According to the current Labor Law, the monthly unemployment benefit for employees is 60% of the average monthly salary of the last six months of unemployment insurance contributions, but not more than five times the regional minimum wage announced by the Government in the last month of unemployment insurance contributions.

Regarding this regulation, when providing feedback on the draft amended Labor Law, the Vietnam General Confederation of Labor (VGCL) proposed to increase the monthly unemployment benefit to 75% of the average monthly salary of the unemployment insurance contributions made before the employee became unemployed.

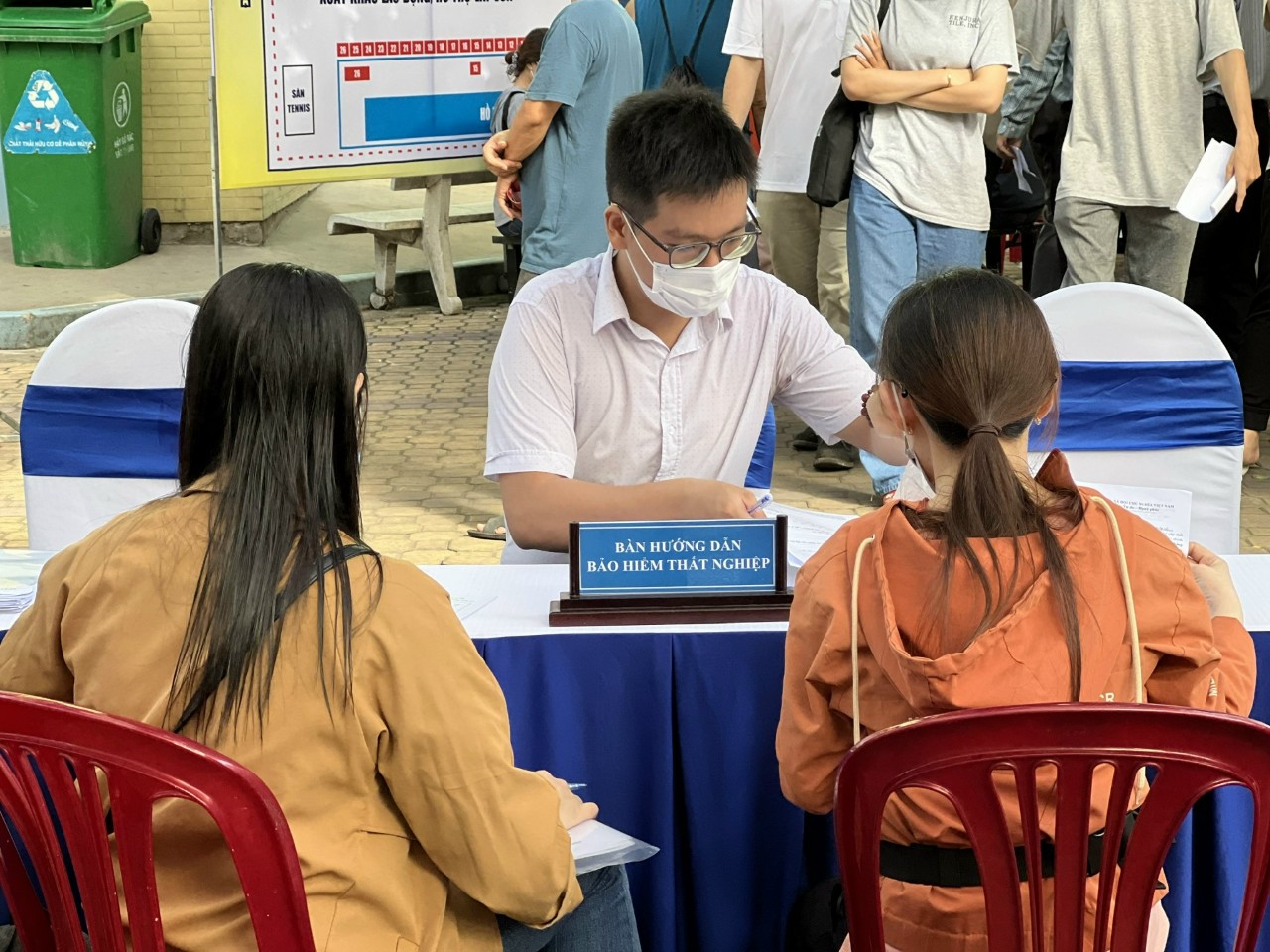

Employees completing procedures for unemployment benefits at the Job Transaction Floor organized by the Ho Chi Minh City Center for Employment Services

In addition, the VGCL also proposed that for those who have contributed to unemployment insurance but have not claimed any unemployment benefits by the time they retire, they should receive 50% of the total amount contributed to the Unemployment Insurance Fund. The VGCL also suggested that employees who have continuously participated in unemployment insurance for 145 months or more should receive an additional 0.1 months of unemployment benefits for every additional 12 months of participation, thereby ensuring the rights and benefits of the unemployment insurance scheme for employees.

Responding to these proposals, the Ministry of Labor, Invalids, and Social Affairs (MOLISA) maintained its stance on retaining the current unemployment benefit rate (60% of the average salary) in its synthesis, explanation, and feedback on the opinions of agencies, organizations, and individuals regarding the proposed amended Labor Law.

According to MOLISA, this benefit rate provides a minimum income to alleviate the difficulties faced by employees who have lost their jobs, and it is in line with Vietnam’s conditions and current international practices.

Retirees are not eligible for unemployment benefits

Moreover, MOLISA stated that unemployment insurance is a short-term insurance scheme designed to share risks, and therefore, they proposed to maintain the regulation that employees who have not claimed any unemployment benefits by the time they retire are not eligible for such benefits.

Similarly, MOLISA also reserved their proposal to maintain the current regulation regarding the maximum unemployment benefit period of 12 months, corresponding to 144 months of unemployment insurance contributions, with no carry-over for contributions exceeding 144 months.

MOLISA explained that not carrying over the unemployment insurance contributions beyond 144 months is in line with the current regulations, international practices, and ensures a balanced Unemployment Insurance Fund. Furthermore, unemployment insurance is a short-term scheme intended to provide income support to employees who have lost their jobs, and it is not meant to replace their entire income for an extended period (more than 12 months). Setting a maximum benefit period will encourage employees to quickly re-enter the labor market through other support measures such as counseling, job referrals, and vocational training.

Regarding the suggestion to amend the regulation so that employees who have participated in unemployment insurance for 12 months are entitled to one month of unemployment benefits, instead of the current lump-sum payment as stipulated in the current Labor Law, MOLISA stated that the regulation on providing three months of unemployment benefits for those who have contributed between 12 and 36 months is a continuation of the 2013 Labor Law and aligns with international practices. This level of unemployment benefit provides a minimum income to alleviate the difficulties faced by employees who have lost their jobs.

A FLC Group subsidiary owes nearly 30 billion VND in social insurance debt

Besides owing billions of salary, FLC Golf and Resort LLC (part of FLC Group) is also late in paying nearly 30 billion dong in social insurance for hundreds of employees.