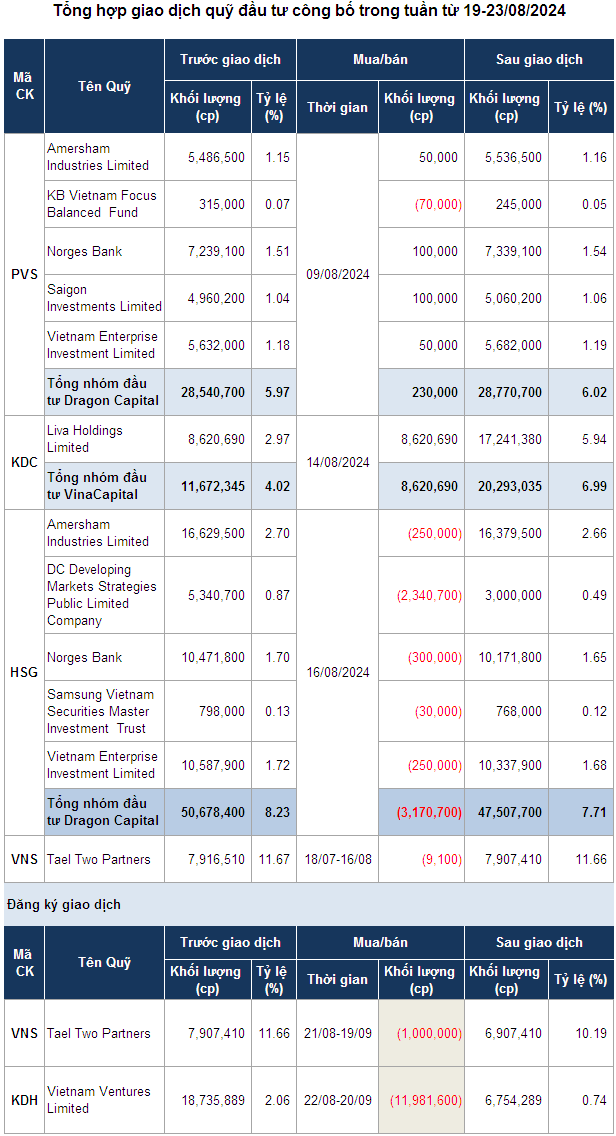

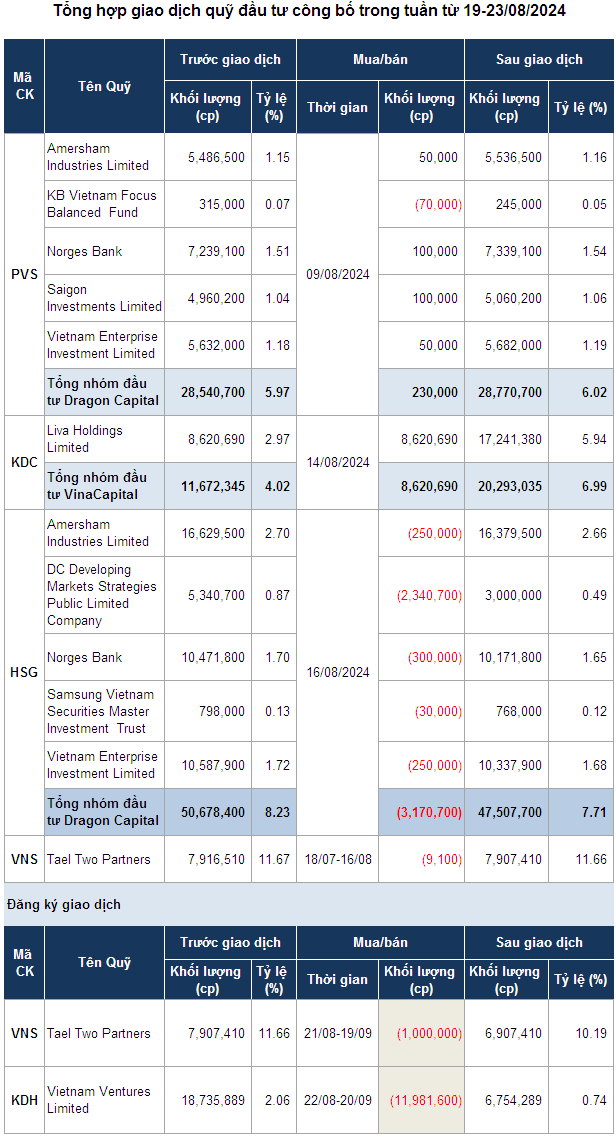

In a recent announcement, an investment fund disclosed transactions that took place the week prior. The highlight was Dragon Capital’s trade.

