Liquidity improved from the previous session, with the VN-Index trading volume reaching over 318 million units, equivalent to a value of nearly 7.5 trillion VND. The HNX-Index recorded a trading volume of nearly 27 million units, with a value of more than 496 billion VND.

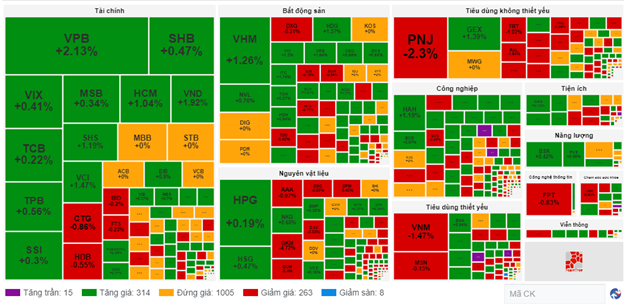

The polarized performance of stocks led to a relatively modest overall gain or loss for industry groups, with movements below 1%. The real estate sector led the market with a 0.66% increase, thanks to strong support from the Vingroup trio: VHM (+1.89%), VIC (+1.32%), and VRE (+2.05%). However, several stocks faced selling pressure, including BCM (-1.52%), IDC (-0.81%), PDR (-0.23%), SIP (-0.93%), and SZC (-0.39%), among others. Following closely were the energy and telecommunications services sectors, which rose by 0.5% and 0.36%, respectively.

Financial stocks also witnessed mixed performances, with some recording notable gains, such as VPB (+2.4%), TCB (+0.67%), BID (+0.59%), PTI (+4.32%), VND (+1.92%), and VCI (+1.16%) while others like VCB, CTG, HDB, STB, SSB, BVH, and FTS traded less positively, weighing down the index.

On the losing side, the information technology and consumer goods sectors lagged, with several large-cap stocks influencing the decline, including FPT (-0.75%), CMG (-0.56%); VNM (-1.47%), MSN (-0.64%), MCH (-1.2%); PNJ (-2.66%), and FRT (-1.51%), to name a few.

Foreign investors continued their net selling trend, offloading nearly 370 billion VND worth of stocks on the HOSE exchange, with HPG being the most sold stock, witnessing net selling of nearly 87 billion VND. On the HNX exchange, foreign investors net sold nearly 39 billion VND, focusing their sales on PVS with a value of over 12 billion VND.

10:40 am: VN-Index edges closer to the 1,290-point mark amid a tug-of-war

Short-term profit-taking pressure resurfaced, leading to a tug-of-war between buyers and sellers around the reference level. As of 10:30 am, the VN-Index gained 1.51 points, hovering around 1,286 points, while the HNX-Index rose 0.66 points to trade around 240 points.

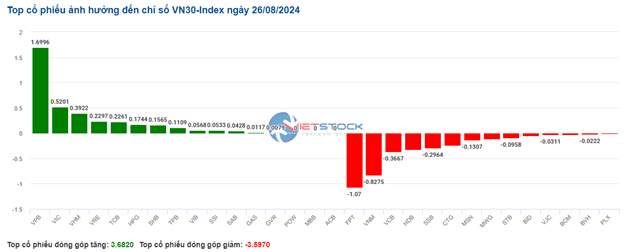

The breadth among the VN30 basket of stocks was relatively balanced between buyers and sellers. Specifically, VPB, VIC, VHM, and VRE contributed 1.7 points, 0.52 points, 0.39 points, and 0.23 points to the overall index, respectively. Conversely, FPT, VNM, VCB, and HDB faced selling pressure, deducting more than 2.5 points from the index.

Source: VietstockFinance

|

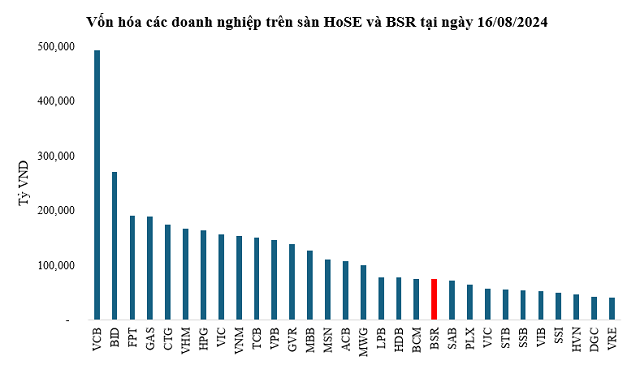

Among the sectors propping up the index, energy posted a modest increase of 0.39%. Buying interest primarily focused on major oil and gas stocks, with PVS rising 0.99%, PVC climbing 1.48%, and notably, BSR advancing 0.84% after news broke that this “giant” in the oil and petrochemical industry had submitted a listing application to the HOSE on August 21, 2024, to list 3.1 billion BSR shares.

With a market capitalization of up to 74,700 billion VND (ranking 21st among companies listed on the HOSE as of August 16, 2024), if approved for the transfer to the HOSE, BSR will become a blue-chip stock and is expected to be included in the VN30 basket in the not-too-distant future. The arrival of this high-quality “blockbuster” stock is anticipated to attract additional investment capital into the stock market from individual and institutional investors, both domestic and foreign.

Source: VietstockFinance

|

The financial sector narrowed its morning gains and turned slightly negative for the overall index, but due to the polarized performances, the number of advancing stocks still outnumbered declining ones. Notably, VPB rose 1.87%, TCB climbed 0.45%, VIB gained 0.27%, and SHB increased by 0.47%… Meanwhile, SSB, CTG, HDB, and VCB continued to face selling pressure, although their declines were not significant.

Compared to the opening, the market remained polarized, with over 1,000 stocks trading around the reference level, but buyers held a slight edge. There were 314 advancing stocks and 263 declining stocks.

Source: VietstockFinance

|

Market Open: Green Dominates Across Most Sectors

At the start of the August 26 trading session, as of 9:40 am, the VN-Index climbed over 2 points to reach 1,287.73 points, while the HNX-Index also edged slightly above the reference level to trade at 241 points.

Green prevailed among the VN30 basket of stocks, with 19 advancing stocks, 9 declining stocks, and 2 stocks trading flat. Notably, SAB, VIC, and VRE were the top gainers. On the flip side, SSB, BVH, and VNM experienced minor losses of 1%, 0.76%, and 0.93%, respectively.

As of 9:40 am, the energy sector posted impressive growth, with several stocks witnessing positive momentum right from the market open, including PVD (+0.72%), PVS (+1.24%), BSR (+0.84%), PVC (+1.48%), and PVB (+1.03%).