According to the consolidated financial report for the second quarter of 2024 (from January 1, 2024, to June 30, 2024), Hanoi Beer Joint Stock Company – Thanh Hoa (Bia Thanh Hoa) recorded a revenue of 727 billion VND in the first six months of 2024, an increase of nearly 110 billion VND compared to the same period in 2023. However, the cost of goods sold was 667 billion VND, an increase of 106 billion VND year-over-year, resulting in a gross profit of over 50 billion VND, up by only 3 billion VND. This slight increase was insufficient to offset the rise in other expenses.

Specifically, in the first half of 2024, Bia Thanh Hoa incurred selling expenses of 64.3 billion VND, an increase of approximately 9 billion VND compared to the previous year, while administrative expenses amounted to 18.2 billion VND, a rise of about 1.6 billion VND from the same period last year.

Bia Thanh Hoa’s bleak business landscape and losses in recent years. (Photo: QH)

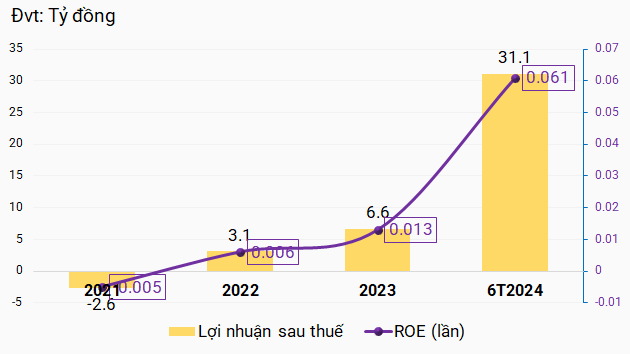

With these increased expenses, Bia Thanh Hoa’s net profit from business operations was negative 31.7 billion VND, a rise of over 7 billion VND compared to the same period last year. This marks the third consecutive quarter that Bia Thanh Hoa has recorded a net loss from business operations in the first half of the year (a loss of 18 billion VND in 2022 and 24 billion VND in 2023).

The final result of Bia Thanh Hoa’s business operations in the first six months was a loss of 3.8 billion VND, compared to a loss of 2 billion VND in the same period last year. These figures paint a picture of the company’s bleak business landscape and losses in recent years.

Bia Thanh Hoa’s consolidated financial report for the second quarter of 2024 also shows that the company’s payables stood at 162 billion VND, a decrease of 6.5 billion VND from the beginning of 2024. Short-term debt amounted to 150 billion VND, while long-term debt was 11.8 billion VND. Meanwhile, equity was recorded at 143.9 billion VND, a decline of approximately 5 billion VND compared to the start of 2024.

In terms of assets, Bia Thanh Hoa reported long-term assets of over 62.6 billion VND as of the end of the second quarter, with short-term assets totaling more than 243 billion VND. The main asset items comprised primarily of cash and investments of about 90 billion VND, inventory of over 58 billion VND, and receivables of 94 billion VND.

Currently, Bia Thanh Hoa owns one subsidiary, Trung Habeco Commercial Trading Co., Ltd., in which it holds a 100% stake.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.