Vietnam’s imports of completely built-up (CBU) vehicles surged in July 2024, according to preliminary statistics from the General Department of Vietnam Customs. The country imported over 17,000 CBU vehicles of various types, valued at more than $343 million, reflecting an increase of 8.5% in volume and 10.6% in value compared to June.

Cumulatively, from the beginning of the year to the end of July, Vietnam’s CBU vehicle imports reached a total of 91,637 units, worth over $1.89 billion. This represents a 14.8% rise in volume and a modest 0.9% increase in value compared to the same period last year. The average import price stood at over $20,600 per unit, marking an 11.7% decrease year-on-year.

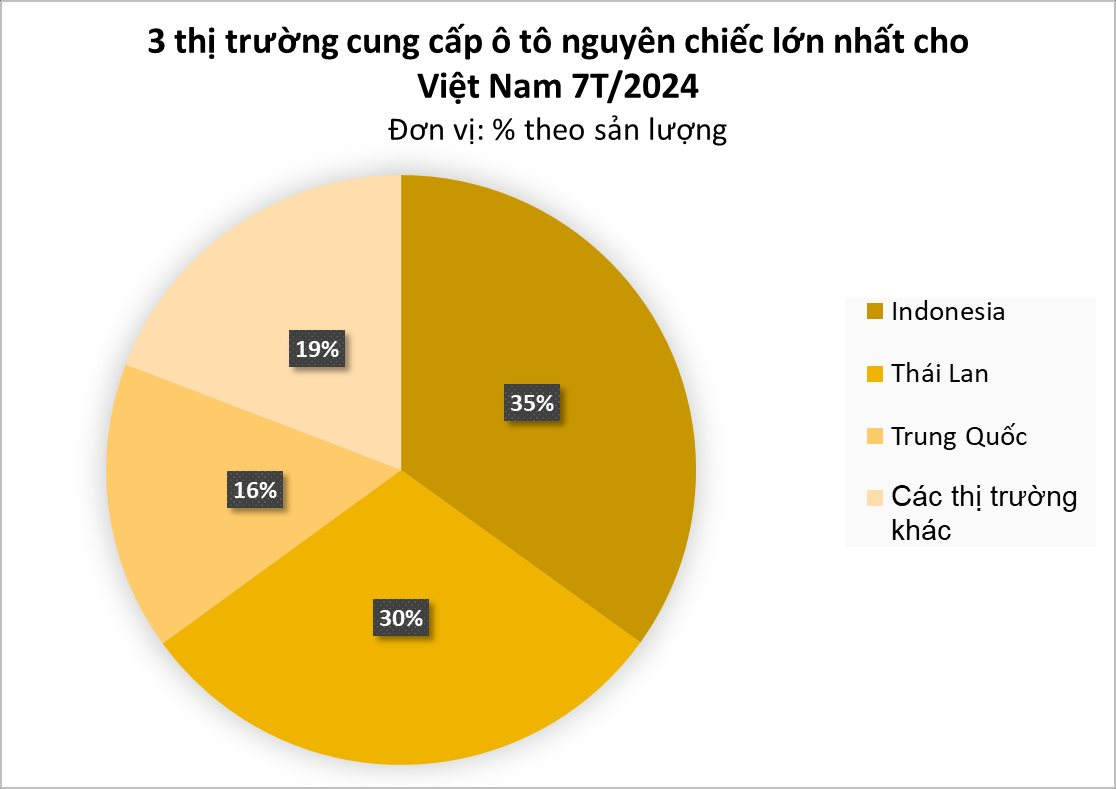

