Vietnam’s stock market witnessed a strong recovery recently, but it is now facing notable corrective pressures on August 22nd. Many large-cap stocks struggled, causing the VN-Index to fluctuate significantly. Amidst the market’s weakness, a group of stocks related to the Apec Group ecosystem unexpectedly surged, becoming the day’s highlight.

During the afternoon session, two tickers, API of Asia-Pacific Investment and IDJ of IDJ Vietnam Investment , hit the daily limit, reaching VND 8,500/share and VND 7,000/share, respectively. Shares of APS, Asia-Pacific Securities , also rose 8.5% to VND 7,700/share. Trading volume improved significantly compared to the previous sessions. Despite the sharp price increases, these stocks remained in high demand, with hundreds of thousands of buy orders at the ceiling price for IDJ and API.

Prior to this, the Apec group of stocks had surged in May-June 2024, with gains of tens to hundreds of percent within a month. However, the share prices quickly retreated and consolidated before rebounding again. It is important to note that all three tickers are currently under control/warning by HNX.

Historically, this trio of Apec-related stocks has made a significant impact on the stock market, with gains of several times their initial value. However, in June 2023, Mr. Nguyen Do Lang, CEO of APS, and his accomplices were arrested and detained for stock market manipulation involving these companies. According to the investigation, between May 4, 2021, and December 31, 2021, Nguyen Do Lang, his wife, Huynh Thi Mai Dung, and Pham Duy Hung directed the use of 40 trading accounts at APS to continuously buy and sell, creating artificial supply and demand and pushing up the closing prices of the three stocks: API, APS, and IDJ.

In addition to using trading accounts for manipulation, the group also disseminated positive information about the three stocks on Zalo groups to attract investors. After the manipulation period, they sold the stocks and illegally profited over VND 157 billion.

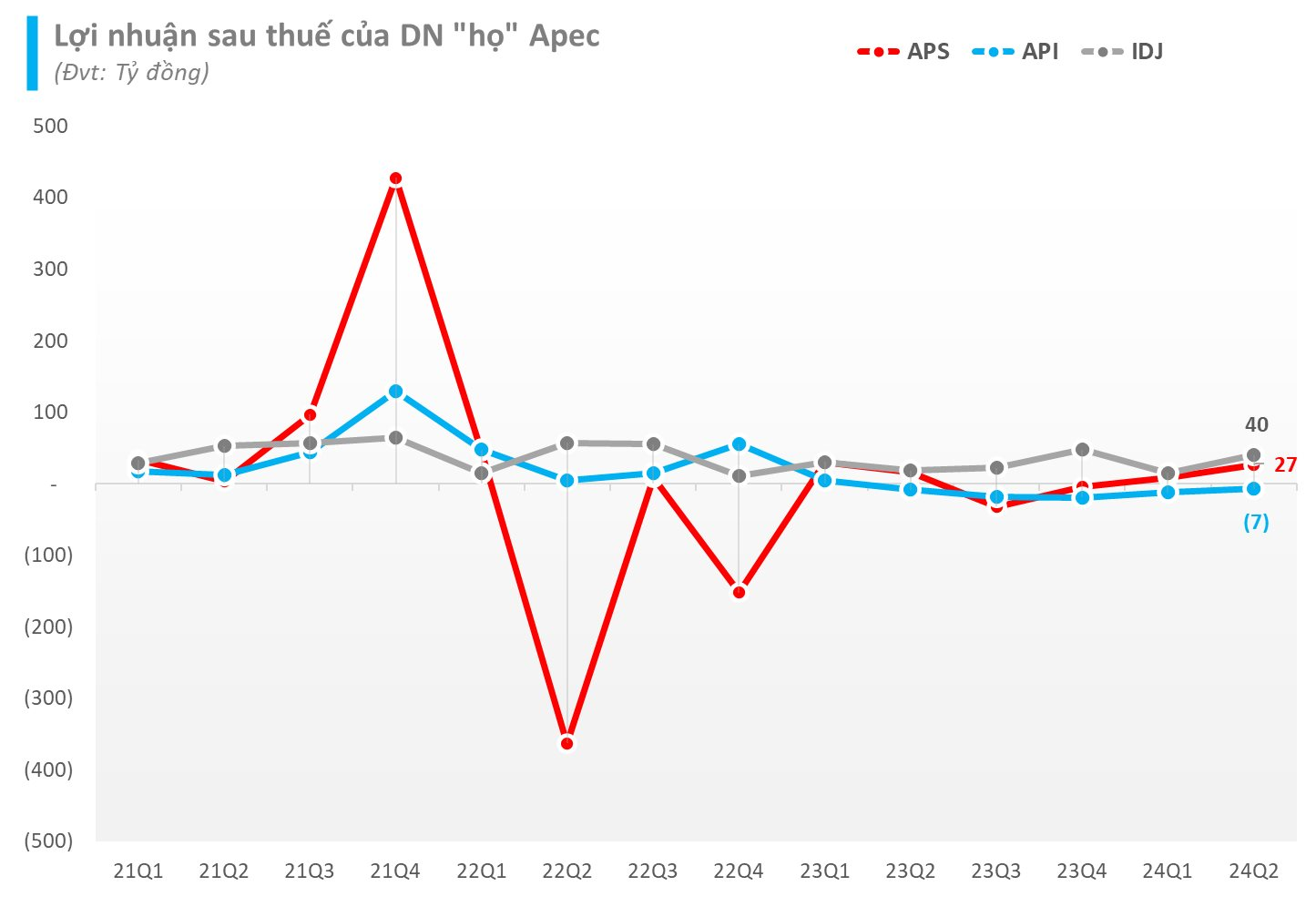

Following this incident involving key leaders, the Apec group of companies experienced a significant decline in their business performance in 2023. API and APS even reported losses. In 2024, all three companies aimed to return to profitability, but the reality has been different.

At Asia-Pacific Securities, the company reported a profit of over VND 35 billion in the first half of 2024, an improvement from a loss of VND 136 billion in the same period last year. Given its target of VND 49 billion in net profit, the company has achieved 71% of its goal.

IDJ, on the other hand, set ambitious targets, with revenue of VND 857 billion and pre-tax profit of VND 140 billion. For the first two quarters, IDJ recorded a pre-tax profit of over VND 69 billion, a 19% increase from the previous year, achieving 49% of its target.

Investment firm API faced challenges, reporting a loss of nearly VND 19 billion in the first half of 2024, double the loss from the same period last year. API attributed the loss to negative impacts on the real estate market, leading to a pause in new project launches. With this loss, the company’s target of VND 38 billion in profit seems increasingly out of reach.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.