Oil Prices Rise by Over $1 per Barrel

Oil prices rose by more than $1 per barrel, as expectations of a US interest rate cut in the coming weeks boosted a recovery in prices after four straight sessions of losses.

Brent crude futures settled at $77.22 per barrel, up $1.17 or 1.54%, while WTI crude futures settled at $73.01 per barrel, up $1.08 or 1.5%.

Minutes from the Fed’s July meeting, released on Wednesday, showed that most officials believed the central bank was poised to cut interest rates in the coming month. Higher interest rates increase borrowing costs, which can slow economic activity and reduce demand for oil.

The recent decline in the US dollar due to concerns about a weakening economy has supported oil prices, as it makes the commodity cheaper for buyers using other currencies.

US Natural Gas Prices Fall to a Two-Week Low

US natural gas prices dropped by 6% to their lowest level in two weeks, following higher-than-expected weekly inventory data and forecasts for less hot weather in the coming weeks.

The September natural gas contract on the New York Mercantile Exchange fell by 12.4 US cents, or 5.7%, to settle at $2.053 per million British thermal units (mmBtu) – its lowest since August 6.

Gold Prices Slip by Over 1%

Gold prices fell by over 1%, pressured by a stronger US dollar and rising US Treasury yields, as investors awaited comments from Fed Chair Jerome Powell for further clues on interest rate cuts.

Spot gold on the LBMA declined by 1.2% to $2,482.16 per ounce, after reaching a record high of $2,531.60 in the previous session. Gold futures for December delivery on the New York Mercantile Exchange fell by 1.2% to $2,516.70 per ounce.

The US dollar index rose by 0.5% against a basket of major currencies, while yields on the 10-year US Treasury note also climbed higher.

Aluminum Prices Ease, Zinc Hits Over One-Month High

Aluminum prices eased after touching a six-week high earlier in the session, as a stronger US dollar eased concerns about tight supply.

Three-month aluminum on the London Metal Exchange (LME) slipped by 0.2% to $2,483 per ton. Earlier in the session, it touched $2,531 per ton, its highest since July 9. However, prices have climbed by 5% so far this week, on track for their biggest weekly gain in four months, amid rising demand for alumina.

Meanwhile, zinc prices on the LME rose by 0.5% to $2,862 per ton, after touching $2,882 per ton, its highest since July 17.

Iron Ore Prices Rise, Steel Prices Fall

Iron ore prices on the Dalian Commodity Exchange rose, supported by strong demand from top consumer China’s property sector and improved steelmakers’ profit margins, although weak fundamentals capped gains.

The January 2025 iron ore contract on the Dalian exchange rose by 0.41% to 730 Chinese yuan ($102.33) per ton, after climbing to 747 yuan per ton earlier in the session. This marks the fourth consecutive session of gains for iron ore prices.

On the Singapore Exchange, the September 2024 iron ore contract fell by 1.12% to $97.20 per ton, amid a stronger US dollar. Earlier in the session, prices touched $99.90 per ton.

Steel prices on the Shanghai Futures Exchange fell, with hot-rolled coil down 0.55%, rebar down 0.69%, hot-rolled plate down 1.64%, and stainless steel down 0.36%.

Rubber Prices in Japan Hit Over Two-Month High

Rubber prices in Japan rose to their highest level in over two months, buoyed by signs of strong demand from China and concerns about supply.

The January 2025 rubber contract on the Osaka Stock Exchange (OSE) climbed by 1.9 Japanese yen, or 0.56%, to 341.0 yen ($2.35) per kg – its highest since mid-June.

Meanwhile, the January 2025 rubber contract on the Shanghai Futures Exchange fell by 60 Chinese yuan, or 0.37%, to 16,210 yuan ($2,272.95) per ton.

Butadiene rubber for October 2024 delivery on the Shanghai Futures Exchange rose by 5 yuan, or 0.03%, to 14,595 yuan ($2,035.14) per ton.

Singapore’s September 2024 rubber contract fell by 0.7% to 174.9 US cents per kg.

Coffee Prices Rise in Vietnam, Fall in Indonesia, London, and New York

Trading activity in Vietnam’s coffee market remained subdued due to low supply at the end of the harvest season, while coffee prices in Indonesia declined.

Export prices for Vietnamese robusta coffee beans (2, 5% black and broken) were offered at a premium of $250-$350 per ton to the November 2024 contract on the London market. Domestic coffee bean prices ranged between 118,500-119,300 Vietnamese dong ($4.75-$4.79) per kg, up from 116,900 – 118,000 dong per kg a week earlier.

In Indonesia, the price of robusta coffee beans (4, 80-defect) was offered at a premium of $200 per ton to the September 2024 contract on the London market, down from a premium of $320 a week earlier.

On the London market, November 2024 robusta coffee futures fell by $58, or 1.3%, to $4,574 per ton, retreating from a one-month high of $4,658 per ton hit in the previous session.

In New York, December 2024 arabica coffee futures fell by 2.5% to $2,429 per lb.

Sugar Prices Extend Gains

October 2024 raw sugar futures on ICE rose by 0.2 US cent, or 1.1%, to 17.85 cents per lb, bouncing back from a near two-year low of 17.52 cents per lb touched in the previous two sessions.

Meanwhile, October 2024 white sugar futures on the London market climbed by 1.3% to $512.10 per ton.

Soybean, Corn, and Wheat Prices Fall in Tandem

Wheat prices on the Chicago Board of Trade declined due to lower Black Sea wheat prices and a stronger US dollar, which reduced the competitiveness of US wheat exports.

