Shares of NTP, a leading Vietnamese plastic company, have been on a strong upward trajectory since the beginning of August. On August 16, the stock witnessed a surge in both price and trading volume, skyrocketing by nearly 10% to reach a new all-time high of 70,900 VND per share since its listing on the stock exchange (adjusted price).

Compared to the beginning of 2024, NTP’s share price has climbed by an impressive 83%, pushing its market capitalization to over 10.1 trillion VND. The sharp increase in trading volume saw more than 1.5 million shares change hands, making it the second-highest volume day in the company’s history, only surpassed by the unusual spike on November 16, 2021.

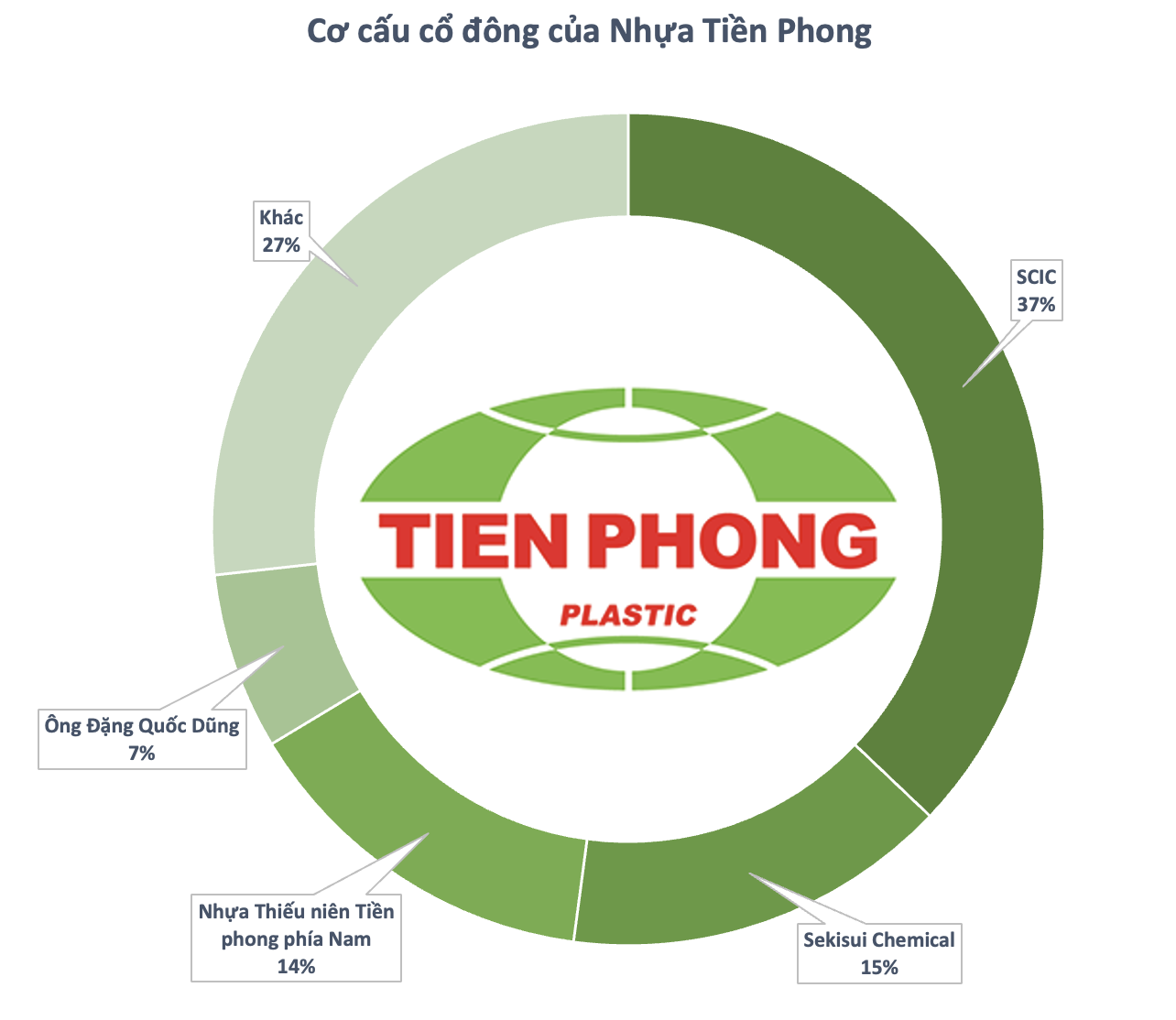

The rally in NTP’s share price followed its inclusion in the State Capital Investment Corporation’s (SCIC) second batch of divestments for 2024. SCIC plans to divest its nearly 481 billion VND stake, equivalent to more than 48 million shares (37.1% of capital) in the company. The state capital divestment is expected to provide a boost to Nhựa Tiền Phong’s performance, with the potential for the Japanese shareholder, Sekisui Chemical, to gain controlling interest.

Strong Financial Performance and Expansion into Education

Nhựa Tiền Phong, established in 1960 and listed on HNX in 2006, currently has a charter capital of 1,425 billion VND. The company owns and operates three factories in Hai Phong, Nghe An, and Binh Duong, running at full capacity with a combined production capacity of approximately 190,000 tons per year. Their distribution network spans Vietnam, with 9 distribution centers, 300 dealers, and over 16,000 sales points.

