On August 29, 2024, QNS Sugar Joint Stock Company will finalize its list of shareholders to receive the first round of 2024 dividends in cash, at a rate of 10%. This means that for every 1 share owned, shareholders will receive VND 1,000.

With nearly 357 million shares currently in circulation, QNS is expected to pay out approximately VND 360 billion to its shareholders. The payment date is tentatively set for September 11, 2024.

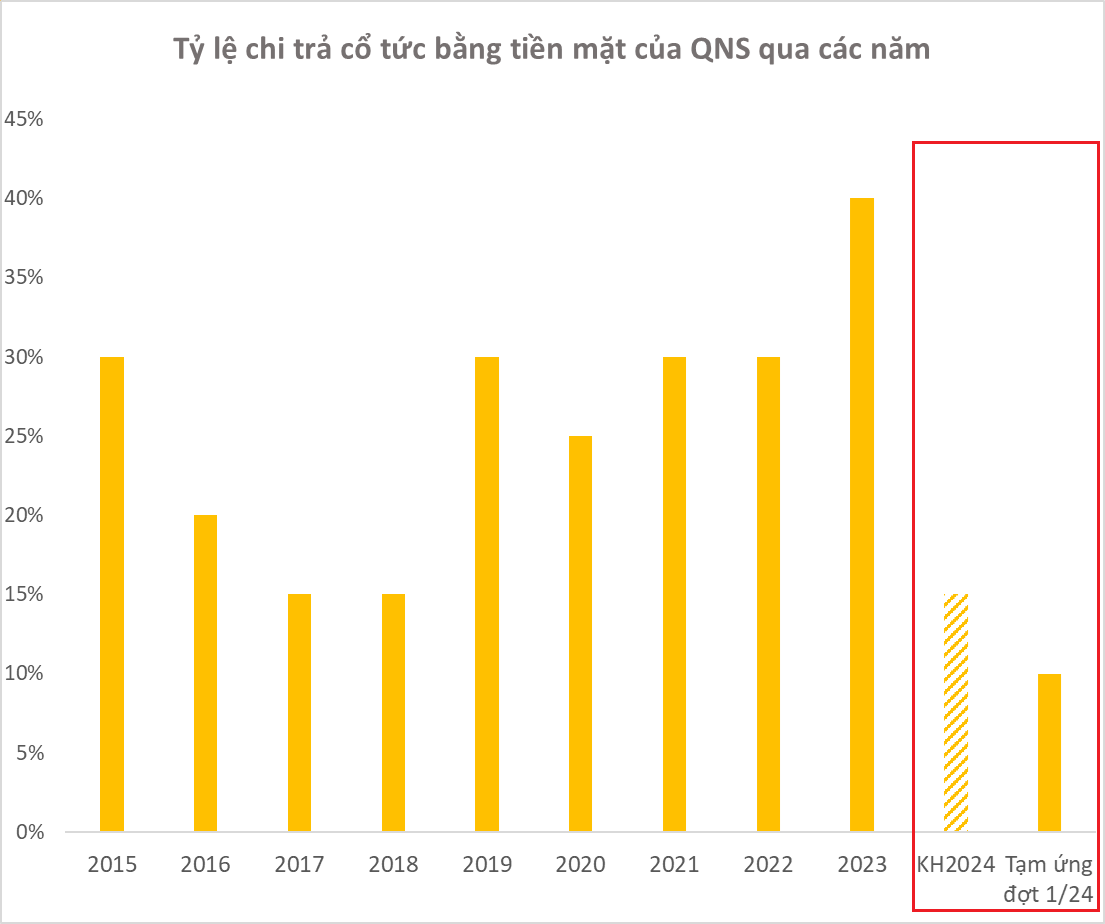

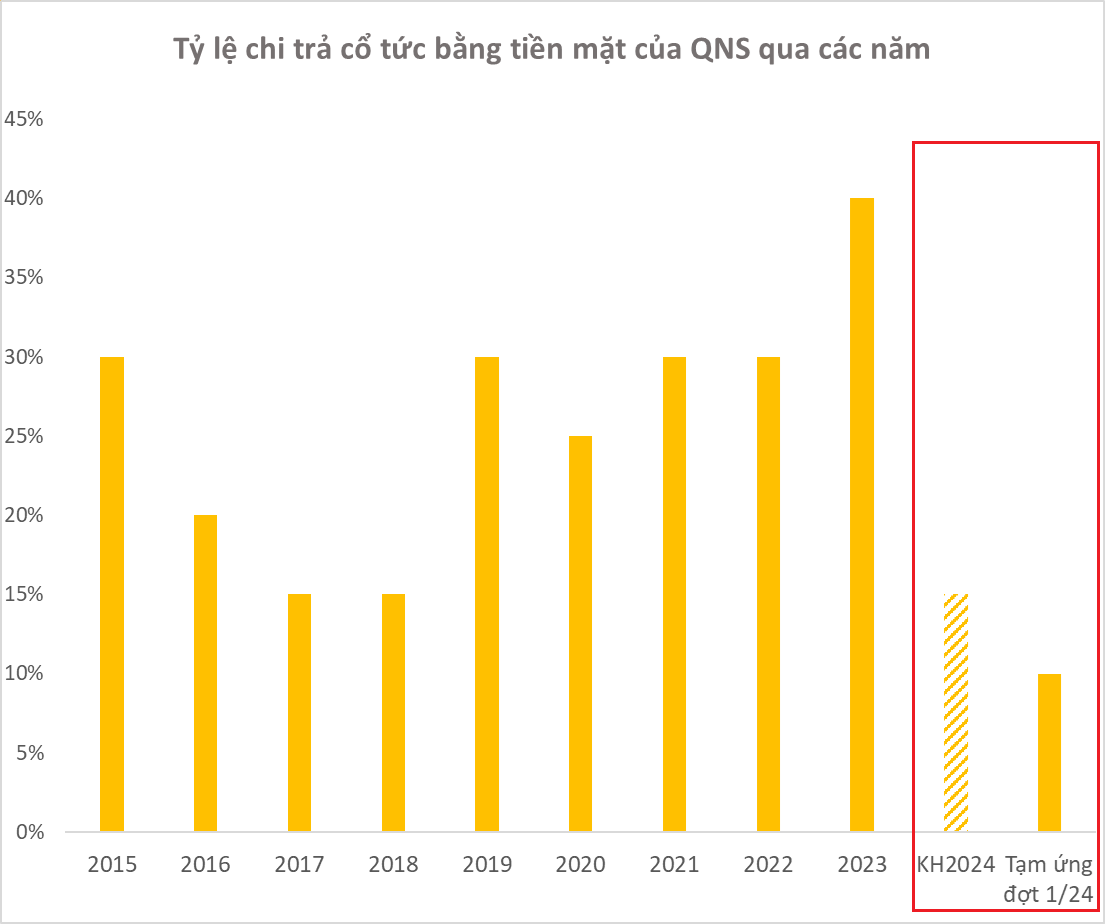

At the 2024 Annual General Meeting of Shareholders, QNS approved a plan to distribute dividends for the year at a minimum rate of 15%. However, the company has a history of exceeding initial plans, as evidenced by the record-high dividend rate of 40% in 2023.

QNS Sugar Joint Stock Company is a well-known enterprise with a significant market share in the soy milk segment, boasting two famous brands: Fami and Vinasoy. The company is also a pioneer in sugar production and owns one of the largest sugarcane farming areas in Vietnam. Additionally, they produce the most popular beer brand in the Quang Ngai province.

