HoSE recently updated its list of securities ineligible for margin trading, adding shares of NT2 owned by Nhơn Trạch 2 Oil and Gas Power Joint Stock Company due to negative audited post-tax profits in the 2024 semi-annual financial statements.

According to the reviewed semi-annual financial statements for 2024, NT2’s net revenue reached 2,448 billion VND, a decrease of nearly 44% compared to the same period last year. Post-tax profits showed a loss of 36 billion VND, whereas, during the same period in the previous year, there was a profit of 378 billion VND. This electricity business incurred a gross loss of nearly 96 billion VND in the first half of 2024 due to selling below cost, whereas, in the same period last year, it made a gross profit of up to 414 billion VND. NT2 attributed this to a decrease in electricity output, which only reached 1,177.9 million kWh in the first six months of 2024, compared to 2,128.8 million kWh in the same period in 2023.

Similarly, on August 7, HoSE announced the addition of AAM shares of Mekong Fisheries to the margin cut list due to negative post-tax profits in the reviewed semi-annual financial statements for 2024. At the end of July, HoSE had removed QNP and TCI shares from the list of ineligible securities for margin trading.

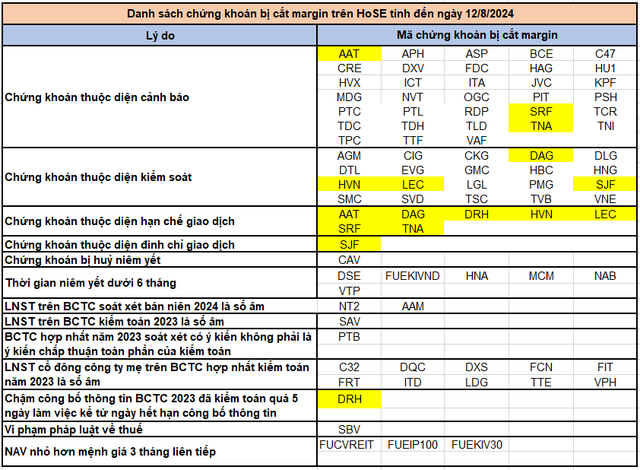

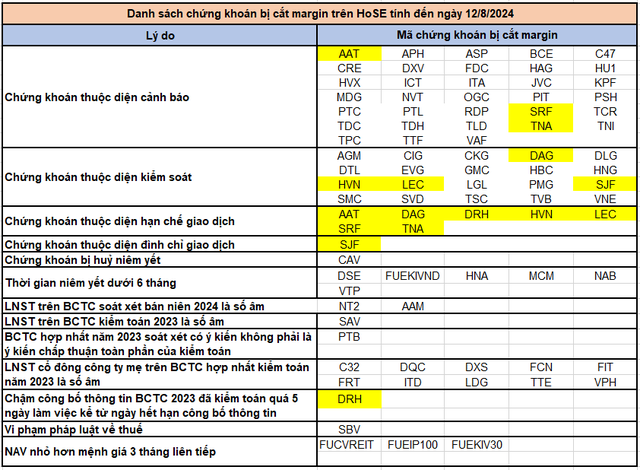

With the addition of NT2, the list of securities ineligible for margin trading on HoSE now includes 79 stocks (as of August 12).

Reasons for HoSE’s margin cuts include securities subject to warning/control/trading restriction; negative post-tax profits, audited reports with opinions from the auditing firm; listing time less than 6 months…

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.