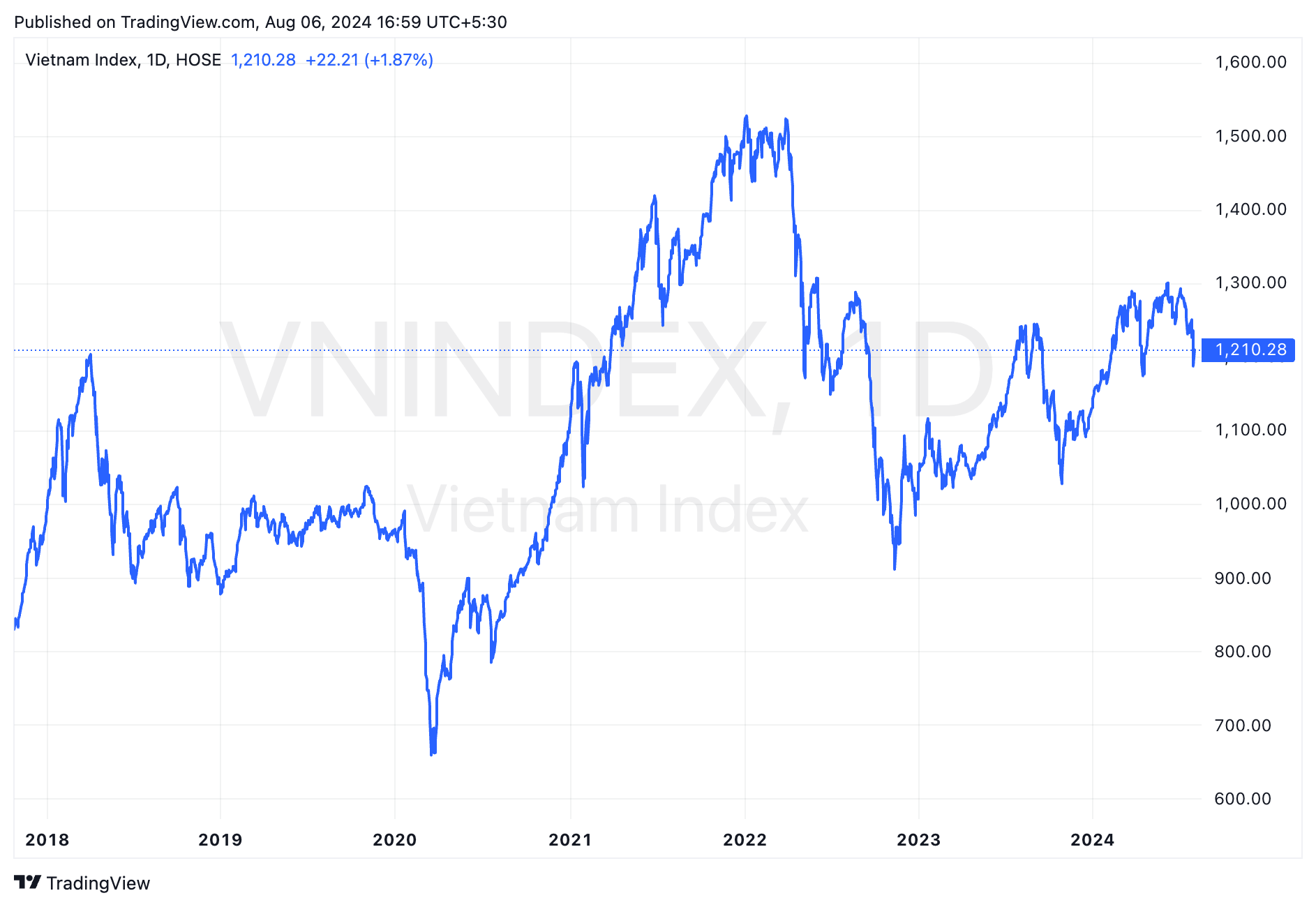

The Vietnamese stock market witnessed a strong recovery on August 6th and maintained its momentum until the end of the trading session. The VN-Index closed at 1,210.88 points, reflecting a notable increase of 1.87%. However, foreign transactions were a downside, as they net sold with a value of nearly VND 755 billion in the market.

Most securities companies believe that the market has not yet established a sustainable upward trend. Investors are advised to remain cautious, avoid chasing purchases, and temporarily observe market movements.