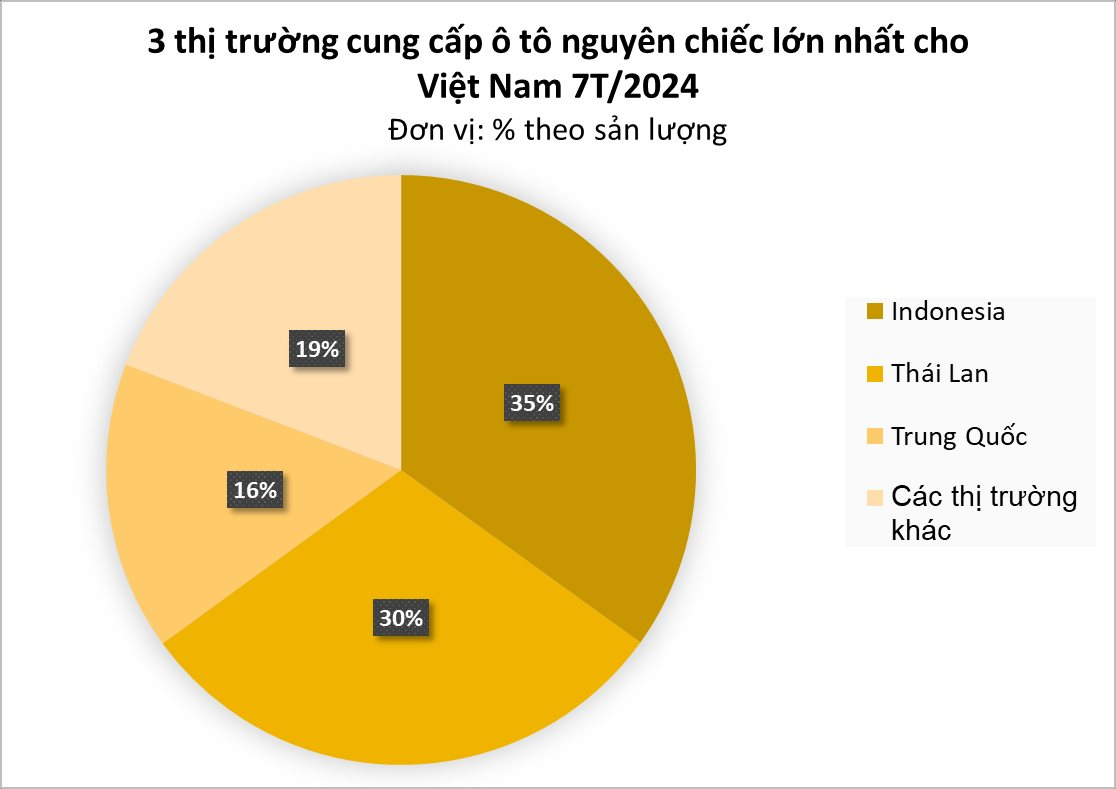

Indonesia emerged as the largest supplier of CBU vehicles to Vietnam during the seven-month period, with 38,040 units totaling $557.3 million in value. The average price per unit from Indonesia was $14,650, reflecting an increase of 8% compared to the previous year. This made Indonesia the leading source of CBU vehicle imports for Vietnam.

Thailand, the second-largest source of CBU vehicle imports, supplied 32,717 units to Vietnam in the first seven months of 2024, valued at $628.6 million. However, compared to the same period in 2023, there was a decline of 9.3% in volume and 17.5% in value. The average import price from Thailand was $19,213 per unit, a 9% decrease year-on-year.

