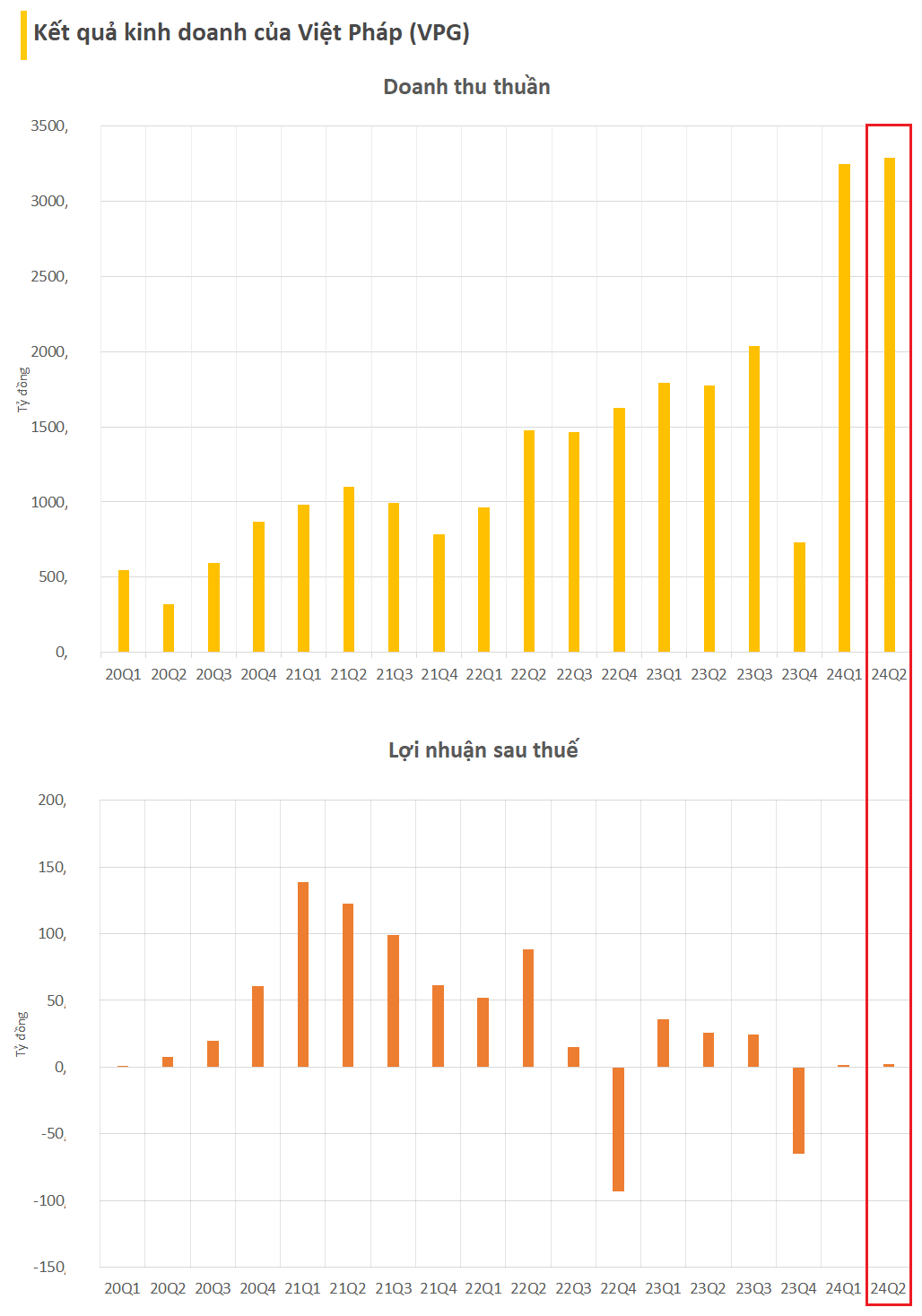

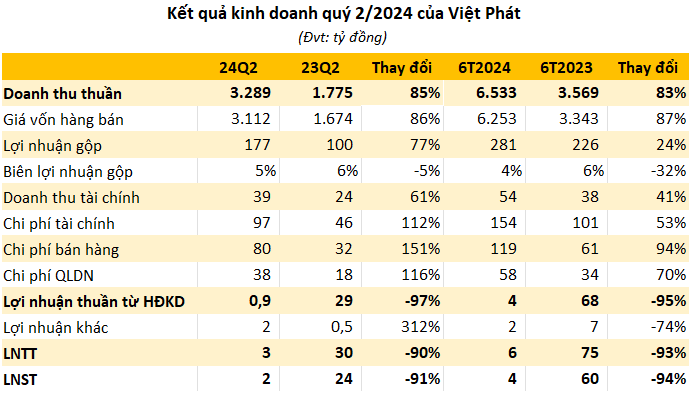

Vietnam Investment and Import-Export Commercial Joint Stock Company (VPG) announces its Q2 2024 financial statements, highlighting a significant 85% year-over-year surge in net revenue to VND 3,289 billion. This figure also represents a slight increase from the preceding quarter, marking the highest quarterly revenue in VPG’s operational history.

VPG’s primary revenue stream stems from thermal coal, which generated VND 2,391 billion, nearly triple the amount from Q2 2023. Additionally, revenue from coke coal and iron ore reached VND 552 billion and VND 306 billion, respectively, with the former witnessing a 4% decrease and the latter a 20% increase compared to the same period last year.

Gross profit margin contracted from 6% in Q2 2022 to 5% in the current quarter, amounting to VND 177 billion, as cost of goods sold accounted for a substantial proportion.

Financial income rose by 61% to VND 39 billion, but financial expenses doubled year-over-year to VND 97 billion. Over VND 55 billion of this was attributed to foreign exchange losses, while the remaining VND 42 billion was spent on interest payments. Selling expenses and general and administrative expenses also witnessed substantial increases compared to the previous year.

After accounting for various expenses, VPG’s net profit for Q2 2024 stood at over VND 2 billion, reflecting a significant 91% decline compared to the corresponding period in 2023.

