|

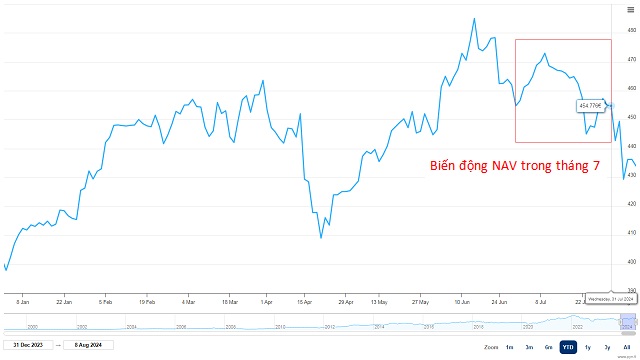

PYN Elite Fund’s NAV Performance in the First 7 Months of 2024

Source: PYN Elite Fund

|

According to PYN Elite Fund, a Finland-based investment fund, the market experienced a turbulent month with the VN-Index fluctuating between 1,220 and 1,300 points, eventually closing July with a 0.5% gain compared to the previous month. However, PYN Elite’s NAV remained unchanged from June.

PYN Elite attributed the market’s positive performance in the last session of July to the strong showing of banking stocks, while mid and small-cap stocks witnessed profit-taking pressures from investors.

|

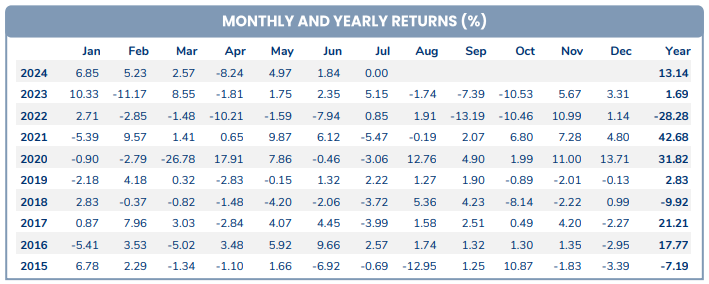

PYN Elite’s Investment Performance in the 2015-2024 Period

Source: PYN Elite Fund

|

Highlighting key economic indicators, PYN Elite noted that pressure on the Vietnamese Dong (VND) had significantly eased, with the currency appreciating by 0.76% month-on-month due to a weaker US Dollar following dovish comments from the US Federal Reserve (Fed). Additionally, the second-quarter earnings of many listed companies showed a strong recovery compared to the same period last year.

On the macroeconomic front, the fund observed that July 2024 economic data indicated stronger growth compared to the first half of the year. Exports and imports reached new record highs, increasing by 19.1% and 24.7% year-on-year, respectively. The growth in export value was driven by robust performance in electronics, computers, components, and machinery equipment.

Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) remained steady at 54.7 in July. Industrial production maintained its positive trajectory in July, rising by 11.2% year-on-year, outpacing the growth rate recorded in the first half of 2024 (7.7% compared to 6T2023).

Foreign direct investment (FDI) disbursed since the beginning of the year has been steadily increasing, with a 8.4% year-on-year rise recorded in July. Inflation remained under control, with the consumer price index (CPI) increasing by 4.4% year-on-year despite wage reforms in the public sector during the month.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.