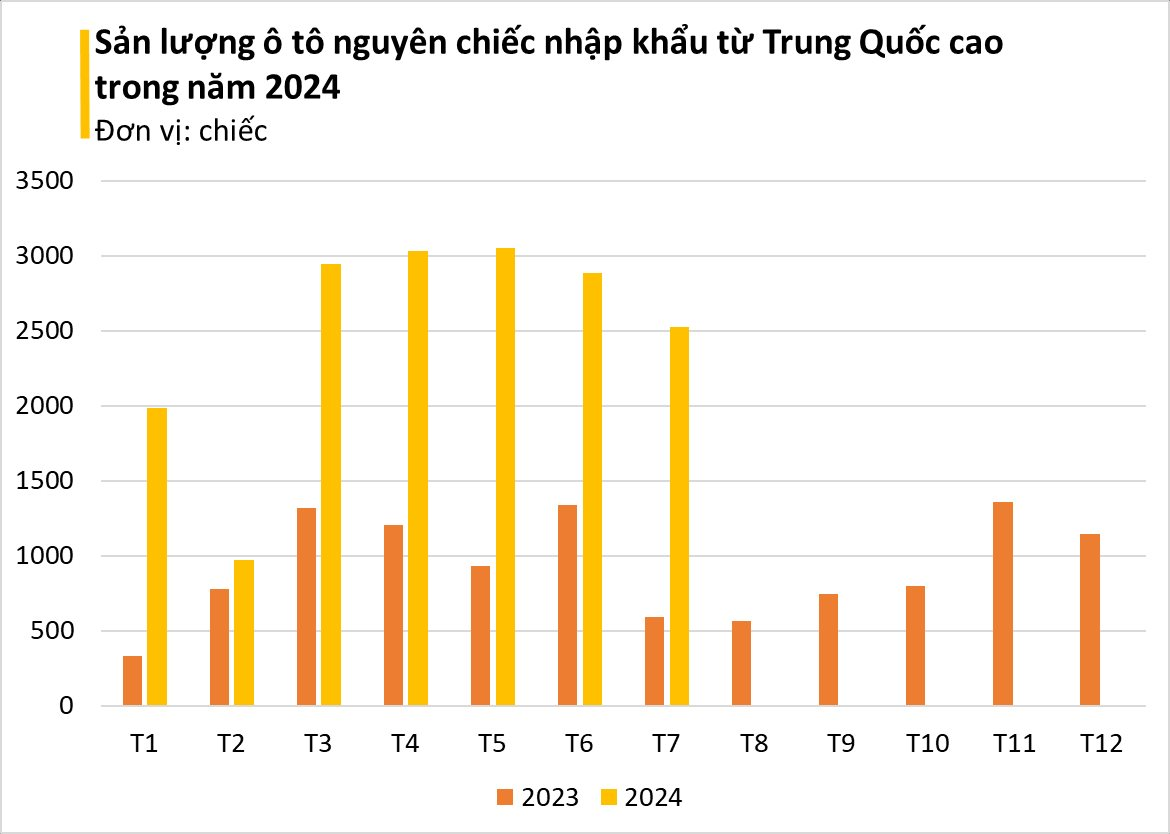

Notably, China has been actively ramping up its exports of vehicles to Vietnam since the beginning of the year. In the seven-month period, Vietnam imported 17,235 CBU vehicles from China, valued at $521.6 million. While the average price per unit was $30,267, reflecting a 22.4% decrease compared to 2023, the volume and value of imports from China surged significantly, with increases of 168% and 108%, respectively. China has become the third-largest source of CBU vehicle imports for Vietnam.

In July alone, Vietnam imported 2,524 vehicles from China, totaling nearly $66.4 million, representing remarkable growth of 327% in volume and 156% in value compared to July 2023.

This influx of vehicles from China is having a significant impact on the Vietnamese market. Chinese brands like BYD, Chery, Lynk&Co, Wuling, and Haval have introduced a diverse range of models and technologies, including electric and hybrid vehicles, to Vietnamese consumers. However, these Chinese automakers face the challenge of high import taxes, which can reach up to 49% depending on the model, compared to the 0% import tax enjoyed by vehicles from Southeast Asian countries.

Additionally, the perception of Chinese products as inexpensive but low quality, along with the lack of charging stations, remains a factor that influences consumers’ purchasing decisions.