Chicago corn futures fell by 4-3/4 cents to $3.93-1/2 per bushel, while soybean futures dropped by 20 cents to $9.61-1/2 per bushel. Soft red winter wheat futures for December 2024 delivery fell by 8-1/2 cents to $5.35-1/2 per bushel, after touching a session low of $5.26-1/4 per bushel.

Rice Prices Rise Across Major Asian Markets

Export prices for rice across major Asian markets climbed, with Vietnamese rice prices reaching their highest level in nearly three months due to tight supply. However, weak demand for the staple food capped gains.

In India, a leading rice exporter, the 5% broken variety was quoted at $540-$545 per ton, up from $536-$540 per ton a week earlier.

India raised the price it pays to local rice farmers for the new crop by 5.4% to 2,300 rupees per 100 kg.

The 5% broken variety of Vietnamese rice was offered at $578 per ton, up from $570 a week earlier.

In Thailand, the 5% broken variety was quoted at $570 per ton, slightly up from $567 per ton a week ago.

Palm Oil Prices Rise for a Second Straight Session

Palm oil prices in Malaysia rose for a second straight session, bolstered by Indonesia’s plans to increase biodiesel production.

The November 2024 palm oil contract on the Bursa Malaysia rose by 72 ringgit, or 1.92%, to 3,826 ringgit per ton – its biggest daily gain since July 2.

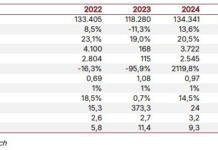

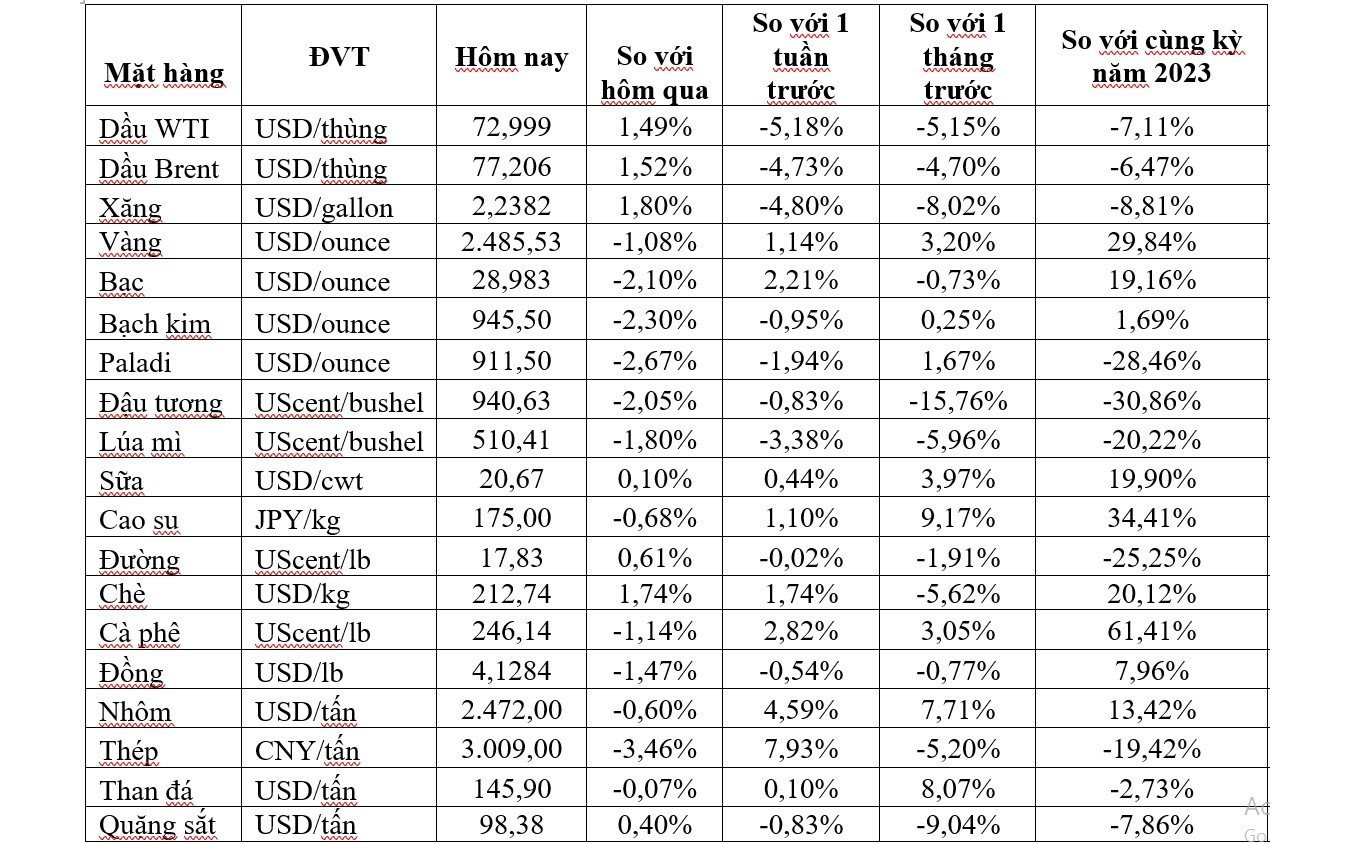

Prices of Key Commodities on August 23

Weekend Ending Sees Significant Gold SJC Price Drop

After surging to nearly 79 million dong per tael on February 2nd, the price of SJC gold is now plummeting towards the 78 million dong per tael mark this weekend.