The VN-Index’s recovery couldn’t recoup all the losses from the August 5 session, but it did ease some of the psychological pressure on investors. There was no more panic selling, and the domestic stock market reacted positively at the opening bell, with the index climbing 12 points during the ATO session to return to the 1,200-point threshold. However, the market was once again tested during the morning session, struggling to hold on to the 1,200-point mark.

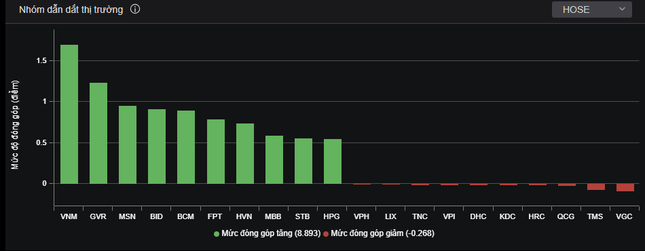

After the lunch break, many stocks extended their gains, with green dominating the market. The VN-Index once again conquered the psychological mark of 1,200 points. Of the VN30 basket, 28/30 stocks posted gains, with VNM leading the market drivers, closing up 4.8%. Large-cap stocks rose 3-5%, providing additional support to the main index, including BCM, STB, GVR, MSN, POW, SSI, PLX, and TPB.

Large-cap stocks lead the recovery.

Several sectors outperformed the broader market recovery, notably securities. More than 20 stocks rose, with BSI hitting the ceiling price. Money flowed into SSI, VIX, SHS, VND, HCM, FTS, VCI, and MBS. FTS closed near the ceiling price.

Some small-cap stocks also saw strong gains, closing at the ceiling price, such as HNG, DLG, and LDG. HBC, the construction firm, rose 5.6%, indicating bottom-fishing following news that Le Viet Hai’s brother had registered to buy 500,000 shares. Le Viet Hung, HBC’s senior advisor, registered to buy during the period from August 8 to September 6, citing portfolio diversification as the reason. Meanwhile, in a contrasting move, Huyndai Elevator Co., Ltd., a major shareholder of HBC, recently sold 5 million HBC shares due to the risk of this stock being delisted.

At the close, the VN-Index was up 22.21 points (1.87%) to 1,210.28. The HNX-Index gained 3.75 points (1.68%) to 226.46, while the UPCoM-Index climbed 1.43 points (1.58%) to 92.22. Liquidity fell sharply from the previous session to VND 13,800 billion. Foreign investors net sold VND 756 billion, focusing on VJC, FPT, AGG, and MWG.

Asian stocks also witnessed a broad recovery today, notably in the Japanese market, with the Nikkei 225 ending the August 6 session up 10.23% at 34,675 points. The Topix also rose 9.3% to 2,434.21 points. South Korea’s Kospi index climbed over 3%, while the small- cap Kosdaq gained more than 5%.

According to Barry Weisblatt David, Director of Analytics at VNDirect Securities, yesterday’s trading session presented a good buying opportunity, and he forecasts an improved outlook for the market in the latter part of 2024.

The Bank of Japan’s (BOJ) decision to raise interest rates has a minimal impact on Vietnam. Japan is only Vietnam’s sixth-largest export market. Most investments from Japan to Vietnam are in the form of development assistance (between governments) or long-term FDI, such as SMBC’s $1.5 billion investment in VPBank. This type of capital is typically not sensitive to moderate currency fluctuations, unlike how ETF capital might react.

Therefore, yesterday’s news is unlikely to significantly affect Japanese investment flows into Vietnam. “I don’t think global investors will exit Vietnam and shift to Japan just to earn an extra 25 basis points in yen interest rates,” the VNDirect expert said, emphasizing the importance of risk management, especially during highly volatile market sessions like yesterday’s.

“The US’s slowing growth could exert some pressure on export forecasts (as the US is Vietnam’s largest export market). Meanwhile, manufacturing activity remained robust in July, with the PMI (Purchasing Managers’ Index) reaching 54.7 points due to a significant increase in new orders. In a positive scenario, the VN-Index could close 2024 above the 1,400-point threshold, corresponding to a P/E (price-to-earnings ratio) of 14.8x, which is feasible,” Mr. Barry added.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.