have frequently fluctuated rapidly and continuously, leaving borrowers unable to react in time and resulting in their debt increasing day by day.