In addition to SCIC, the company’s major shareholders include Sekisui Chemical (15%), Nhựa Thiếu niên Tiền Phong Southern (14.27%), and Chairman of the Board of Directors, Dang Quoc Dung (6.87%). If Sekisui Chemical were to acquire SCIC’s entire stake, they would become the controlling shareholder of Nhựa Tiền Phong.

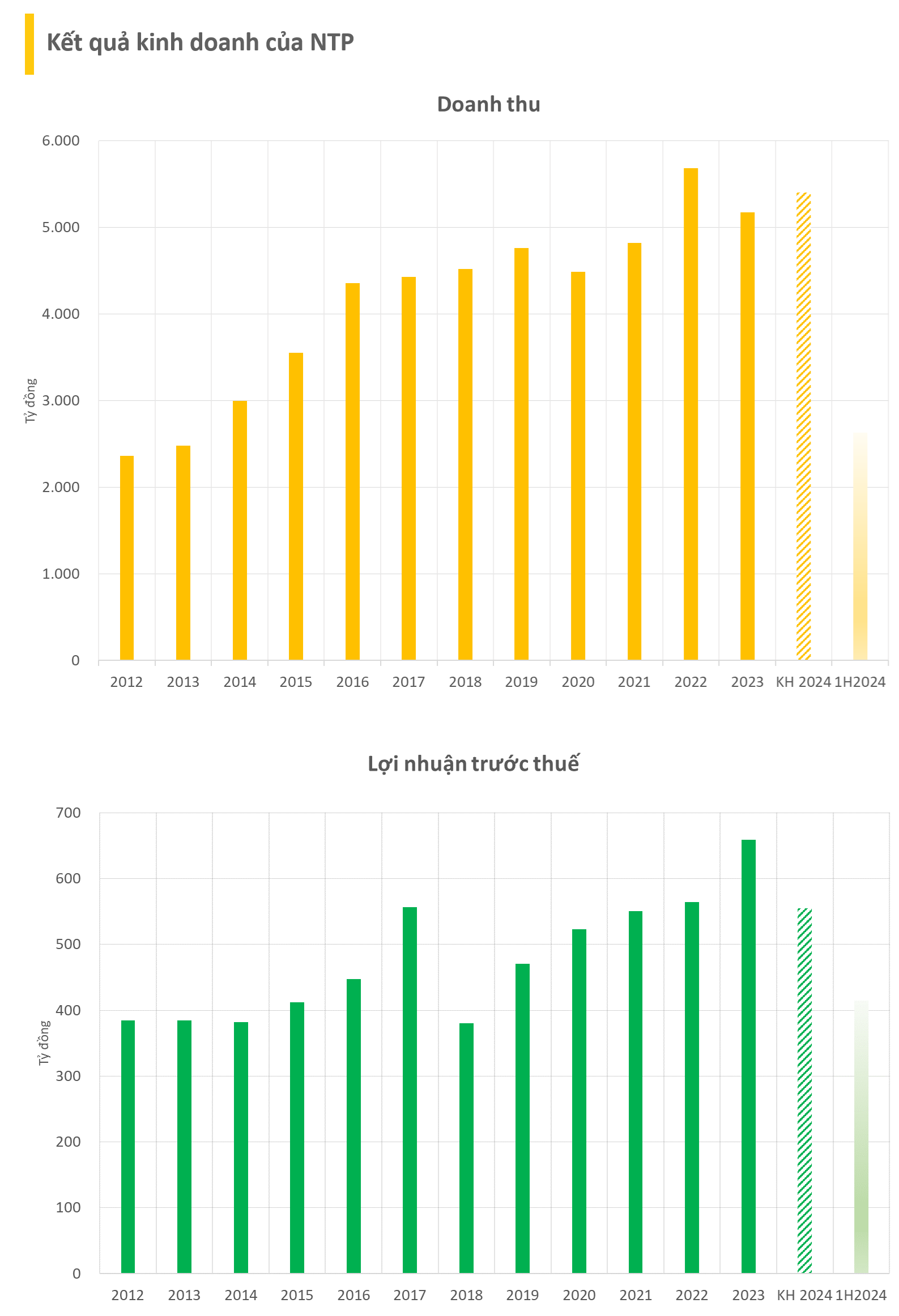

In terms of financial performance, for the first half of 2024, the company reported revenue of 2,629 billion VND, a modest 4% increase year-over-year. Notably, their pre-tax profit reached 415 billion VND, representing a significant 45% growth compared to the same period last year.

For the full year 2024, NTP has set ambitious targets, aiming for 5.4 trillion VND in revenue and 555 billion VND in pre-tax profit, corresponding to a 5% increase and a 13% decrease, respectively, from 2023. With the strong first-half results, the company has already achieved 49% of its revenue target and a remarkable 75% of its profit target.

Beyond its core business, Nhựa Tiền Phong is venturing into the education sector with plans to invest in an educational complex named “Trường phổ thông có nhiều cấp học Tiền Phong” at its headquarters in Da Nang. The company’s chairman, Mr. Dang Quoc Dung, addressed concerns about their lack of experience in education, stating that success lies in human resources and that they are committed to learning and adapting.

According to the company’s CFO, following the approval of the project, they will proceed with the necessary procedures and collaborations with the city administration. The preliminary investment is estimated at 600 billion VND, with 50% funded by equity. The project is expected to generate revenue of 180-200 billion VND annually, with a payback period of 8-10 years.

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.