An Enviable Financial Picture

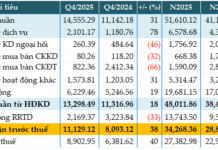

DPM’s results for the first half of 2024 exceeded expectations and targets, thanks to favorable market conditions and enhanced system governance. Specifically, net revenue and profit after tax for the second quarter reached VND 3,948 billion and VND 236 billion, respectively, a 6.5% and 123% increase year-on-year. The six-month cumulative profit after tax stood at VND 503 billion, equivalent to 93% of the annual plan and a 37% increase from the previous year. Tight cost control measures contributed to a gross profit margin improvement to 15.8% from 13.1% in the same period last year.

| DPM’s Quarterly Net Profit |

DPM maintains a healthy financial position with cash and bank deposits of over VND 9,700 billion, accounting for nearly 62% of total assets. As of the second quarter, the company’s total assets exceeded VND 15,700 billion. On the other side of the balance sheet, equity increased to VND 12,000 billion, while short-term financial debt remained low at VND 1,682 billion.

Urea Selling Prices Recover Slightly, and Consumption Volume Increases

In 2023, DPM faced challenges due to rising input gas prices driven by escalating oil prices and high transportation costs, while urea selling prices dropped significantly because of weak demand in key markets. However, the first half of 2024 witnessed a slight recovery in urea fertilizer prices after hitting a low in Q2 2023. This recovery occurred amid tightening global supply as China and Russia restricted exports, and some plants reduced capacity due to maintenance issues and gas shortages.

Urea prices in the first six months of 2024 were slightly higher than the 2023 average but remained relatively low, encouraging farmers to invest in production. As a result, DPM increased its urea consumption volume both domestically and internationally. In the first half of 2024, DPM’s urea consumption volume reached 501,000 tons, a 4% increase year-on-year. The slight increase in prices and consumption volume led to a modest rise in revenue but a significant boost in profits.

Positive Developments in NPK Business Due to Lower Input Costs

NPK business volume for the first six months reached 87,000 tons, completing 61% of the annual plan and a 21% increase year-on-year. With favorable weather conditions and improved affordability due to lower fertilizer prices and expected increases in rice and coffee prices, the consumption of agricultural products like rice and coffee is projected to rise, boosting the demand for fertilizers. The growth is supported by favorable weather conditions for agricultural production and improved affordability due to lower fertilizer prices and expected increases in rice prices. NPK consumption volume is also expected to continue its positive trajectory in 2024 due to factors such as reduced selling prices stimulating demand, potential market share gains in the high-quality NPK segment, and the NPK plant operating at higher capacity. Additionally, lower input costs have contributed to improved profits for DPM.

Stable Macroeconomic Conditions

Overall, the first half of 2024 saw stable developments in the domestic and global fertilizer markets, with prices recovering in Q2 after a downturn in Q1. The average selling price of urea at the beginning of July rebounded to USD 321/ton FoB, compared to USD 307.9/ton at the end of 2023 and a 14.4% increase year-on-year.

The market is now awaiting the outcome of India’s new tender to determine short-term price trends. This recovery reflects positive consumption growth amid China’s continued policy of restricting urea exports and reducing production capacity in some other regions. The domestic market is supported by positive sentiment from the global market and improved buying power as the southern region enters the rainy season after a prolonged heat wave. Moreover, the continuous rise in agricultural product prices has significantly enhanced farmers’ purchasing power.

Forecasts for the Second Half of 2024

Several favorable conditions will continue to drive the fertilizer industry, including DPM. Recovering selling prices and purchasing power will enhance operational efficiency and consumption volume. High agricultural product prices and expanded export markets will encourage farmers to invest in and expand their production.

However, it is essential to consider certain factors, such as potentially higher input costs than planned and the previous year, leading to increased production costs. Exchange rate pressure affects the prices of raw materials, production equipment, goods, etc. The VAT policy has not been adjusted to favor domestic fertilizer production and businesses.

To proactively address these forecasts, DPM will actively enhance the reputation of Phu My Fertilizer brand in the market and expand its distribution system to reach more consumption areas nationwide.

Restructuring and Innovating Governance and Business Models

Recently, following leadership changes, DPM has embarked on a comprehensive restructuring, updating its development strategy, and innovating its governance and business models. In the last six months of 2024, DPM’s management focuses on efficiently, safely, and stably operating the plants, prioritizing cost reduction and product quality enhancement. The company also emphasizes market monitoring and forecasting to make optimal business decisions, considering business model and distribution system adjustments to align with market dynamics. Additionally, DPM aims to seize export opportunities to alleviate the pressure of excess supply in the domestic market.

To enhance transparency, DPM plans to host an Investor Conference in Q4 2024 to establish a direct connection between the company and investors.

Thien Van

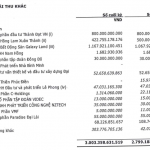

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

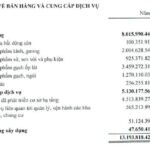

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.