Crude oil gains 1% on signs of tightening supply

Crude oil prices rose 1% as political tensions in the Middle East and signs of tightening short-term supply weighed on traders’ minds.

U.S. West Texas Intermediate (WTI) crude futures rose 87 cents, or 1.1%, to settle at $77.91 per barrel, while Brent crude futures rose 69 cents, or 0.8%, to $83.03 per barrel.

U.S. refineries are showing signs of coming back online after maintenance shutdowns that reduced activity to the lowest level since December 2022, which will boost crude oil inventories. Data from the U.S. Energy Information Administration showed that U.S. crude oil inventories increased by 7.17 million barrels.

Houthi attacks on commercial ships in the Red Sea and the Bab al-Mandab strait continued to raise concerns about the flow of goods through this crucial waterway. Drone and missile attacks have hit at least four ships since last Friday.

Gold rises on Middle East conflict

Gold edged higher as conflict in the Middle East fueled safe-haven demand, while the latest minutes from the U.S. Federal Reserve dampened hopes of an early interest rate cut.

Spot gold gained 0.1%, rising to $2,026.21 per ounce at 20:05 GMT. Earlier, the price had hit its highest level since February 9, 2024. Gold futures fell 0.3% to $2,034.30.

Gold bars are seen as a hedge against economic and political instability, while higher interest rates reduce the appeal of holding unproductive gold.

The Fed may lower the federal fund rate in June 2024, according to most economists surveyed by Reuters.

Platinum lost 2% to $882.76 per ounce, palladium fell 2.8% to $947.85, and silver dropped 0.3% to $22.92 per ounce.

Aluminum hits 3-week high on new U.S. sanctions risk

Aluminum prices hit their highest in three weeks as traders anticipated an announcement from the United States of sanctions against Russia over the death of opposition leader Alexei Navalny that could disrupt supply.

The U.S. sanctions mean any company in the aluminum industry that trades in USD will no longer be able to touch Russia’s metal. The issue could become more serious if the sanctions are retroactive, as 90% of the London Metal Exchange’s aluminum stocks are sourced from Russia.

Three-month aluminum on the London Metal Exchange touched $2,269 per tonne, reaching the highest price since February 1, 2024.

The U.S. will announce sanctions against Russia on Friday. They will target the country’s defense and industrial facilities.

China’s economic stimulus measures are also supporting base metal prices. China announced its largest cut to reserve requirements in 2024 on Tuesday to prop up the property market.

At close, nickel prices rose 2.9% to $16,820 after hitting $16,785 per tonne, a near 4-week high. The U.S. also has a 35% import duty on Russian nickel.

Among other metals, copper traded at $8,557.5, up 0.7%. Zinc rose 0.7% to $2,396, lead rose 1.3% to $2,074.5, and tin fell 1.1% to $26,125.

Iron ore falls on weak demand from China

Iron ore futures fell for a third straight session to hit the lowest in nearly four months on concerns of weak short-term demand in China.

Iron ore for May 2024 delivery on the Dalian Commodity Exchange closed down 3.98% at 893 yuan ($124.29) per tonne, the lowest close since October 31, 2023, after falling over 5% the previous day.

Iron ore on Singapore’s SGX futures exchange for March 2024 delivery slumped over 1.8% to $118.65 per tonne at 0702 GMT, also the lowest since October 31.

Analysts said the price drop was due to increased supply at a time when the recovery in demand is slower than expected after the week-long Lunar New Year holiday. Supply from major producers in Brazil and Australia is at higher levels compared to previous years; weather since the start of the year at major production centers has been better than the five-year average.

Coke and coking coal prices rose 6.19% and 3.79%, respectively. Steel rebar prices increased by 1.21%, while billet, hot-rolled coil, and stainless steel remained little changed.

Corn hits 3-year low, soybeans and wheat also fall

U.S. corn futures fell to a three-year low, inching closer to the $4 per bushel mark as abundant domestic grain supplies and strong prospects for a robust South American crop weighed on sentiment, analysts said.

Soybeans followed corn lower after a price rally the previous day, while wheat closed nearly unchanged.

Corn at the Chicago Board of Trade (CBOT) for March 2024 delivery fell 7-3/4 cents, or 1.85%, to $4.11 per bushel after touching $4.10, the lowest since November 2020. Soybeans for March 2024 ended down 18-1/4 cents at $11.60-3/4 per bushel. Wheat for May 2024 delivery fell 1-1/4 cents to $5.78 per bushel.

