Earning 30 million VND a month: Should you borrow to buy a house?

Interest rates on home loans at many banks have decreased by about 1-3% compared to last year. Some banks even offer promotional interest rates as low as 5-6%/year for the first year.

While this is a desirable solution for many who wish to own a home, how much should one borrow, and what percentage of their monthly income should be allocated to avoid turning their home into a “debt burden”?

A few months ago, Mr. Nguyen Duc Huy borrowed 3.5 billion VND to purchase two houses in Ha Dong District, one for living and the other for business. With a 15-year loan term, his family has to set aside 34 million VND each month to repay the interest and principal. This amount accounts for only about 1/3 of their total income.

“The golden ratio” for borrowing to buy a house, as suggested by financial experts, is about 30-50%. Currently, a small private house or apartment in the two major cities of Hanoi and Ho Chi Minh City starts at around 2-2.5 billion VND. According to calculations, if a home buyer borrows about 50%-70% of the property value over 15 years, they will have to pay monthly installments ranging from 10 to 16 million VND. Not to mention that apartments with low prices are often scarce and far from the city center.

For properties in the mid-range price segment, around 4-5 billion VND, borrowing 50% would result in monthly payments of approximately 19 million VND. Adding about 10 million VND for basic living expenses, the borrower’s income should be at least 30 million VND/month.

Mr. Do Quy Duy, Executive Director of Times New Roman Real Estate Investment and Trading Company, shared, “If our monthly household income is around 30-40 million VND, it would be reasonable to borrow about 40% of that amount to pay the bank interest. With an income of 30 million, you should allocate about 12 million, and with 40 million, about 16-17 million for bank interest payments.”

For those with an income of only about 20 million VND, experts advise considering ways to increase cash flow before borrowing to buy a house to avoid risks. Moreover, the percentage of the property value to be borrowed is also worth considering.

Mr. Le Trung Phuc, Head of Retail Credit Group, Retail Products Division at BIDV, stated, “At present, the average and common loan-to-value ratio is around 70-80%. It is still possible to borrow up to 100% of the property value, but of course, the higher the loan amount, the higher the interest rate.”

Financial experts suggest a “golden ratio” of borrowing about 30-50% of one’s income for a home loan and choosing a suitable loan package. Those with stable but not very high incomes should opt for longer-term loans, ranging from 10 to 25 years.

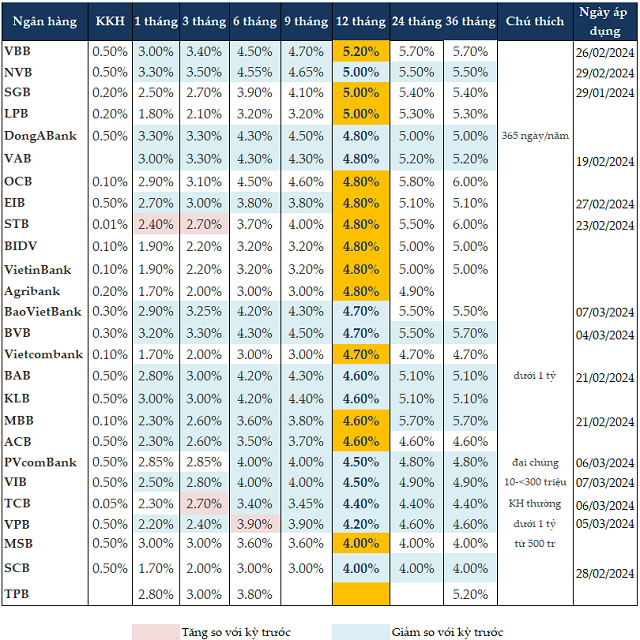

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Banks Sacrificing Profits to Support the Economy

In 2023, the question “which bank has the lowest interest rates?” is being talked about more than ever. With the prevailing difficult economic situation affecting individuals and businesses, in line with the directive of the State Bank of Vietnam (SBV), banks have unanimously sacrificed their profits by reducing lending rates and introducing credit packages with interest rates as low as 0%.