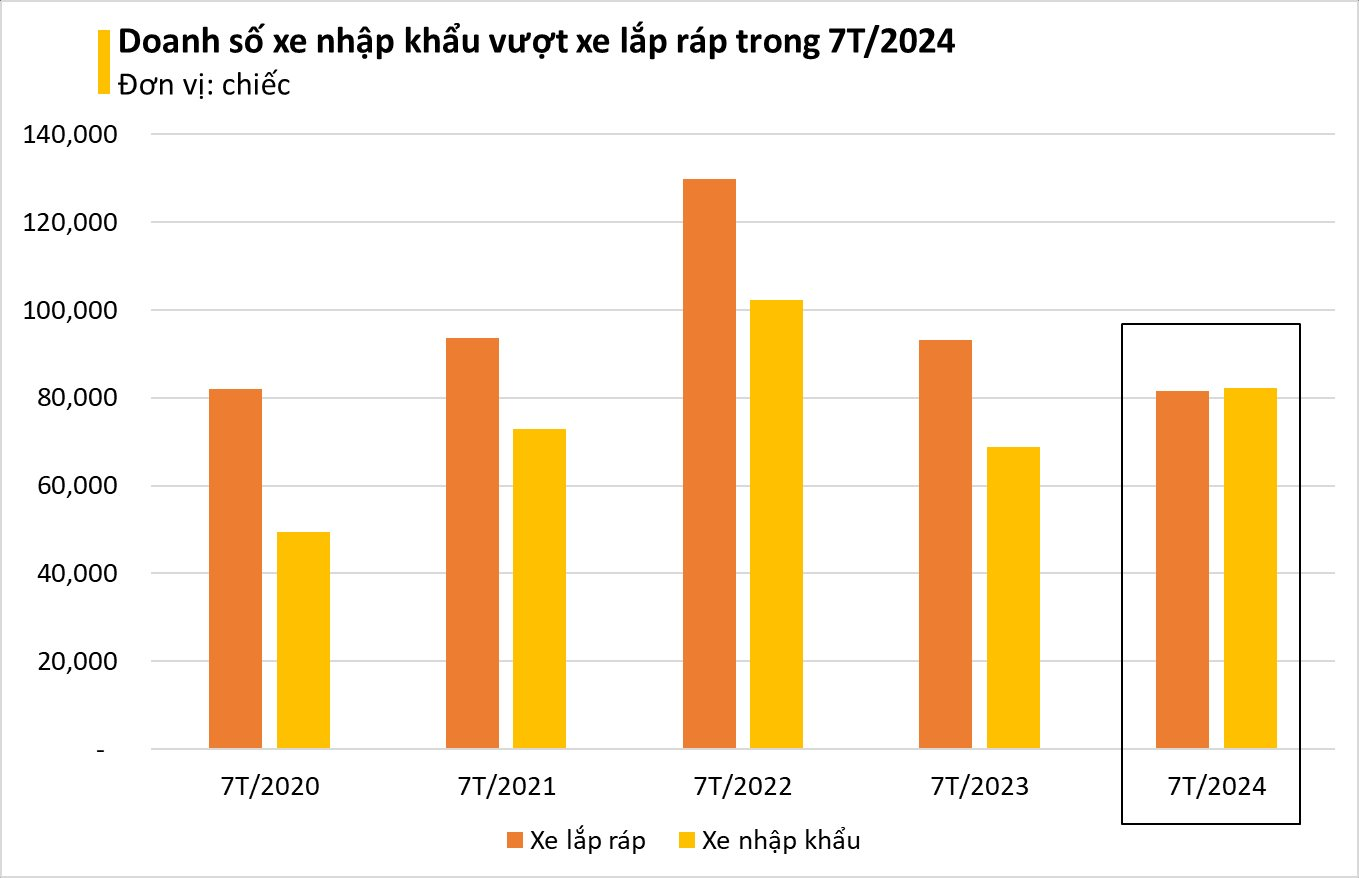

Imported Vehicle Sales Surpass Domestically Assembled Vehicles

Not only are more imported vehicles entering the country, but their sales are also outpacing those of domestically assembled vehicles.

