METZ USA is a company associated with Tran Thanh Minh, who is a member of the Board of Directors and also the General Director of DTH. The reason why METZ USA did not complete the registered transaction was due to disagreements between the related parties on the quantity and price.

During this period, the majority of the transactions involving DTH shares were agreement transactions. Notably, the transactions between July 15 and August 2 had volumes matching the amount purchased by METZ USA. The total value of these transactions amounted to nearly VND 84.6 billion, equivalent to an average of VND 13,600 per share. On the morning of August 19, the market price of DTH was VND 13,300 per share, and METZ USA had purchased shares at a premium of approximately 2.2% above this price.

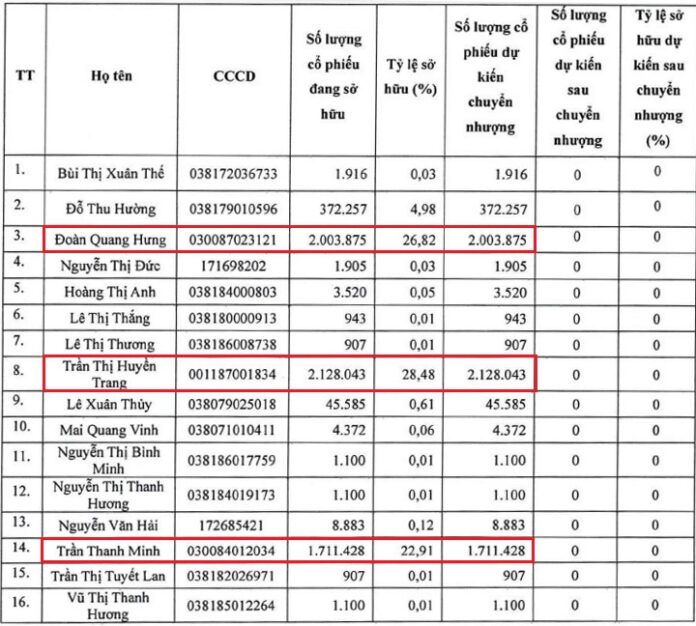

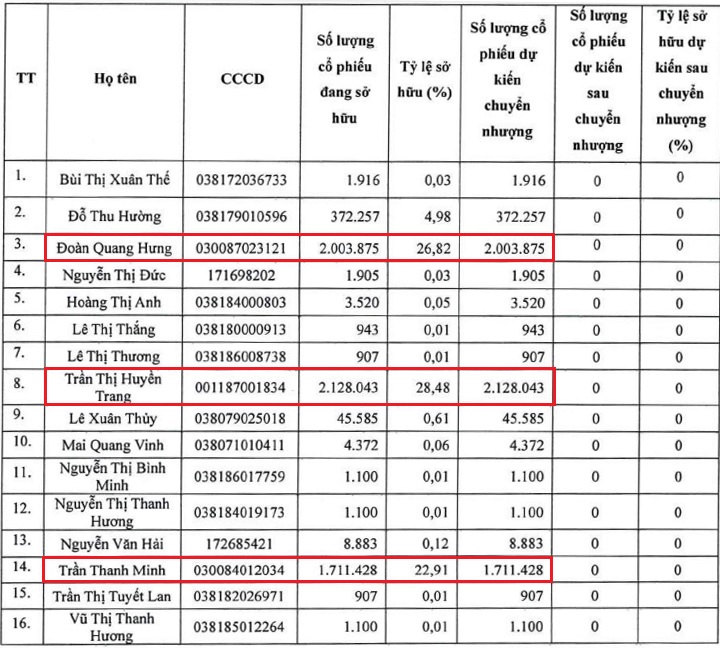

Prior to this, Mr. Minh and his wife, Tran Thi Huyen Trang, who is also a member of the Board of Directors of DTH, simultaneously registered to divest their entire holdings of 51.39% of the charter capital during the period from July 16 to August 12, 2024. Mr. Minh registered to sell 1.7 million shares (equivalent to 22.91% of charter capital), while Mrs. Trang intended to sell 2.1 million shares (equivalent to 28.48%).

Both transactions were successfully executed. Mr. Minh completed his sale on July 26, while Mrs. Trang finalized her divestment on August 2, 2024. It is estimated that Mr. Minh and Mrs. Trang respectively earned more than VND 23 billion and nearly VND 29 billion from these transactions.

In addition, on July 15, another major shareholder of DTH, Mr. Doan Quang Hung, sold a total of nearly 2 million shares over two days, on July 15 and July 18, reducing his ownership from 26.82% to 0.54%, equivalent to 40,600 shares. Mr. Hung is estimated to have earned approximately VND 27 billion from this sale.

In reality, the plan to welcome METZ USA as a new investor had been approved by the 2024 Annual General Meeting of Shareholders of DTH. The meeting had agreed to allow METZ USA to acquire shares without a public offering. Mr. Minh, Mrs. Trang, and Mr. Hung were included in the list of individuals who would transfer their shares to METZ USA.

|

List of shareholders who will transfer their shares to METZ USA

Source: DTH

|

In terms of business performance, DTH has achieved revenue in the hundreds of billions of VND annually since 2018, but profits have been modest, never exceeding VND 4 billion. In 2023, the company recorded a revenue of VND 526 billion, a 10% decrease from the previous year, while net profit stood at only VND 2.4 billion, a 31% drop.

| Despite generating revenue of over VND 500 billion per year, DTH has consistently reported thin profit margins. |

At the 2024 Annual General Meeting, General Director Tran Thanh Minh shared that the company had faced numerous challenges in recent years. Prior to 2021, the company pursued a competitive pricing strategy, which resulted in lower profits. Starting in 2021, the company shifted its focus towards enhancing product quality, but due to the nature of the pharmaceutical industry, research on stability takes time, and the benefits of these investments may not be immediately visible in the short term.

Mr. Minh also acknowledged that many of the company’s products are currently being sold at incorrect prices, as many salespeople are willing to offer discounts to meet sales targets. This has led to some customers bypassing the company’s distribution system. As a result, in 2024, DTH will undergo a comprehensive transformation in terms of product design and upgrades, as well as invest in an ERP system to improve overall management.

Additionally, he mentioned ongoing efforts to recover outstanding debts, such as those from the Thanh Hoa Provincial General Hospital and Miway Company.