Vietnam’s stock market in the first half of 2024 saw a lack of interest from investors in residential real estate stocks. Stocks in this sector tended to adjust in the first half, including Novaland (NVL), Dat Xanh Group (DXG), Construction and Infrastructure Development Corporation (DIG), and the C.E.O Group (CEO).

However, companies such as NLG (Nam Long) and KDH (Khang Dien) demonstrated strong sales performance due to successful enterprise restructuring, accelerated land clearance progress, and completion of land use payments according to the government’s old land price framework, allowing them to maintain attractive profit margins in the upcoming period.

Vietnam’s stock market in the first half of 2024 showed a lack of interest in residential real estate stocks. (Illustration: B.L)

Vndirect’s real estate analysts attributed the slow performance in the first half to the typical lag in real estate business results, making the sector less appealing to investors.

“In the second half, we anticipate an improvement in market sentiment driven by the accelerated business results of enterprises as they ramp up home deliveries to customers. Notable examples include Vinhomes with their deliveries of Vinhomes Ocean Park 3, Sky Park, and Golden Avenue; Nam Long with Akari, Nam Long Can Tho, and Southgate; and Khang Dien with The Privia,” Vndirect stated.

Mr. Tran Trung Kien, Vndirect’s real estate analyst, noted that it would take time for the supportive policies and the new Real Estate Law to positively impact investor sentiment in the stock market.

In the short term, the new laws will have mixed effects on the real estate market. Some localities have started applying the new land price framework, which carries the risk of significantly higher land prices compared to the previously applied rates, thereby creating additional financial pressure on enterprises and making it challenging to cool down housing prices.

On the other hand, more favorable regulations for homebuyers, such as the requirement for developers not to collect more than a 5% deposit and the expanded scope of homeownership rights for foreigners, will positively influence buyer sentiment.

According to Mr. Kien, a strong upward trend in real estate stocks is unlikely in the second half of the year. The recovery trend will be gradual and will only become more apparent as the market observes improvements in the business and financial performance of enterprises.

Investment opportunities in real estate stocks will be polarized. Enterprises with a proven track record of successful project implementation, adequate legal compliance, strong presales performance, healthy financial standing, and low leverage will offer potential investment prospects in this phase.

Analysts from Vietnam International Securities (VIS) share a similar sentiment, stating that opportunities for real estate stocks lie ahead. Real estate stocks need more time, especially considering the current lack of notable improvements in the real estate market’s purchasing power.

At present, enterprises are restructuring their assets and repaying bond obligations. Therefore, it is likely that the operations of real estate enterprises will only return to a healthy and stable state in 2025.

Regarding potential real estate stocks, Vndirect’s experts suggest that KDH and NLG stocks show promising growth prospects in the upcoming period. This optimism is attributed to their efforts in accelerating land clearance and completing land use payments for large-scale projects in Ho Chi Minh City and its neighboring satellite cities.

The projects undertaken by these enterprises boast prime locations and the companies’ established reputations, ensuring strong sales performance and attractive profit margins in the coming years, backed by their solid project development plans.

On the other hand, enterprises without upcoming product launches will continue to face financial challenges and legal procedure-related obstacles due to the increasingly stringent regulations.

Vndirect advises investors to thoroughly assess the financial health and legal compliance capabilities of ongoing projects to make suitable investment decisions.

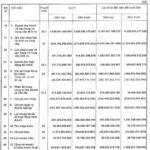

Analysis of Investment Strategies of Funds in 2023

With a dynamic strategy, major investment funds in the past year have achieved outstanding profitability compared to the VN-Index. Analyzing the investment strategies and portfolio allocation of these funds provides us with additional insights to make investment decisions in 2024.