The VN-Index witnessed a significant weekly gain, surging 28.59 points (2.34%) to close at 1,252.23. Foreign investors net bought VND 1,072 billion on HoSE, focusing on HDB, KDC, FPT, VNM, and MWG. However, HoSE‘s liquidity decreased by over 14% compared to the previous week, as the market lacked momentum with lackluster trading for the remaining four sessions.

According to Saigon-Hanoi Securities JSC (SHS), the real estate sector (VHM, TCB, DIG, NVL, etc.) was the most significant contributor to the market’s upward trend. Stocks benefiting from public investment also traded in the green after the Prime Minister’s directive to “unleash all resources, with public investment taking the lead and triggering private investment.”

Securities stocks witnessed impressive performances, notably BSI, FTS, VIX, SHS, and SSI. SHS data revealed that the VN-Index is regaining the strong psychological support level of 1,250 points, and in the short term, it has broken through the current short-term downtrend. The index may face short-term profit-taking pressure in the first few sessions of the next week before attempting to conquer the 1,250-point resistance level again. Similarly, VN30 is likely to undergo adjustments before retesting the resistance zone around 1,290 points.

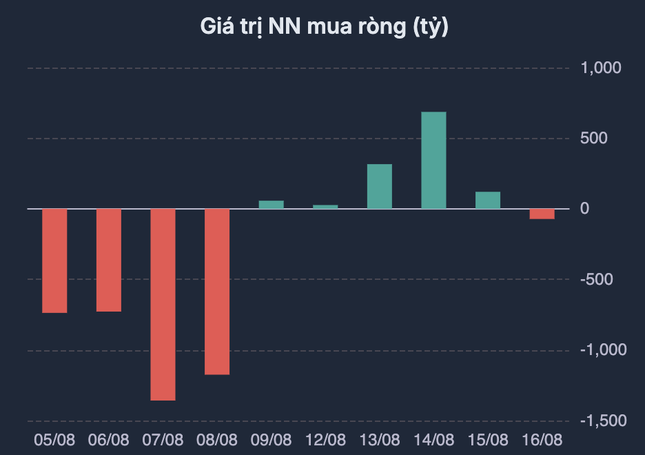

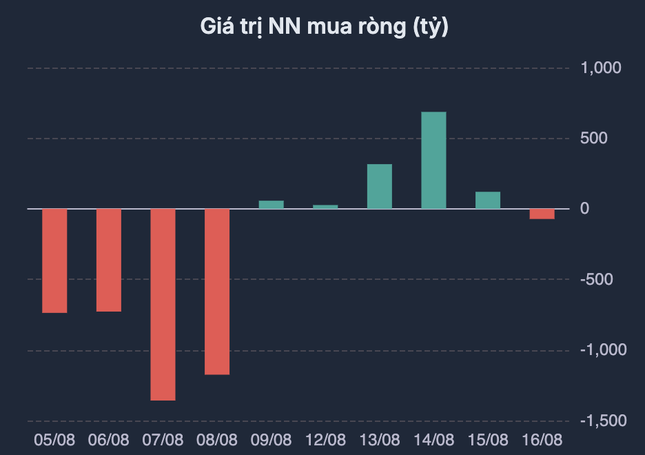

A notable development was the return of net buying from foreign investors during the past trading week.

Regarding the medium term, the VN-Index has been fluctuating within a broad range of 1,180 – 1,300 points since the beginning of the year. If the index can surpass the resistance level of around 1,250 points, there is a chance for the medium-term trend to revert to the 1,250 – 1,300 accumulation channel. However, the 1,250-point region is a formidable resistance level that won’t be easily breached without strong positive macro factors, given the previous accumulation of sell orders at that level.

“Short and medium-term investors should maintain a reasonable portfolio allocation and refrain from chasing purchases when the VN-Index recovers to the 1,250-point region. Instead, they should await the index’s short-term adjustments (expected in the early sessions of the next week) before initiating new buying positions,” advised SHS experts.

Analysts from KB Securities Vietnam (KBSV) interpreted the VN-Index‘s robust surge, accompanied by surging liquidity, as a breakout session. This development, coupled with the index’s successful breakthrough and conquest of the resistance zone around 1,235 points, confirms the resumption of the short-term upward trend after the decline from the 1,300-point peak. The VN-Index is likely to extend its recovery before encountering profit-taking pressure and adjustments at the next resistance zone around 1,270 points.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.