Discover the 5 most popular installment plans currently available with VIB.

By understanding the needs of over 750,000 existing credit cardholders, VIB has identified that people have a wide range of spending categories. The 5 most common categories are travel, shopping, education, motorcycle purchases, and beauty & dental care. These are all expenses that can enhance one’s lifestyle and often carry a significant price tag compared to monthly income.

For instance, single cardholders may hesitate to spend an entire month’s salary on upgrading their laptop for better work performance or even opt for a new scooter that offers safer rides. Such decisions might lead to postponing other needs, such as orthodontic treatment, potentially missing the optimal time for dental correction.

Cardholders with families also face tough choices when it comes to investing in premium schools and courses for their children, splurging on annual vacations to strengthen family bonds, or spending on shopping and self-care to boost their happiness.

A common thread in these “brain-teasing” choices is the pressure of paying a large sum of money upfront, which can significantly impact the cardholder’s financial situation.

Empathizing with its cardholders’ budgeting needs, VIB has crafted the best installment plans tailored to these 5 popular categories. This makes payments more convenient and efficient by spreading out large expenses over a period of up to 36 months. Through automatic installments for these significant expenses, cardholders can also enhance their knowledge and experience in personal financial management, enjoying the life they desire.

3 personalized touchpoints that cater to cardholders’ preferences

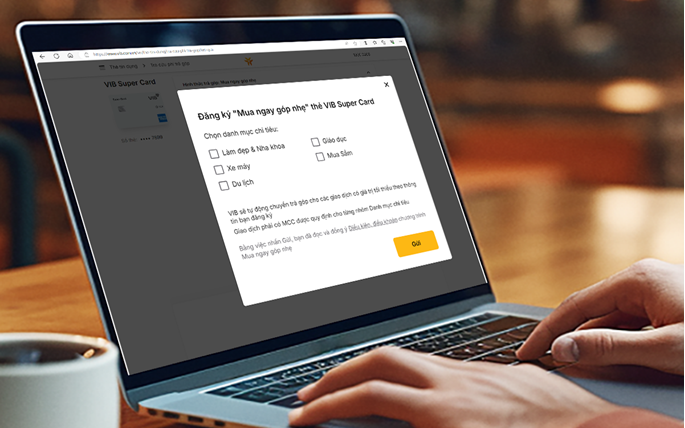

Rather than offering generic promotions, VIB is personalizing the installment experience through credit cards with 3 customizable options: product characteristics, tenure, and monthly payment amount.

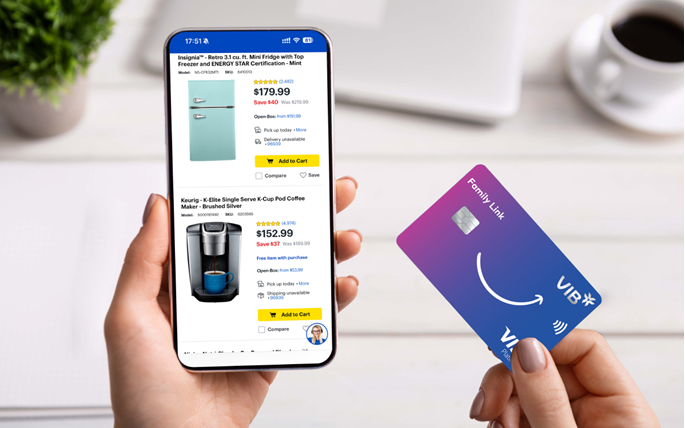

Regardless of who you are, your income, age, or interests, VIB’s ecosystem of 10 distinct credit card lines can meet your spending needs, be it for shopping (Cash Back, Super Card, Online Plus 2in1, LazCard), travel (Travel Élite, Premier Boundless), or family and education (Family Link, Ivy Card). Cardholders can choose any of their existing cards or apply for a new one to easily register for these installment plans.

VIB empowers its cardholders to choose their preferred tenure of 6, 9, 12, 18, 24, or even 36 months – the longest installment period currently available in the market. Additionally, cardholders can select their monthly installment amount based on their financial capacity for transactions within these five categories. The longer the tenure, the smaller the monthly payment, ensuring long-term financial stability.

Typically, cardholders with families and multiple expenses would opt for longer tenures of 2 – 5 large categories to avoid disrupting their daily spending. On the other hand, those with fewer shopping categories, higher incomes, and stable finances might prefer shorter tenures but occasionally choose longer ones to invest their idle money.

With this level of personalization reflecting today’s spending realities, VIB cardholders have the opportunity to design their own installment packages that align with their income sources and long-term personal financial management plans, benefiting themselves and their families.

This feature, a first in the market, addresses the need for automatic installment registration for large-value transactions. It’s a one-time registration that applies until the customer chooses to cancel the conversion at the VIB website.

3 tiers of benefits – the more you spend, the more you gain

For VIB cardholders, credit cards are not just a means of payment or installment; they are a tool to optimize spending. Holding a VIB credit card unlocks a trio of benefits, including installment plans, exclusive privileges for each card line, and partner discounts.

Upon registering for the “Buy Now, Pay Light” program, customers enjoy an interest rate of 0%, no initial participation fee, and a 0% periodic fee for the first 3 months. Starting from the 4th month onwards, new installments for the mentioned categories will be subject to a periodic fee of 0.4%/month for tenures of 6 or 9 months, and 0.8%/month for tenures ranging from 12 to 36 months. This interest rate is the lowest in the current consumer lending market.

VIB’s specialized credit card lines also offer exclusive privileges according to spending categories. For instance, the Family Link card provides up to 10% cashback on all education, healthcare, and insurance expenses, lightening the financial load for parents who opt for installment plans to pay their children’s tuition fees. The Super Card, with its flexible cashback of up to 15% on shopping, travel, dining, and more, is ideal for cardholders who frequently make substantial purchases.

The Cash Back card offers up to VND 24 million in annual cashback for shopping, dental care, and beauty treatments. Housewives can now allocate funds for self-care and family healthcare needs without significantly impacting their monthly budget.

Moreover, VIB has partnered with 150 strategic partners to create the VIB Privileges ecosystem, offering discounts of up to 40% across various categories, including shopping (VIB Shop), dining (VIB Dine), travel (VIB Travel), transportation (VIB Move), and other lifestyle needs (VIB More).

|

Customers who apply for a new credit card here before September 30, 2024, will be exempt from the annual fee for the first year if they spend at least VND 1 million within 30 days of card activation and 45 days of card issuance. |

The Isuzu mu-X conquers Vietnam: ‘No need to follow the trend, just buy what satisfies you’

Crossing Vietnam is not an uncommon feat, but to do it at the age of Mr. Phuong and his wife, who are willing to stay up late at night to chat while the husband drives, is truly remarkable.

Two extremely unlucky days for store grand opening in 2024 may cause businesses to suffer financial losses throughout the year

Our ancestors used to say: “A good start leads to a good finish.” Opening a company or a store on a favorable day can have a significant impact on future business. A successful grand opening will help the company or store run smoothly, bringing in luck and prosperity. On the other hand, choosing an unfavorable day can have the opposite effect.