Small change can add up to big savings! While loose change may not seem like much, it can quickly accumulate into a substantial sum. This is the story of one individual who shared their experience saving loose change, and it sparked a discussion among others who had similar habits.

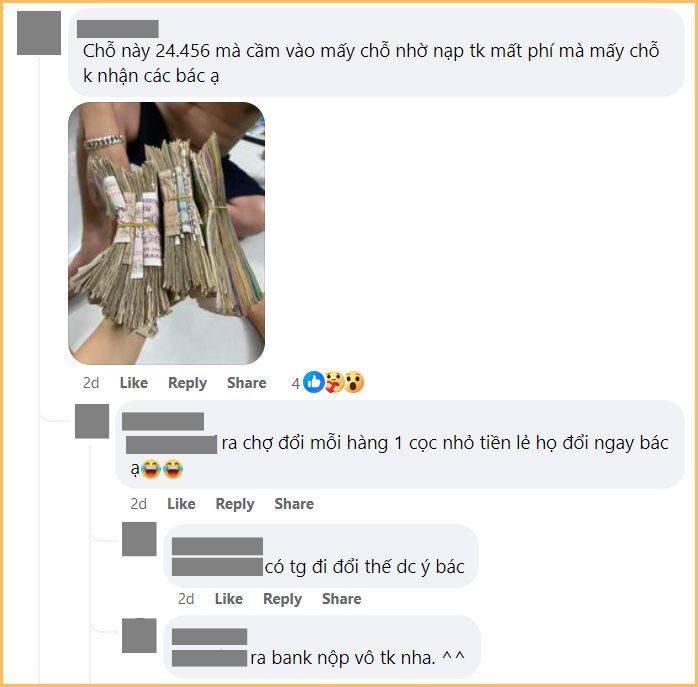

The original post included images of people’s savings, which ranged from a few million to over 24 million VND. The story inspired others to share their own experiences with saving loose change, with many commenting that they, too, had a significant amount of saved change without even realizing it.

Loose change adds up quickly!

In a community focused on personal finance and savings, an anonymous user shared their unique story of saving loose change. The post included images of various amounts of saved change, with denominations of less than 10,000 VND. While these small bills might not seem significant, the total savings were impressive.

The comments section of the post revealed that many others also had a similar habit of saving loose change, and some were surprised at the total amount they had accumulated over time.

A casual share that garnered a lot of attention

Loose change from grocery shopping can add up to a significant amount

This family saved over 24 million VND in loose change!

“Counting the money was so satisfying”

Many people have the habit of saving loose change

Saving large amounts like 100,000-200,000-500,000 VND can be challenging, but anyone can save loose change

Thu Minh, a 28-year-old living and working in Hanoi, shared her experience with saving loose change. She often shops and pays in cash, resulting in a substantial amount of loose change. Interestingly, Thu Minh never kept track of her loose change because she found it tedious to count.

“In 2022, when I was moving houses, I found loose change in almost every pocket of my clothes, ranging from 1,000-2,000 VND to 15,000-20,000 VND. That’s when I decided to start saving my loose change. I started putting aside any change I had in my wallet that was 10,000 VND or less, as I would otherwise spend it randomly and forget about it.”

“I started saving my loose change in September 2022, and by December 2023, I had saved almost 5.5 million VND. It was quite a pleasant surprise.” – Thu Minh shared.

2 stress-free saving methods you can try!

If you’re struggling to develop a savings habit, in addition to saving loose change, consider the following two suggestions to ease your financial burden.

1 – Save a percentage equal to your age

If you’re worried about getting older but not achieving your financial goals, try maintaining a savings rate equal to your age. For example, if you’re 24 years old, save 24% of your monthly income. Then, as you get older, increase your savings rate by 1% each year. It’s as simple as that!

Not only does this method help you develop a savings habit, but it also motivates you to earn more money.

2 – Save for Tet in advance

This is a secret trick that Thu Minh has been using for the past three years to reduce her financial stress during the Tet holiday season. She shared, “The amount I spend during Tet doesn’t vary much from year to year, so it’s easy to calculate how much I need to save. I just divide the total amount by 12 months, and I know exactly how much I need to set aside each month to ensure a warm and fulfilling Tet holiday.”

Illustration

Thanks to this habit, despite her company reducing bonuses by 60% during the last Tet holiday, Thu Minh’s celebrations were not significantly impacted. She explained, “I save for Tet in advance because my company usually pays our salaries and bonuses just a few days before Tet. If I waited until then to send money to my parents for their Tet preparations, it would be too late. So, I make sure to have a certain amount set aside in advance, and then I can supplement it with my salary and bonus.”

“When I first set this savings goal, I didn’t anticipate that I would face a situation where I worked all year but received very little in bonuses at the end. It’s a blessing in disguise.” – Thu Minh confided.

With only five months left until Tet, now is the perfect time to start saving if you’re unsure about your bonus situation this year.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Young people choose “new style” New Year gifts for parents

The choice of Tet gifts for young people this year has changed. They are striving and making more effort to give their parents and themselves practical and valuable gifts such as savings books, gold jewelry, or life insurance packages.