According to the company’s explanation, the sharp drop in profit was due to a more than 20% decrease in gross profit from the thermal coal segment, coupled with a significant rise in financial expenses attributed to increased production in this segment, which necessitated additional capital mobilization. The substantial increases in selling and general and administrative expenses further eroded the company’s profits.

For the first half of 2024, VPG’s net revenue climbed by 83% year-over-year to VND 6,533 billion. However, net profit plummeted by 94%, resulting in a meager VND 4 billion.

This year, VPG set ambitious targets, aiming for VND 10,500 billion in net revenue and VND 150 billion in net profit. As of the end of the first half, the company has accomplished 62% of its revenue goal but less than 3% of its profit target.

Founded in 2008, Vietnam Investment and Import-Export Commercial Joint Stock Company (VPG) began as a domestic transportation service provider. Today, its primary operations encompass the trading, import, and export of iron ore and coal for steel mills and thermal power plants, alongside additional services such as transportation and warehousing. VPG is a leading supplier of raw materials to prominent steel manufacturers, including Hoa Phat, Gang Thep Thai Nguyen, DONGBU, and SAMINA. The company also provides coal to thermal power plants operated by EVN and PVN. In 2023, VPG expanded its business in the thermal coal sector by successfully bidding for contracts at Song Hau 1 and Vung Ang 1 Thermal Power Plants.

The company has diversified its import market for coke coal and ore, establishing partnerships with entities in Japan, Switzerland, and Singapore, such as Daichu Corporation, Glencore International AG, and Noble Resources International PTE LTD.

