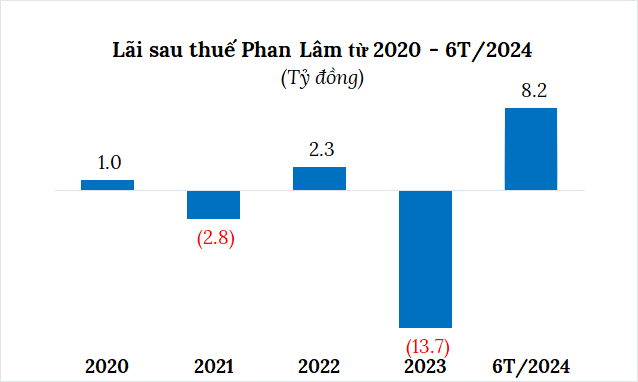

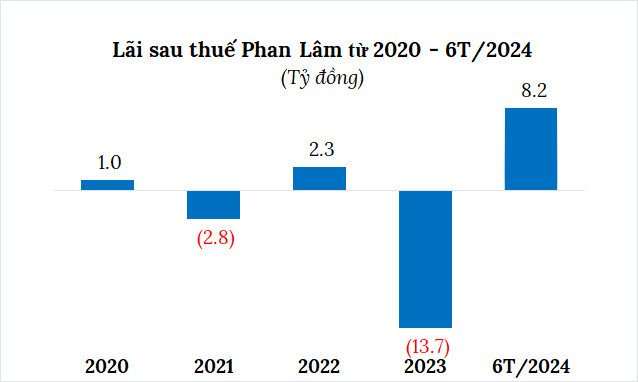

Phan Lâm Energy reported impressive semi-annual business results for 2024, with a post-tax profit of over 8 billion VND, a significant improvement from the previous year’s loss of nearly 14 billion VND. This marks the energy company’s best performance in the last four years (2020-2023).

Source: VietstockFinance

|

As of June 30, 2024, Phan Lâm’s equity stood at nearly 389 billion VND, a slight increase of 2% compared to the first half of 2023. The company’s debt amounted to 626 billion VND, a decrease of 3%, with approximately 486 billion VND in outstanding bond debt.

During the first half of this year, the company also made payments of over 45 billion VND in interest and principal on its bonds.

Currently, Phan Lâm has one lot of bonds with the code NLPLH2032001, totaling an issued value of 592.6 billion VND. These bonds were issued on November 24, 2020, with a 12-year term and a maturity date of November 24, 2032, carrying an interest rate of 10.5% per annum.

Since the issuance, the company has repurchased nearly 105 billion VND of these bonds before their maturity, and the current outstanding value of this bond lot is approximately 488 billion VND.

Phan Lâm Energy is known for its investment in the Phan Lâm 2 Solar Power Plant project, which spans an area of nearly 58.8 hectares and has an installed capacity of 49MWp. The plant is located in Phan Lâm Commune, Bắc Bình District, Bình Thuận Province, with a total investment of over 1,200 billion VND.

Phan Lâm 2 Solar Power Plant. Source: BB Group

|

Established in May 2017, Phan Lâm Energy specializes in electricity production, transmission, and distribution. According to HNX data, the company has a chartered capital of 394 billion VND, with Mr. Vũ Quang Bảo as its legal representative.

Mr. Bảo also holds prominent positions in other companies, including Chairman of BB Group and General Director of Bitexco Group, alongside his brother, Mr. Vũ Quang Hội, who serves as the Chairman of Bitexco Group.

Mr. Vũ Quang Bảo, Chairman of BB Group and brother of Mr. Vũ Quang Hội, Chairman of Bitexco Group

|

In the energy sector, in addition to the Phan Lâm 2 Solar Power Plant, BB Group, through its subsidiary BB Power Holdings, also owns several other solar power plants, such as Mỹ Sơn 1, Mỹ Sơn 2, Đầm Trà Ổ, Gio Thành 1, Gio Thành 2, and Hồng Phong 5.2. Their portfolio also includes hydroelectric power plants like Sông Lô 2, Đăkpsi 3, Đăkpsi 4, and Đăk Mi 1, as well as wind power plants like BB Power Gia Lai and Hanbaram.

|

According to the BB Group website, the conglomerate currently comprises 33 member companies and continues to expand its scale and scope. BB Group operates in diverse industries, including energy, real estate, industrial gas, mining, construction, and consumer goods. Within the BB Group ecosystem, each member company plays a specialized role in different fields, including BB Power Holdings (energy), BB Land Holdings (real estate), Construction Bạch Đằng (industrial construction), BB CIM Holdings (mining), BB Gas (industrial gas), and Vitasco (mineral water), to name a few. |

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.