Latest Deposit Interest Rates at MB Bank

Recently, Military Commercial Joint Stock Bank (MB) officially adjusted interest rates across all terms. Accordingly, the bank has adjusted average interest rates by 0.1-0.3 percentage points.

Specifically, for individual customers depositing money at the bank, the lowest interest rate for a 1-month term is 2.3% per year, 2 months at 2.5% per year, 3 months at 2.6% per year, 4 months at 2.9% per year, and 5 months at 3% per year.

For 6-8 month terms, the applicable interest rate is 3.6% per year. For 9-10 months terms, the bank pays an interest rate of 3.8% per year.

At an 11-month term, the interest rate is 3.9% per year, 12-15 months applies an interest rate of 4.6% per year, and 18 months applies an interest rate of 4.8% per year. The highest interest rate of 5.7% per year applies to terms of 24-60 months.

With this reduction, MB officially no longer maintains a 6% interest rate. For customers belonging to branches in the Central and Southern regions, at different terms, the interest rate is increased by an additional 0.1 percentage point.

| Term | Interest Rate |

|---|---|

| 1 month | 2.3 |

| 2 months | 2.5 |

| 3 months | 2.6 |

| 4 months | 2.9 |

| 5 months | 3 |

| 6-8 months | 3.6 |

| 9-10 months | 3.8 |

| 11 months | 3.9 |

| 12-15 months | 4.6 |

| 18 months | 4.8 |

| 24-60 months | 5.7 |

| Term | Interest Rate |

|---|---|

| 1 month | 2.2 |

| 2 months | 2.3 |

| 3 months | 2.5 |

| 4 months | 2.7 |

| 5 months | 2.8 |

| 6-10 months | 3.5 |

| 11 months | 3.6 |

| 12-13 months | 4.3 |

| 18 months | 4.7 |

| 24 months | 5.3 |

| 60 months | 5.7 |

Deposit interest rates for business customers. (Source: MB)

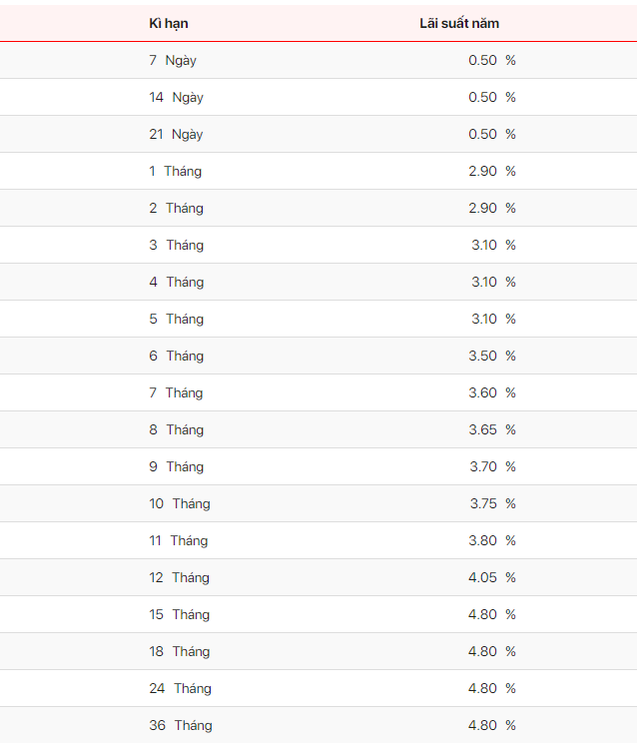

Latest Deposit Interest Rates at SeABank

Southeast Asia Commercial Joint Stock Bank (SeABank) has also adjusted its deposit interest rates. The average reduction is 0.2-0.5 percentage points across all terms.

According to the deposit interest rate table, for 1-2 month terms, the interest rate is 2.9% per year; for 3-5 months, it is 3.1% per year; for 6 months, it is 3.5% per year; for 7 months, it is 3.6% per year; for 8 months, it is 3.65% per year; for 9 months, it is 3.7% per year; for 10 months, it is 3.75% per year; for 11 months, it is 3.8% per year; for 12 months, it is 4.05% per year; and for 15-36 months, it is 5.4% per year.

Latest Deposit Interest Rates at SeABank.

