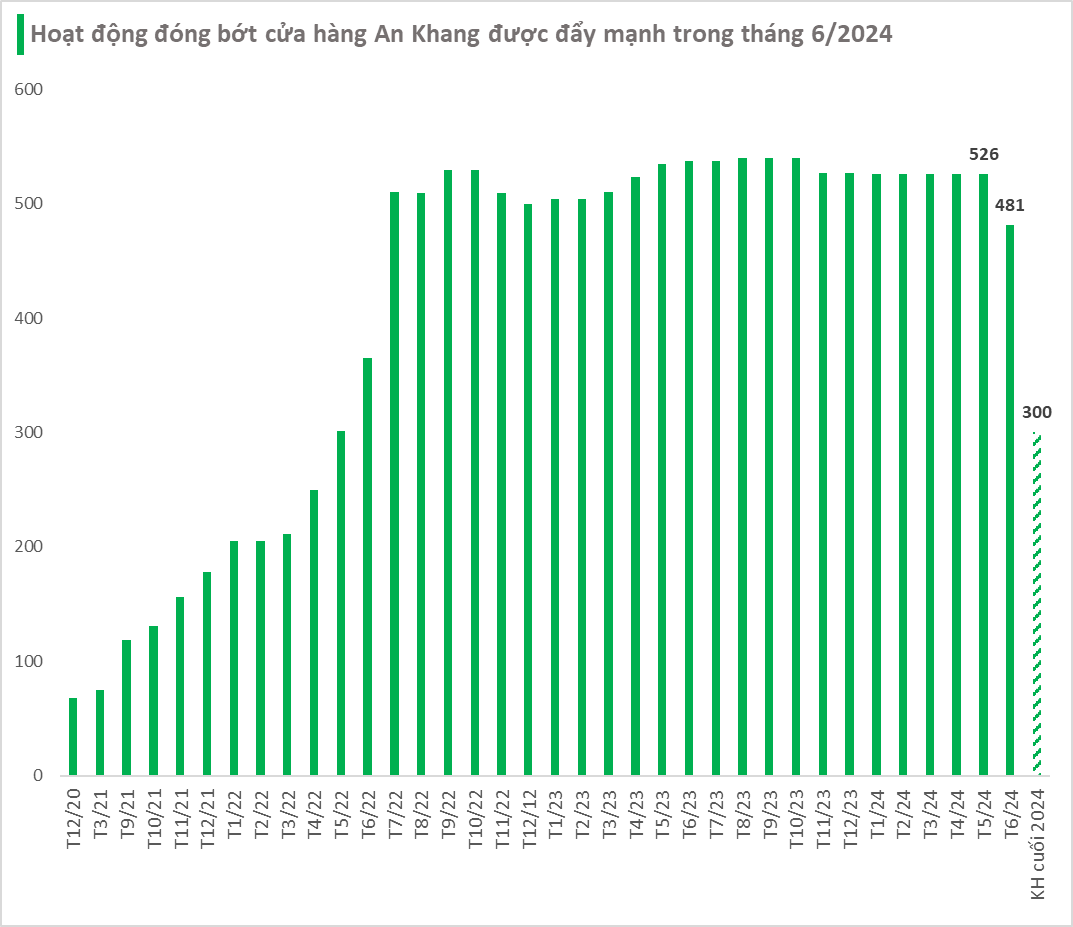

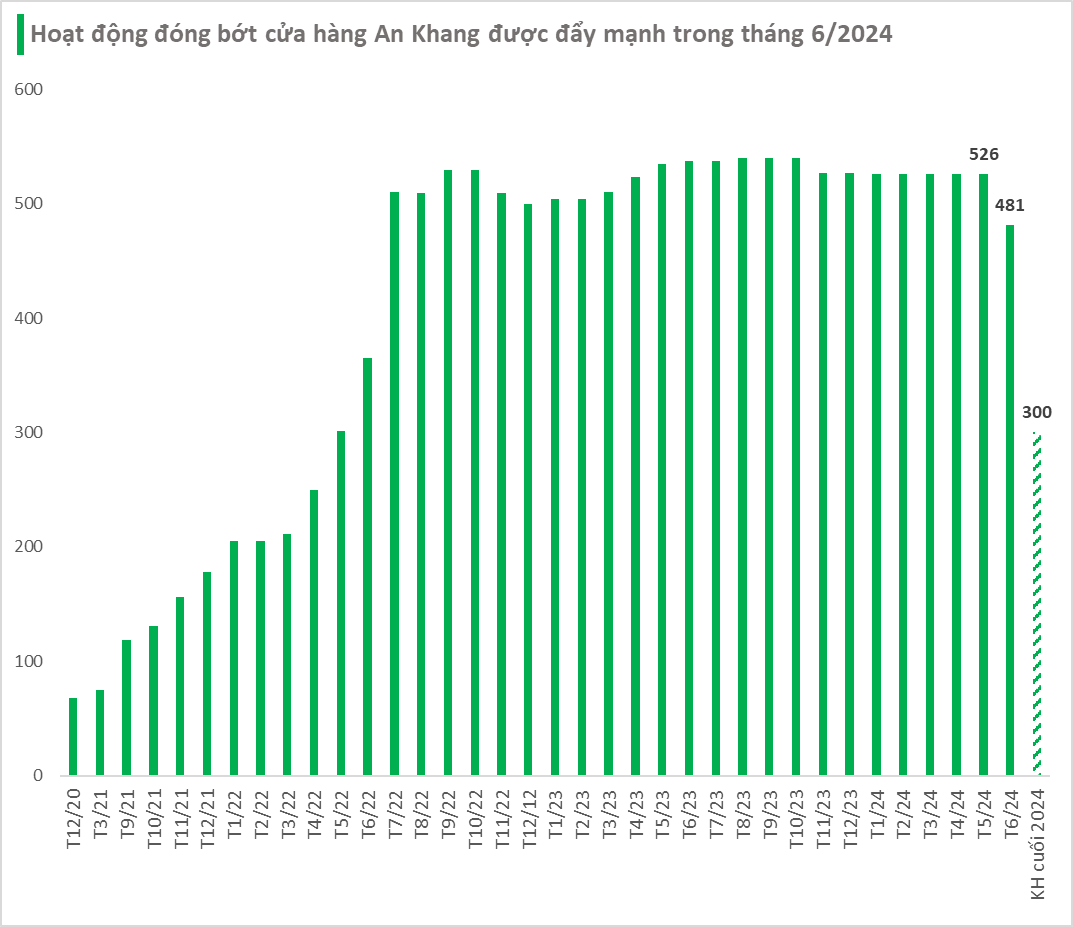

At MWG (Mobile World Investment Corporation)’s investor meeting for Q2 2024, Mr. Doan Van Hieu Em, Member of the Board of Directors and CEO of An Khang Pharma, shared that the company is undergoing a restructuring process. They are reviewing each pharmacy and closing down underperforming outlets that are not contributing significantly to revenue and profits.

According to Mr. Hieu Em, by the end of 2024, the number of An Khang pharmacies will be reduced to approximately 300 stores. As of the end of June, there were 481 An Khang pharmacies. This means that, according to the plan, about 200 An Khang pharmacies will have to close within the next six months. Prior to this, in the first half of 2024, the chain had already closed nearly 50 stores.

For the remaining operational pharmacies, revenue has surpassed VND 500 million per store per month, an improvement from VND 450 million at the end of 2023. Mr. Hieu Em emphasized that the breakeven point for the pharmacy chain is above VND 550 million per store per month.

“The two main goals we are striving for are ensuring sufficient medicine supply for customers and improving the qualifications of our pharmacists. In terms of direction, the first step is to reduce the number of stores to operate with the lowest possible costs. Subsequently, we will perfect our business model to achieve breakeven before accelerating expansion,” the MWG representative stated.

From the Ambition of Opening Thousands of Pharmacies to Shouldering a Loss of Nearly VND 1,000 Billion

MWG ventured into the pharmaceutical sector in 2017, but it was not until 2022 that they fully committed to the An Khang chain by rapidly expanding its scale and opening hundreds of new stores. At that time, MWG’s management expressed confidence in the chain’s growth potential, setting ambitious targets such as 800 stores by the end of 2022 and 2,000 stores by the end of 2023.