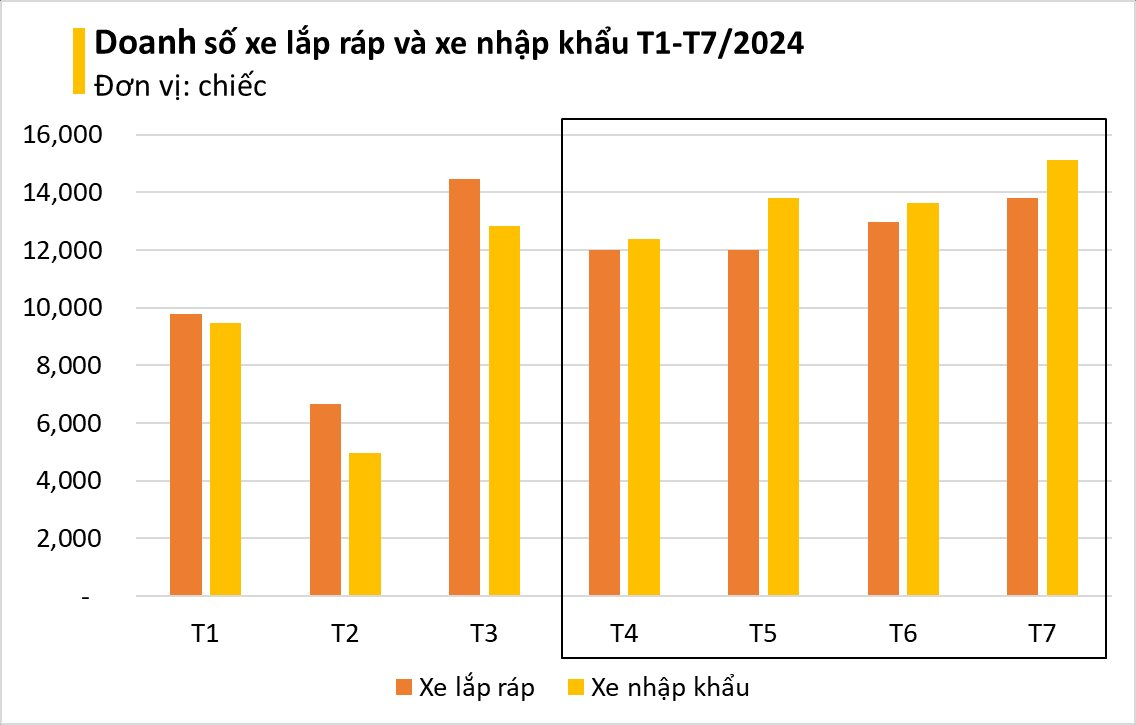

According to the Vietnam Automobile Manufacturers’ Association (VAMA), total vehicle sales in Vietnam reached 28,920 units in July 2024. Among these, imported CBU vehicles accounted for 15,132 units, reflecting an increase of over 11% compared to the previous month. In contrast, domestically assembled vehicles recorded sales of 13,788 units, a more modest increase of 6.3%. This marks the fourth consecutive month where imported vehicles have outsold their domestically assembled counterparts.

For the seven-month period, domestically assembled vehicle sales reached 81,637 units, a 12% decrease compared to the same period last year. In contrast, imported CBU vehicle sales totaled 82,167 units, a significant increase of 19%. This marks a shift in the market, as imported vehicles have now surpassed domestically assembled vehicles in sales, narrowing the gap that existed in previous years.

This shift in consumer preference can be attributed to the uncertainty surrounding the reduction of registration fees, which has led consumers to opt for imported CBU vehicles instead of waiting, despite the notable improvements in the quality of domestically assembled vehicles. Vietnamese consumers are increasingly prioritizing safety features, comfort, and technological advancements, and imported vehicles tend to offer more modern features than their domestically assembled counterparts, better meeting the evolving demands of the market.

The imported vehicle market also boasts a diverse range of models, from compact city cars to SUVs, catering to a wide range of customer preferences. These factors have positively influenced the sales of imported vehicles while creating significant pressure on domestic automakers.

Additionally, importers have been offering attractive promotions and discounts of up to hundreds of millions of dong, making imported vehicles more financially appealing to consumers.

Looking ahead, it is anticipated that more CBU vehicles from Indonesia and Thailand will enter the Vietnamese market. Chinese automotive companies are making substantial investments in these countries, and the influx of affordable vehicles from these sources is expected to intensify competition in the Vietnamese market.

For 2024, the production of domestically assembled vehicles in Vietnam is estimated to reach 340,000 units, similar to the production volume in 2023 but significantly lower than the 440,000 units produced in 2022. With this substantial decline in production volume, the absence of specific policies to support the domestic automotive industry could result in Vietnamese-made vehicles losing ground to imported vehicles in their home market.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.