Data aggregated by the VBMA from the Hanoi Stock Exchange (HNX) and the State Securities Commission of Vietnam (SSC) reveals that in July 2024, there were 33 private placements of corporate bonds valued at VND 31,387 billion and 1 public issuance worth VND 395 billion. As of July, there have been a total of 175 private placements valued at VND 168,433 billion and 12 public issuances valued at VND 14,586 billion in 2024. Among the private placements, rated bonds accounted for 7% of the value.

In the secondary market, the total trading value of private corporate bonds in July reached VND 84,406 billion, averaging VND 3,670 billion per session, a 26.2% decrease compared to the average in June.

According to VBMA, in July, enterprises repurchased VND 32,094 billion of bonds before maturity, a 17% increase compared to the same period in 2023. For the remainder of 2024, an estimated VND 121,854 billion in bonds will mature, with the majority being real estate bonds amounting to VND 51,603 billion, equivalent to 42%. Regarding abnormal information disclosure, there were 4 bond codes that announced late payment of principal and interest in the month, with a total value of VND 3,392 billion, and 41 bond codes that extended the time for interest and principal payment.

In the secondary market, the total trading value of private corporate bonds in July reached VND 84,406 billion, averaging VND 3,670 billion per session, a 26.2% decrease compared to the average in June.

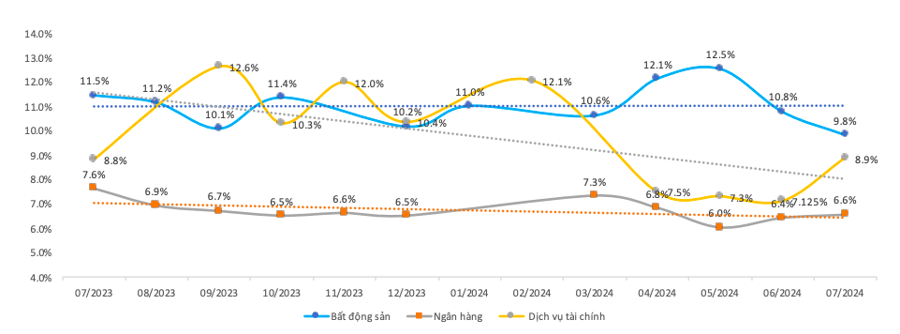

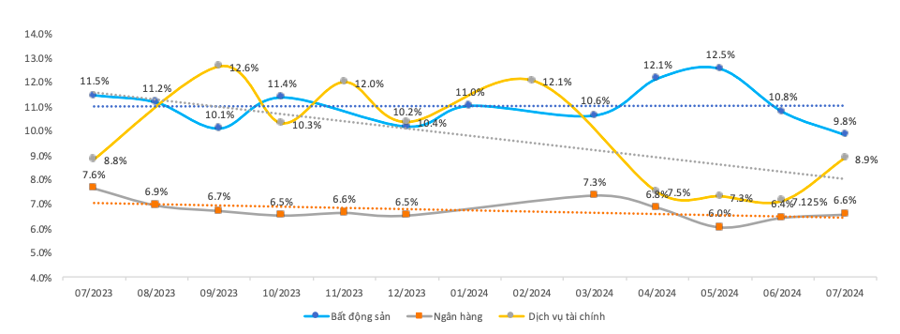

According to FiinGroup, in the primary market, the issuance interest rates of the real estate sector decreased significantly in July, partly due to the absence of bond issuances from VinGroup during the period. On the other hand, the issuance interest rates of banks slightly increased, averaging 6.6%/year. There was a significant rise in the issuance interest rates of the financial services sector; however, due to the insignificant volume (VND 20 billion), it does not reflect a clear trend in the sector’s interest rates.

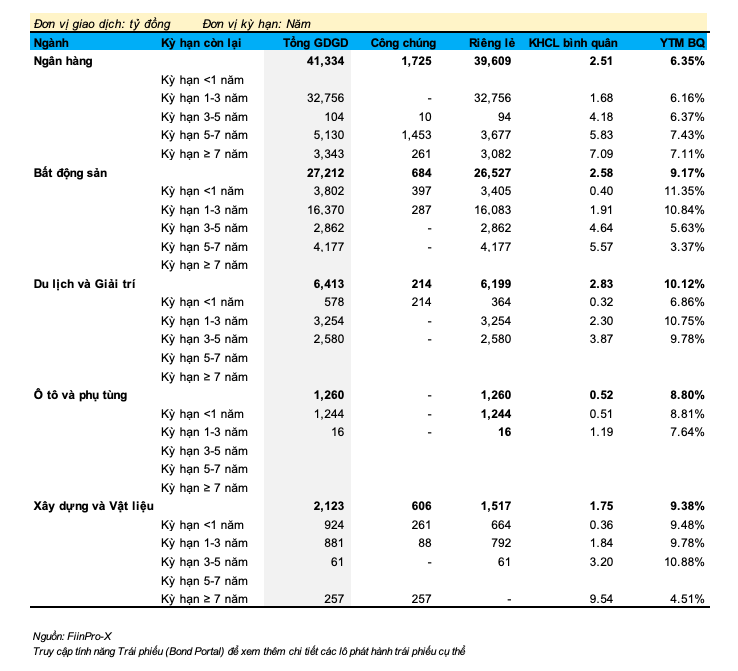

In the secondary market, only the real estate sector witnessed a decline in yield to maturity (YTM). FiinGroup attributed this drop to unusual transactions in the 5-7 year maturity bracket, with a YTM of only 3.37%, which does not accurately reflect the market’s true yield.

In July, the YTM of secondary market transactions slightly decreased compared to the previous month, with only 2 bond codes having a YTM above 11%: those of Hung Thinh Quy Nhon Entertainment Services JSC and Vinhomes. The investment yield of bank bonds remained stable at 6-7%, depending on the remaining term.

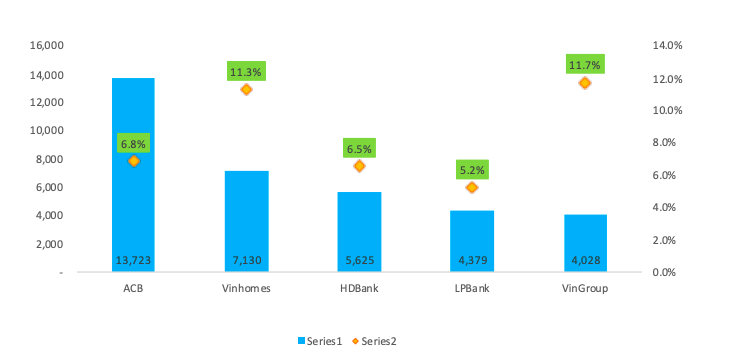

According to FiinGroup’s statistics, 3 out of the 5 top issuers in terms of trading volume in the secondary market in July were from the banking sector. ACB maintained its position as the issuer with the highest trading volume. In terms of investment yield, VinGroup and Vinhomes had the highest yields in the group, at 11.7% and 11.3%, respectively.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.