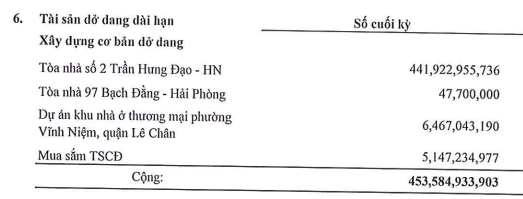

Moreover, VPG has ventured into the real estate sector and possesses prime land assets. The company is currently developing five prestigious projects in Hai Phong and Hanoi, including a commercial housing project in Vinh Niem Ward, Le Chan District (branded as Vietnam South City); the Bac Song Cam project; the Viet Phat Inland Port project; and a building at 2 Tran Hung Dao Street, Hoan Kiem District, Hanoi…

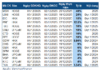

As of Q2 2024

As of June 30, 2024, the company’s total assets stood at VND 7,256 billion, with cash and cash equivalents accounting for VND 526 billion, a 66% decrease from the beginning of the year. Inventory increased by 20% to VND 3,586 billion, while short-term receivables from customers reached VND 1,169 billion, more than triple the amount at the start of the year.

VPG’s total liabilities amounted to VND 5,760 billion, predominantly comprised of short-term debt totaling VND 5,476 billion, reflecting an increase of nearly VND 650 billion compared to the beginning of the quarter. Meanwhile, equity stood at only VND 1,497 billion, resulting in a debt-to-equity ratio of over 3.8 times (indicating that the company’s assets are predominantly financed by external debt). According to the notes, VPG had over VND 750 billion in payables to suppliers, nearly VND 1,950 billion in short-term borrowings, and over VND 285 billion in long-term debt.

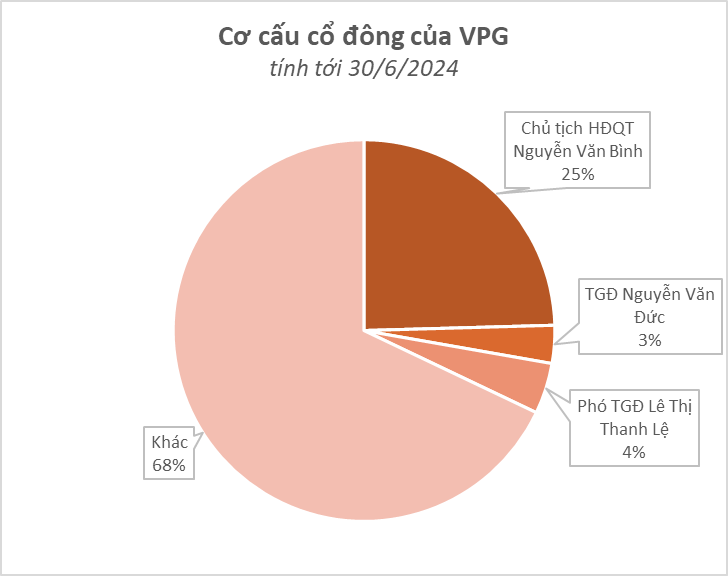

As of June 30, 2024, VPG’s largest shareholder, Chairman of the Board of Directors, Nguyen Van Binh, held 21.7 million VPG shares, representing a 25.8% stake. Vice General Director Le Thi Thanh Le owned 3.8 million shares (4.3% stake), while Board Member and General Director Nguyen Van Duc held over 2.8 million shares (3.2% stake).

On the market, VPG shares are currently trading at VND 12,300 per share, reflecting a decline of approximately 24% since the beginning of 2024.

Market on 8/2: Oil prices rise, dong hits 3-week low, cocoa at all-time high

The trading session on 07/02 ended with an increase in oil prices due to the decrease in US fuel inventories. Meanwhile, gold remained stable, and the dollar hit its lowest point in 3 weeks. Additionally, cocoa prices reached their highest level in history ahead of Valentine’s Day.

Market Update 22/02: Oil Up 1%, Gold Rises, Aluminium at Highest in 3 Weeks

Closing trading on 21/02/2024, the Middle East conflict and the fragile hope of an early interest rate cut by the Fed have pushed oil and gold prices higher. Iron ore has further declined due to concerns over prolonged weak demand from China. Aluminium reached a three-week high due to new US sanctions risks. Cocoa has reached a record high due to tightening supply. Corn has hit a three-year low, while soybeans and wheat have also declined. Japanese rubber has fallen consecutively due to a decrease in Nikkei, and the yen is stronger.