However, the actual performance fell short of expectations, leading to a halt in the expansion plans. In 2023, An Khang only added 27 pharmacies, bringing the total to 527. In 2024, the scale remained largely unchanged in the first half before the recent aggressive downsizing since June.

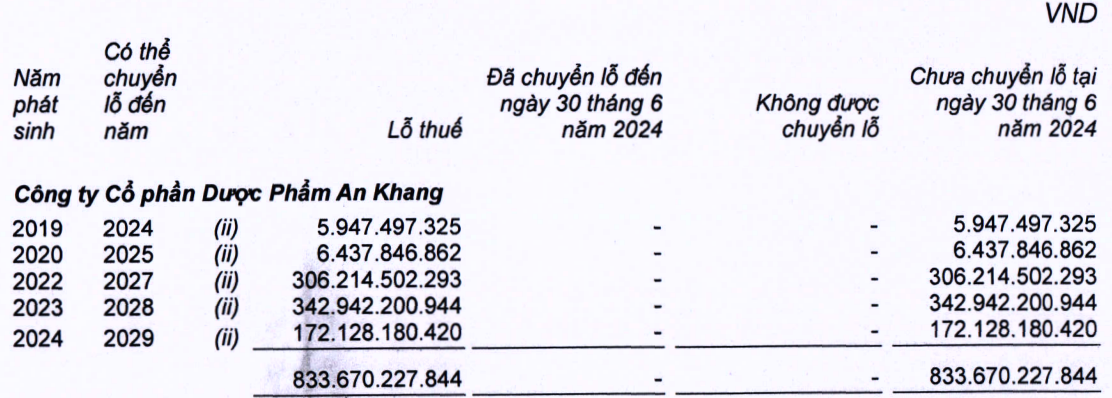

In terms of profitability, An Khang has not yet contributed positively to MWG’s bottom line. In the period of 2022-2023, the chain incurred a tax loss of over VND 300 billion each year. In the first half of 2024, An Khang reported a loss of VND 172 billion, bringing the cumulative loss as of the end of June 2024 to nearly VND 834 billion.

In its 2024 business orientation, MWG omitted any mention of “profitability” when discussing An Khang’s objectives. Instead, the pharmacy chain is now aimed at achieving double-digit revenue growth, increasing market share, and reaching breakeven by December 31, 2024.

Source: MWG’s Q2 2024 Financial Statements

In reality, An Khang still faces intense competition from other modern commercial pharmacies such as Long Chau, Pharmacity, and thousands of existing retail pharmacies that have been in the market for decades. An Khang’s business model shares similarities with the Long Chau chain, but it has not yielded the desired outcomes.

Additionally, since An Khang does not heavily focus on prescription drugs for chronic diseases like Long Chau, it will be challenging for them to capture market share from hospital pharmacies.

According to SSI Research, the stagnant performance of the An Khang pharmacy chain is attributed to an imbalanced product mix. The gross profit margin was negative 15% in 2023 and remained negative at around 8-10% in the first half of 2024. SSI forecasts that the An Khang pharmacy chain will incur losses of VND 339 billion and VND 243 billion in 2024 and 2025, respectively. The closure of An Khang pharmacies may not significantly impact MWG’s overall net profit.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.