The market’s upward trend continued with strong momentum during today’s trading session. Towards the end of the day, the index surged, with real estate unexpectedly emerging as a positive influence on the market.

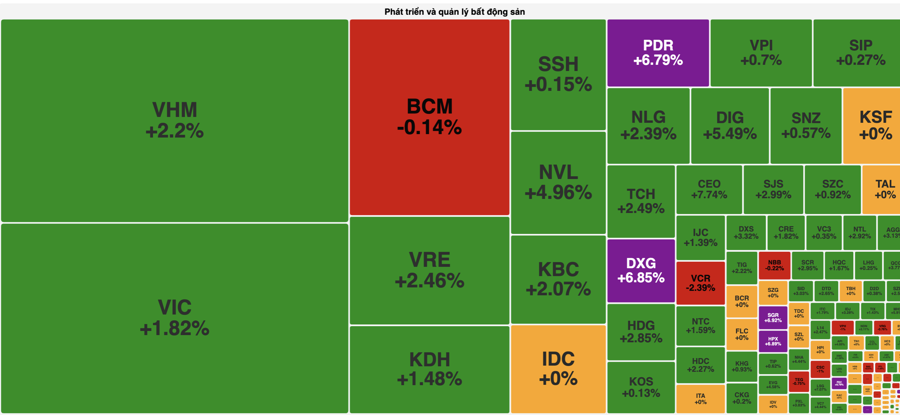

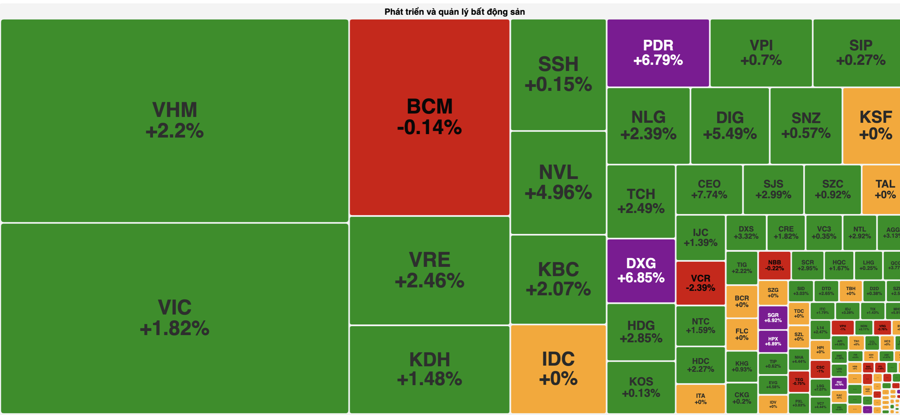

Two “hot” stocks, PDR and DXG, soared to their daily limit, with nearly 5 million buy orders left unfilled. Several other real estate stocks also witnessed significant gains, including VHM, up 2.2%; VIC, up 1.82%; and VRE, up 2.46%. Additionally, DIG rose by 5.49%, NVL by 4.96%, KDH by 1.48%, HDG by 2.85%, and NLG by 2.39%.

The strong performance of the real estate sector can be attributed to positive business news from companies like PDR and DXG in recent times. Moreover, many stocks have reached multi-year lows, attracting investors seeking opportunities.

According to analysts at VnDirect, the first half of the year saw limited interest in real estate stocks, with most of them experiencing adjustments, including NVL, DXG, DIG, and CEO. However, companies with strong sales performance, positive narratives such as successful corporate restructuring, and growth potential due to advantages in accelerating project land clearance and completing land use payments under the old government framework to maintain healthy profit margins, like NLG and KDH, have managed to hold their ground relative to the VN-Index.

The slow start to the year for the real estate sector is partly due to the typical lag in their business results, which haven’t yet created a strong enough positive effect on investor sentiment. In the second half, the market sentiment is expected to be bolstered by the acceleration of deliveries to customers, resulting in improved business results for these companies.

Several enterprises have announced their delivery plans for the latter half of the year, including Vinhomes (Vinhomes Ocean Park 3, Sky Park, Golden Avenue), Nam Long (Akari, Can Tho, Southgate), and Khang Dien (The Privia), among others.

VnDirect also believes that it will take time for the positive impact of supportive policies and the new Real Estate Laws to be felt by investors. In the short term, the new laws may have mixed effects on the market. The implementation of a new land price framework by some localities, with the risk of significantly higher land prices, could create additional financial pressure on businesses and make it challenging to cool down housing prices.

On the other hand, more favorable regulations for homebuyers, such as limiting the down payment collected by developers to 5% and expanding the scope of homeownership rights for foreigners, are expected to boost buyer confidence.

Overall, a strong uptrend in the real estate sector in the second half of the year is unlikely, and the recovery trend is expected to be gradual and become more apparent as the market witnesses improvements in the financial and business performance of these companies. Investment opportunities in real estate stocks will be polarized, favoring enterprises with a proven track record of successful project development, adequate legal compliance, healthy sales figures, and robust financial health with low leverage.

Companies without new project launches in the near future will continue to face financial challenges and legal procedure-related obstacles due to the increasingly stringent regulations.

“Investors need to thoroughly assess the financial health and legal compliance capabilities of ongoing projects to make informed decisions when investing in real estate companies,” VnDirect emphasized.

According to financial reports for Q2 2024 from listed real estate companies on HoSE, the industry’s total profit reached 12,175 billion VND, a 15.73% decrease compared to the same period last year, mainly due to VIC’s loss of 3,404 billion VND against a net profit of 1,824 billion VND in Q2 2023. Excluding VIC, VHM, and VRE, the after-tax profit for Q2 2024 was 3,774 billion VND, a 59.9% increase.

Overall, the industry’s financial performance has not yet shown a strong recovery, as sales have only started to pick up since late 2023 for a limited number of companies, with delivery peaks expected in 2H2024, and profit margins have been affected by various promotional policies.

In terms of valuation, BSC believes that the valuation of the industry in each phase of the new cycle will be higher than the previous cycle, as most of the current land banks were accumulated in the previous cycle, resulting in lower costs. The demand for housing remains strong, unlike the sluggish market of 2011-2013. Overall, BSC considers the valuation of the real estate group to be in an attractive investment range.

Sharing a similar view, KBSV expects the business performance of real estate enterprises in the second half of 2024 to witness a more noticeable recovery, thanks to improved buyer sentiment and increased supply from new project launches and subsequent phases of existing projects.

While many companies have set relatively high sales targets for 2024, KBSV’s estimates are more cautious, considering that while the apartment segment is expected to witness a strong recovery, other segments may need more time.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.