Starting in Q2 2024, VIB’s loan packages for 1 million apartments and 30,000 billion VND for purchasing houses in urban areas have been very well received, especially in major cities such as Ho Chi Minh City, Hanoi, Hai Phong, Binh Duong, Dong Nai, Can Tho, and Da Nang.

Home Loan: What are the options to borrow 2 billion VND but only pay 12.5 million VND per month for the first 24 months?

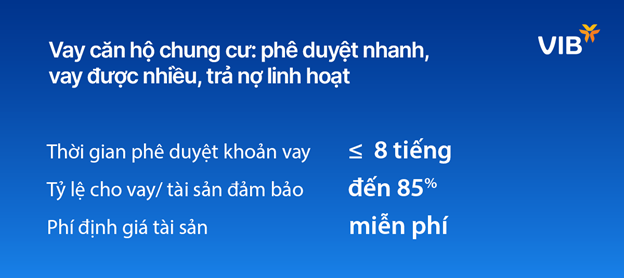

Mr. Le Minh, from District 9, Ho Chi Minh City, is currently borrowing to purchase an apartment with an outstanding balance of 2 billion VND at another bank, and his monthly principal and interest payments are 25 million VND. When he learned about VIB’s new home loan product with interest rates of 5.9% – 6.9% – 7.9% for 6-month, 12-month, and 24-month fixed-rate periods, and a further 0.4% reduction when borrowing to repay another bank’s loan, he visited VIB District 9 and met with a VIB consultant. Mr. Minh was advised on an optimal financial plan, with a total monthly payment of only 12.5 million VND for the first 24 months. His loan request was submitted to VIB in the morning, and the loan was approved by the afternoon.

Mr. Minh’s choice was a 30-year loan term, with no principal payments for the first 5 years and a 2-year fixed interest rate. Since the loan is for repaying another bank, the fixed interest rate for the first year is reduced to 7.5%. Thus, in the first 24 months, he does not have to pay any principal, and the interest cost is only (2 billion VND * 7.5%) / 12 months = 12.5 million VND per month.

To approve Mr. Minh’s loan within 8 hours, VIB has built a diverse and rich database, with valuation data for over half a million apartments in major cities, while continuously upgrading and simplifying the approval process to minimize loan approval time.

House Purchase Loan: Attractive interest rates, no principal payments for 4 years, and advanced disbursement to quickly settle existing loans.

Similar to the apartment loan package, the house purchase loan package also offers very attractive interest rates of 5.9% – 6.9% – 7.9% for 6-month, 12-month, and 24-month fixed-rate periods, with a further 0.4% reduction when borrowing to repay another bank’s loan.

In addition, for customers who wish to transfer their loans to VIB, unlike the market practice of having to settle the loan at the old bank and withdraw the collateral asset file or supplement other collateral assets before disbursement, VIB will support all customers with advanced disbursement for settlement. This benefit gives customers complete financial control when choosing to transfer their loans to VIB, as they don’t need to worry about borrowing money for settlement, thereby minimizing risks and additional costs.

Furthermore, for loans used to repay another bank’s loan, VIB offers a loan term of up to 30 years and a loan limit of up to 80% for collateralized assets such as houses, villas, apartments, and adjacent houses with a certificate of ownership. The asset valuation fee is currently waived for customers transferring their loans to VIB. Additionally, VIB offers flexibility in proving income sources.

Why is it the golden time to buy a house with a VIB loan?

Home loan interest rates have been at a low level since the beginning of the year until early August 2024, but some banks have started to increase deposit rates, so it is essential to choose the right time to borrow to reduce future financial burdens.

Moreover, as VIB is ranked in the highest group in the industry by the State Bank of Vietnam, it has been granted a higher credit room than many other banks. This means VIB has more flexibility in offering favorable loan terms, including interest rates, interest payment periods, and principal repayment schedules, to meet customers’ needs.

Register for consultation on apartment and house purchase loans with VIB here.

Which bank offers the highest interest rate for online savings in early February 2024?

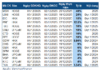

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Banks Sacrificing Profits to Support the Economy

In 2023, the question “which bank has the lowest interest rates?” is being talked about more than ever. With the prevailing difficult economic situation affecting individuals and businesses, in line with the directive of the State Bank of Vietnam (SBV), banks have unanimously sacrificed their profits by reducing lending rates and introducing credit packages with interest rates as low as 0%.