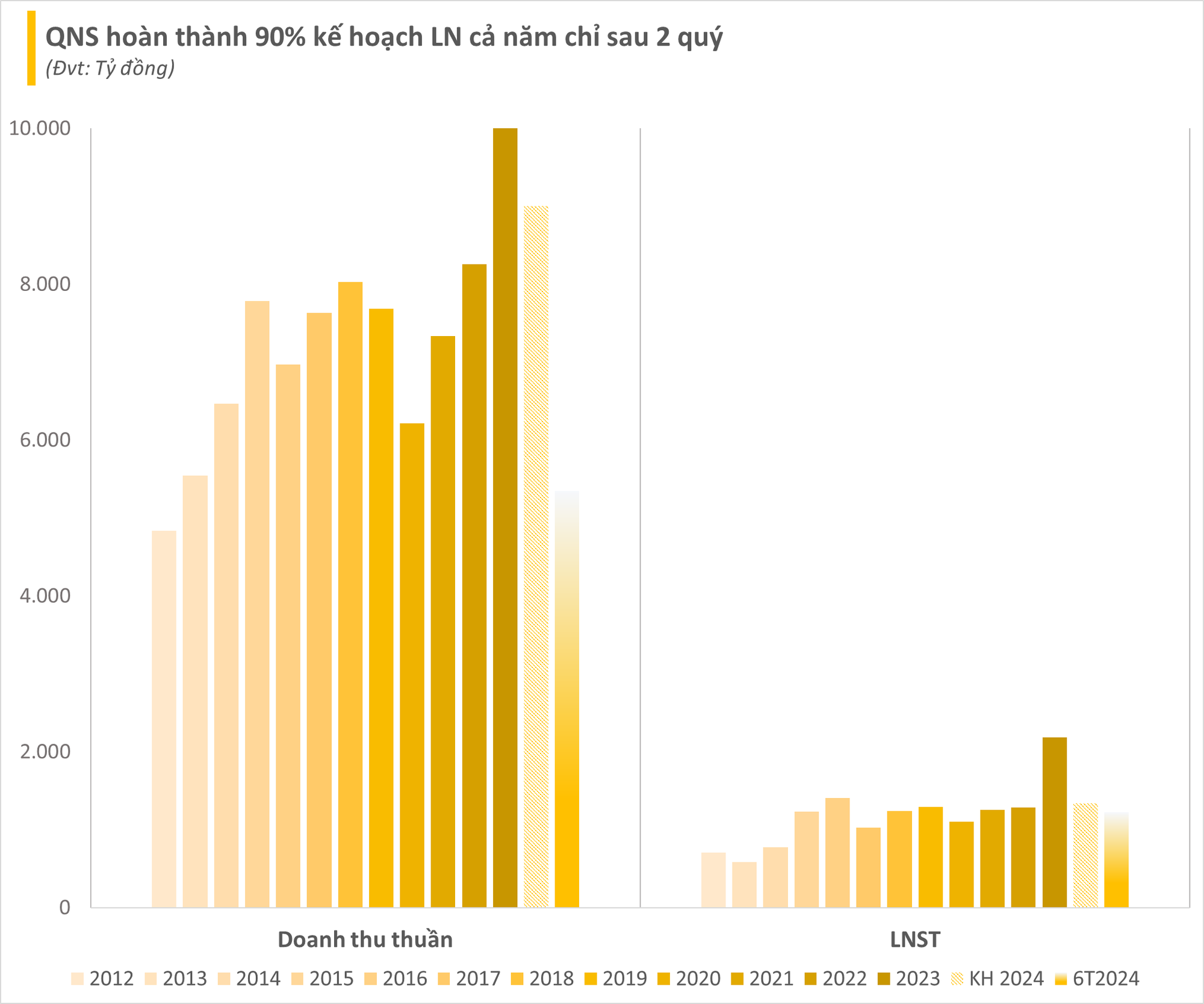

In terms of business operations, QNS reported a slight 1% year-on-year increase in revenue for the first half of 2024, reaching VND 5,343 billion. Consequently, the company’s after-tax profit rose to VND 1,222 billion, reflecting a 19% growth compared to the same period last year and achieving 90% of the full-year profit plan.

As of the close of the August 21 session, QNS shares were trading at VND 48,500 per share, marking a 13% increase since the beginning of 2024.

In a recent report, DSC Securities anticipated a stronger recovery in purchasing power in the upcoming quarters, as the VAT reduction has been extended until the end of 2024. QNS also plans to launch two new product lines, providing room for growth in their dairy segment.

Regarding the sugar segment, DSC believes that domestic sugar prices in 2024 will remain relatively stable or experience only a slight decrease due to reduced supply as some factories have ceased production. Additionally, the high exchange rate has increased the cost of imported sugar, reducing the amount of sugar entering the market and lessening competitive pressure on domestic sugar producers like QNS.

Furthermore, QNS’s long-term growth drivers include the rising consumer trend towards health-conscious products and the fact that domestic sugar production currently meets only ~50% of consumption demand. The company’s ethanol plant project also holds potential as a new revenue stream in the future.

DSC estimates QNS’s 2024 financial results to yield a profit of approximately VND 1,950 billion, a decrease from the record-high in 2023 but still significantly higher than the company’s 5-year average.

Vietjet Air achieves revenue of 62.5 trillion VND in 2023, cash surplus doubles

Last year, Vietjet safely operated 133,000 flights, transporting 25.3 million passengers (excluding Vietjet Thailand), including over 7.6 million international travelers, marking a remarkable 183% increase compared to 2022.