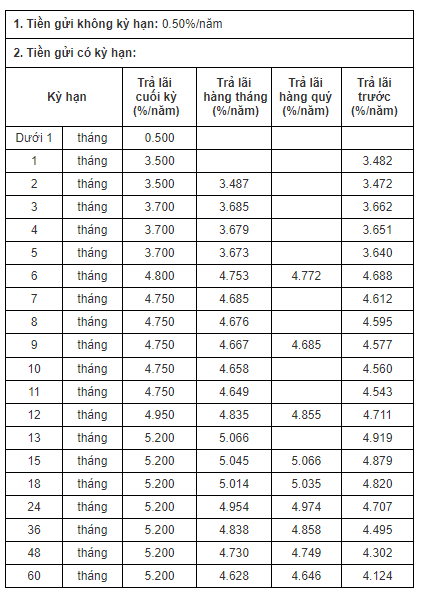

Latest Deposit Interest Rates at CBBank

On February 22, Vietnam Construction Bank (CBBank) announced an adjustment to its deposit interest rates.

For 1-2 month terms, the interest rate is reduced to 3.5% per year. For 3-5 month terms, the interest rate is currently 3.7% per year. The deposit interest rate for a 6-month term is 4.8% per year, and for 7-11 month terms, it is 4.75% per year. Meanwhile, the interest rate for a 12-month term is reduced to 4.95% per year.

The highest interest rate at CBBank for terms from 13 months onwards is listed at 5.2% per year.

Latest Deposit Interest Rates at CBBank.

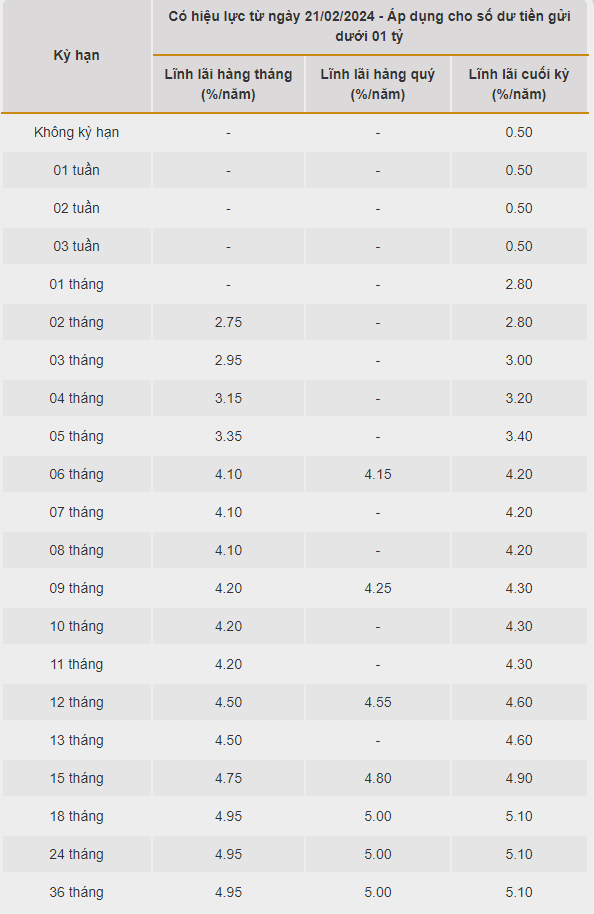

Latest Deposit Interest Rates at Bac A Bank

Bac A Bank has also announced a reduction in deposit interest rates. Specifically, the 2-month term interest rate is now only 2.75% per year, 3 months at 2.95% per year, 4 months at 3.15% per year, and 5 months at 3.35% per year. For the 6-8 month term, the interest rate is currently 4.1% per year, and for the 9-11 month term, it is 4.2% per year. Meanwhile, the 12-month term interest rate is currently posted at 4.5% per year, and the 15-month term interest rate is 4.75% per year.

The highest interest rate belongs to the 18-36 month term with 4.95% per year.

Source: Bac A Bank

Latest Deposit Interest Rates at Techcombank

On February 21, 2024, Techcombank continued to adjust its deposit interest rates. Accordingly, the bank reduced interest rates by an average of 0.2-0.3 percentage points for terms of 1-5 months. Specifically, the deposit interest rate for 1-2 month terms is 2.45% per year, and for 3-5 month terms, it is 2.85% per year.

For 6-36 month terms, the interest rates remain unchanged. Therefore, the deposit interest rate for 3-5 month terms is 2.85% per year, for 6-8 month terms, it is 3.7% per year and for 12-36 month terms, it is 4.5% per year.

In the case of online savings accounts, for different terms, the interest rate is increased by an additional 0.25-0.4 percentage points. The highest interest rate is 4.8% per year, applicable to 12-36 month terms.