Specifically, the investment fund sold nearly 3.2 million HSG shares (of Hoa Sen Group Joint Stock Company) on August 16, reducing their group’s ownership to 7.71%, equivalent to 47.5 million shares.

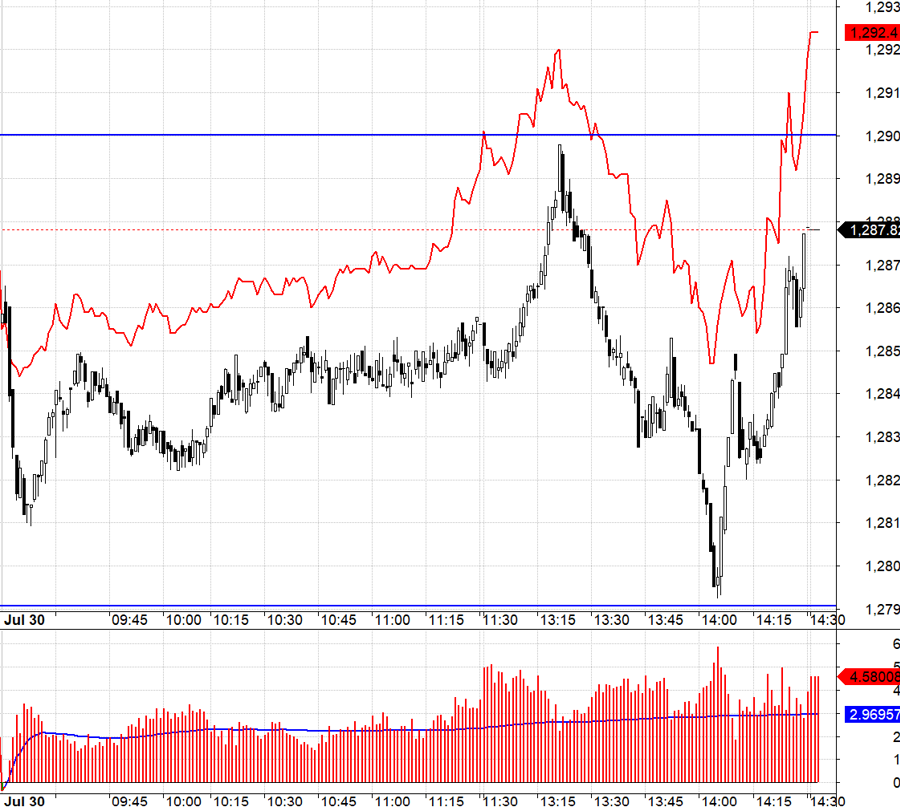

| HSG share price movement from the beginning of 2024 to August 23 |

Based on HSG’s closing price of 20,350 VND per share on August 16, Dragon Capital could have potentially earned around VND 65 billion from this transaction.

HSG, a steel stock, is frequently traded by the foreign fund, Dragon Capital. The fund recently “surfed” this stock by selling 600,000 HSG shares during the declining session on July 30, only to quickly return and buy a net of 574,100 HSG shares on July 31.

On the buying side, Liva Holdings Limited, a member of the VinaCapital fund, purchased 8.62 million KDC shares (of KIDO Group Joint Stock Company) on August 14. This increased the VinaCapital group’s ownership to 7%, marking their return as a major shareholder in Kido after more than a year. Liva also became a major shareholder of KDC, with their ownership rising to 5.95%.

Last year, the VinaCapital group sold a total of over 4.7 million KDC shares in two sessions on July 26 and August 4, with Liva being the biggest seller, offloading 4.3 million shares. Following these transactions, the VinaCapital group was no longer a major shareholder of Kido as of August 8, 2023.

| KDC share price movement from the beginning of 2024 to August 23 |

On August 14, KDC recorded a matched transaction with a volume equal to the volume traded by the VinaCapital group. The transaction value was VND 500 billion, corresponding to VND 58,000 per share. KDC closed at VND 55,200 per share on that day.

Source: VietstockFinance

|

Leaders and loved ones rush to “lock in” before Tet?

With just a few more trading sessions until the Lunar New Year, the stock market is gearing up for a break. Prior to this holiday period, data from the trading week of January 29th to February 2nd, 2024 indicates a notable trend of company leaders and their close associates actively selling off their stocks.