Soybeans declined as harvest proceeds in Brazil, even as analysts debate the scale of planting in South America.

Traders continued to watch for fresh demand signals from China, the world’s top soybean buyer, after the Lunar New Year holiday last week and as the government attempts to revive the real estate sector.

Meanwhile, expected rainfall in the coming days in Argentina’s Pampas region could bolster the outlook for corn and soybean production in the 2023/24 season, the Buenos Aires Grains Exchange said on Wednesday.

As of last Thursday, 32% of the soybean area in Brazil had been harvested, up 9% from the previous week and faster than last year’s pace, according to consultancy AgRural.

Cocoa hits record high on tightening supply

Cocoa futures prices in London and New York on the ICE exchange hit fresh record highs as tightening supply after poor harvests in Ghana and Ivory Coast lifted prices.

London cocoa futures for May 2024 rose 5.2% to 4,976 pounds per tonne, after setting a record high of 4,997 pounds. New York cocoa futures for May rose 4.1% to $5,861 per tonne after hitting a record high of $5,976.

Merchants noted dry, hot weather in Ivory Coast which could increase estimates of a global deficit in the 2023/24 season by as much as 500,000 tonnes.

Raw sugar futures settled little changed at 22.77 cents per lb after earlier setting a one-month low of 22.47 cents. White sugars for May closed little changed at $625.50 per tonne.

Merchants said rainfall in Brazil this week has bolstered prospects for the 2024 cane crop in the Center-South region, despite concerns that dry conditions early in the year will hurt production.

Robusta coffee for May 2024 rose 1% to $3,177 per tonne. Arabica coffee for May 2024 rose 1% to $1.8810 per lb.

Traders said robusta supplies remain tight in Europe even as high prices have prompted increased exports from leading producer Vietnam.

Vietnam exported a total of 238,366 tonnes of coffee in January 2024, up 67.4% from the same month a year ago, customs data showed on Wednesday. Brazil’s 2024 coffee crop is expected to reach 67 million bags, up 4.2% from the prior crop.

Japanese rubber falls again on weaker Nikkei, stronger yen

Japanese rubber futures fell for a second straight session to the lowest in four days as weaker stocks and a stronger yen weighed on investor sentiment, although higher oil prices limited losses.

Rubber for July 2024 delivery closed down 0.1 yen, or 0.03%, at 296 yen ($1.97) per kg, the lowest closing level since February 16, 2024. Rubber contracts on the Shanghai Futures Exchange (SHFE) for May delivery fell 20 yuan, ending at 13,550 yuan (1,885.90 USD) per tonne.

Japan’s Nikkei average ended the session lower. The yen strengthened to 150.01 versus the dollar, having recently hovered near a three-month low in previous sessions.

Rubber prices on Singapore’s exchange for March 2024 delivery rose 0.06% to 155.4 US cents/kg.

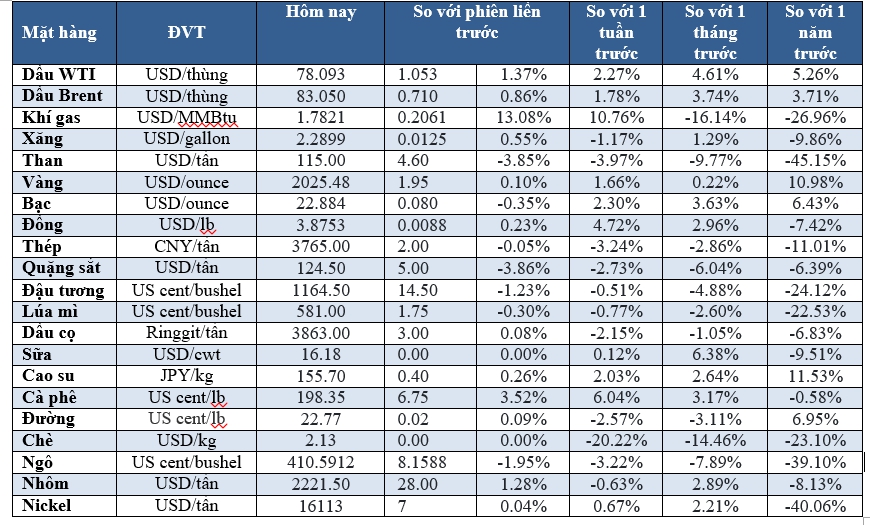

Key commodity prices on the morning of February 22, 2024