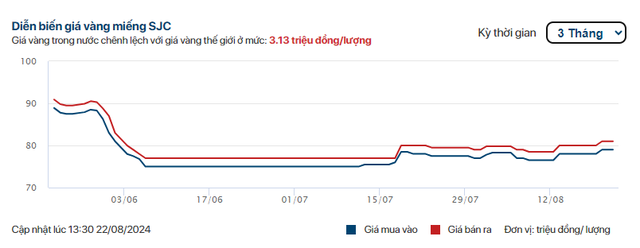

Since the beginning of 2024 until May, SJC gold prices and domestic gold rings have experienced significant fluctuations. At certain times, gold prices rose continuously, even changing by the hour. The domestic SJC gold price once reached a difference of up to 18 million VND per tael compared to the world gold price.

In response to the volatility in gold prices, from the beginning of June, the SBV changed its strategy by selling gold directly to the people at a designated price through authorized commercial banks that are licensed to sell SJC gold.

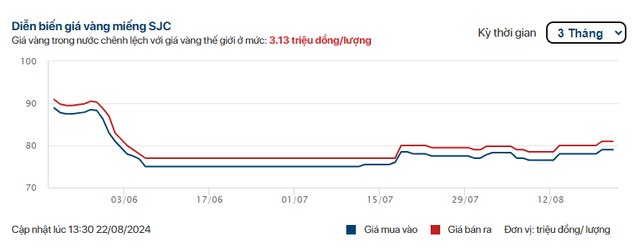

At the same time, the competent authorities implemented administrative solutions, including inspections, gold identification, and anti-speculation measures, which put an end to the abnormal surge in SJC gold prices. After more than two months of implementation, the gap between domestic and world gold prices has narrowed significantly. The SJC gold price in the domestic market is currently fluctuating at the threshold of 80 million VND per tael.

Commenting on the gold price stabilization policies introduced by the State Bank of Vietnam (SBV) in the past, Dr. Bui Duy Tung, an economics lecturer at RMIT University, assessed that the policies have contributed to narrowing the gap between domestic and world gold prices. Currently, the domestic gold price is only about 5 million VND per tael higher than the world price, compared to the very large difference of 16-17 million VND per tael in the first months of the year.

Especially, the “goldization” situation has also been controlled. Mr. Tung believes that the policy of selling gold through commercial banks has helped reduce people’s demand for gold hoarding, thereby reducing the “goldization” situation in the market. This contributes to stabilizing the gold market in the short term.

“The current gold selling mechanism has helped reduce the ‘gold fever’ in Vietnam, as people are no longer rushing to buy gold as before. This helps stabilize the market and prevent ‘goldization’. By keeping the SJC gold bar price stable, the SBV has helped to stabilize the psychology of domestic consumers and investors, avoiding a rush to buy gold leading to uncontrollable gold fevers. This has contributed to reducing pressure on the gold market and avoiding negative economic consequences,” said Mr. Tung.

SJC gold price movement in the past 3 months. Chart: CAFEF

However, according to Mr. Tung, the gold price stabilization policy still has some drawbacks.

First, the gold trading network has been narrowed. The fact that the SBV designated only four commercial banks and SJC to sell gold has narrowed the gold trading network, making it difficult for people to access gold, especially in provinces and cities outside Hanoi and Ho Chi Minh City. This reduces the dynamism of the market and hinders people with a genuine need to buy gold.

Second, the gold buying and selling process has become complicated. The current gold buying procedure, which requires online registration, waiting for a few days to receive the gold, and a limited number of sales points, reduces flexibility and causes inconvenience for people. This discourages many people from engaging in gold transactions. Since only commercial banks and SJC are allowed to sell gold and not buy it back, many people feel unsafe investing in gold. The lack of options to sell back gold has made people less interested in gold as an investment channel.

Third, the market lacks supply and demand balance. Although the SBV has implemented measures to stabilize gold prices, overly tight control can lead to imbalances in supply and demand, potentially causing long-term instability, such as the emergence of a black market and gold trading that does not comply with regulations. The SJC gold bar market has become less vibrant, with a stagnant and illiquid situation. As a result, gold transactions have decreased significantly, making the market less attractive to investors.

In addition, according to Mr. Tung, maintaining administrative management measures for too long can lead to negative issues such as the formation of a black market, the appearance of fake and counterfeit gold, and fraud in gold trading. This could undermine people’s trust in the official gold market.

Fourth, the policies have not eliminated the monopoly of the SJC gold brand. The current policy still maintains the monopoly of the SJC gold bar brand, which can lead to unreasonable price differences and unfair competition in the market. The fact that the SBV still has a monopoly on gold imports also restricts supply, leading to shortages and unnecessary price increases.

“The gold bar price stabilization policy has created a ‘squeeze here, bulge there’ situation, causing the gold ring price to rise sharply and potentially continuing to rise, causing instability in the market. The strong intervention of the SBV in managing the SJC gold bar price can lead to market distortions. When the gold bar price is suppressed at a low level compared to the gold ring price, this may encourage speculative behavior or undesirable capital flows, causing long-term instability in the market,” Mr. Tung assessed.

Deadline for Reporting Gold Market Management and Operations Results to SBV Today, January 31

As per the directive of Prime Minister Pham Minh Chinh, today (January 31, 2024) is the deadline for the State Bank of Vietnam (SBV) to submit a report on the summary of Decree 24, which includes proposals for amending and supplementing certain regulations for managing the gold market.

Gold prices surge to nearly 79 million dong per tael ahead of Tet, investors make huge profits.

After dropping sharply from 80.5 million VND per tael to 74 million VND per tael at the beginning of the year, SJC gold price has been showing signs of recovery recently. On February 2nd, the price of gold continued to rise significantly and reached nearly 79 million VND per tael.