VNINDEX_2024-08-06_18-29-42.png

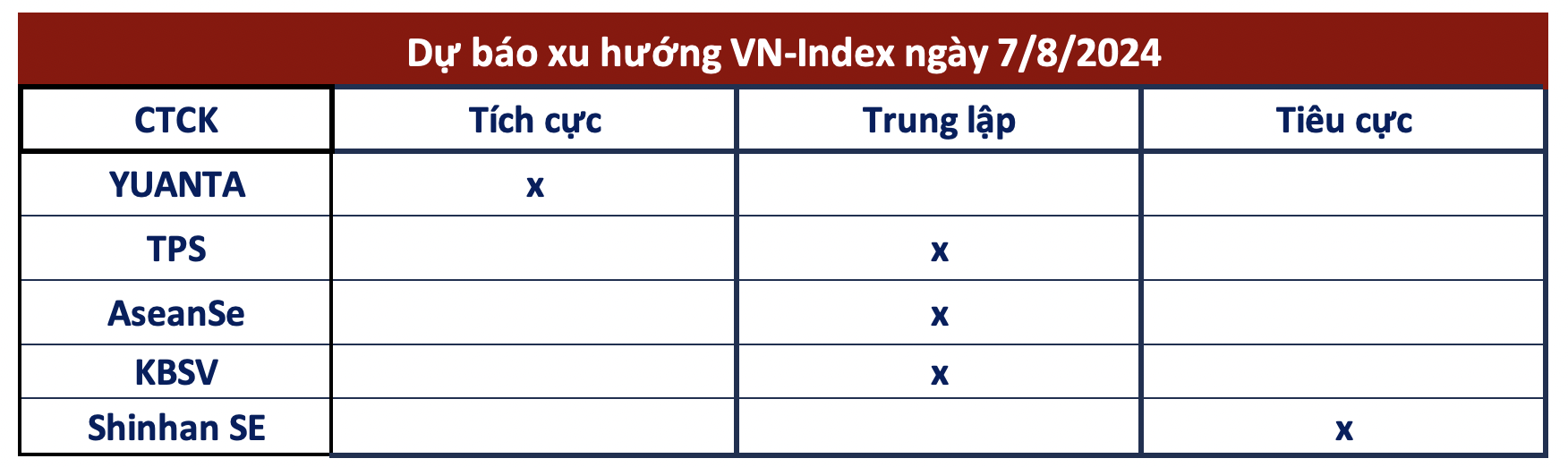

Following the significant gain, Yuanta Securities anticipates that the market is likely to continue its recovery trend in the next session, with the nearest resistance level for the VN-Index being 1,240 points. The supply pressure is expected to gradually increase, testing low-priced stocks, which may lead to a tug-of-war near the 1,200 – 1,210 range. A positive aspect is that the main indices and stocks are forming a bullish reversal pattern, and the short-term undervalued status provides a basis for expecting a short-term bottom for the market.

Yuanta recommends that short-term investors can continue to hold a low proportion of stocks and refrain from selling at this stage. If investors have a high proportion of cash, they can still consider making cautious purchases with a low proportion.

TPS Securities notes that some large-cap groups, such as financial services and banks, show signs of weakening downward momentum, which is a positive signal in the short term. However, more time is needed to confirm the market trend, and the 1,220-point support level needs to be regained this week to pave the way for positive scenarios for the VN-Index in the short and medium term.

Sharing a similar viewpoint, Asean Securities assesses that the market has temporarily achieved a balance thanks to the positive momentum from the inter-market. The recovery movement is in line with global trends, and the market is maintaining an oversold region, making the recovery understandable. However, the buying trend is not particularly aggressive, indicating that the current price range may not be sufficiently attractive in terms of valuation. Although the upward momentum is spreading, it is not robust. Therefore, a cautious stance is still preferred, and investors are advised to avoid chasing purchases and temporarily observe market movements, maintaining a medium-low proportion and awaiting the market to establish a bottom.

According to KB Vietnam Securities, market sentiment has temporarily stabilized after the sell-off. Nevertheless, the emergence of a rebound session without the index returning to the underlying support, coupled with the substantial latent pressure of high-priced supply, poses a high risk of an early trend reversal. Investors are advised to continue prioritizing reducing their portfolio proportions during early recovery sessions.

Exercising more caution, Shinhan Securities asserts that despite the recovery, the gain has not entirely offset the losses incurred previously. The short-term trend of the market remains downward, and there is a possibility of another decline to establish a second bottom. The current support and resistance levels are 1,175 and 1,240 points, respectively. Investors are advised to monitor market movements, await the formation of a new equilibrium price range, and prioritize selling during upward movements.