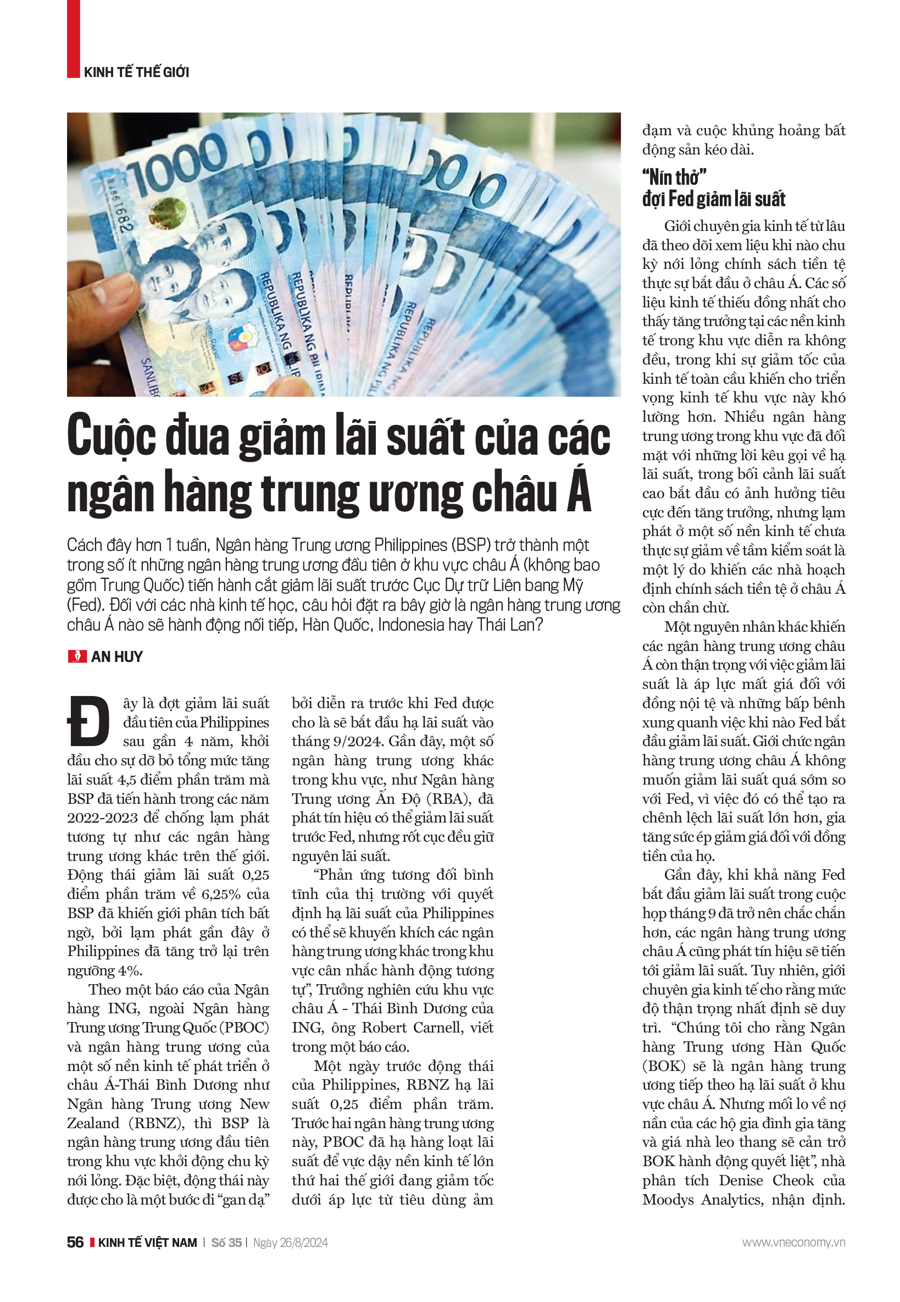

More than a week ago, the Central Bank of the Philippines (BSP) became one of the few central banks in Asia (excluding China) to cut interest rates ahead of the US Federal Reserve. For economists, the question now is: which Asian central bank will follow suit—South Korea, Indonesia, or Thailand?

This is the Philippines’ first rate cut in nearly four years, marking the beginning of an unwinding of the total 4.5 percentage points of hikes that the BSP implemented in 2022-2023 to combat inflation, similar to other central banks worldwide. BSP’s move to lower rates by 0.25 percentage points to 6.25% caught analysts by surprise, as inflation in the Philippines had recently rebounded above the 4% threshold.

According to a report by ING Bank, apart from the People’s Bank of China (PBOC) and the central banks of some developed economies in the Asia-Pacific region, such as the Reserve Bank of New Zealand (RBNZ), the BSP is the first central bank in the region to initiate an easing cycle. Notably, this move is considered bold as it occurred before the Fed is expected to begin lowering rates in September 2024. Recently, several other central banks in the region, such as the Reserve Bank of India (RBI), have signaled the possibility of cutting rates before the Fed, but ultimately maintained their rates.

“The relatively calm market reaction to the Philippines’ rate cut may encourage other central banks in the region to consider similar action,” wrote Robert Carnell, Regional Head of Research for Asia-Pacific at ING, in a report.

A day before the Philippines’ move, the RBNZ lowered its interest rate by 0.25 percentage points. Prior to these two central banks, the PBOC cut a range of key rates to prop up the world’s second-largest economy, which is slowing under the weight of weak consumption and a protracted property crisis.

**BREATHING ROOM FOR ASIAN CENTRAL BANKS AS FED PREPS FOR LIFTOFF**

Economists have long been watching to see when the monetary easing cycle will truly begin in Asia. Inconsistent economic data has shown uneven growth across the region, while the global economic slowdown has made the area’s outlook more uncertain. Many central banks in the region have faced calls to lower interest rates as higher borrowing costs start to bite, but inflation in some economies has not yet fallen back to target, giving Asian policymakers pause.

Another reason for Asian central banks’ caution on rate cuts is the pressure on their currencies and the uncertainty around the timing of the Fed’s pivot. Asian central bankers do not want to cut rates too early relative to the Fed, as that could widen rate differentials and increase downward pressure on their currencies.

Recently, as the likelihood of a Fed rate cut at the September meeting became more certain, Asian central banks have also signaled they will move toward lowering rates. However, economists say a degree of caution will persist. “We think the Bank of Korea (BOK) will be the next central bank in Asia to cut rates. But mounting household debt concerns and soaring property prices will prevent the BOK from acting aggressively,” said Denise Cheok, an analyst at Moody’s Analytics. At its monetary policy meeting on August 22, 2024, the BOK decided to keep rates unchanged at 3.5%, but economist Juliana Lee from Deutsche Bank forecasts a rate cut in October 2024.

At this meeting, the BOK lowered its inflation and growth forecasts for the year. Accordingly, South Korea’s annual inflation rate is expected to be 2.5%, down 0.1 percentage points from the 2.6% projected in May 2024. Gross domestic product (GDP) is forecast at 2.4%, compared to the previous projection of 2.5%.

Data released in July 2024 showed that South Korea’s GDP, the fourth-largest economy in Asia, grew 2.3% in Q2 2024 from a year earlier, slowing sharply from the 3.3% increase in Q1 2024. Compared to the previous quarter, GDP contracted by 0.2%, following a 1.3% expansion in Q1. In the first half of the year, the economy grew by 2.8%, lower than the BOK’s earlier projection of 2.9%.

The Bank of Thailand (BOT) is another candidate for a rate cut this year after it kept its benchmark rate unchanged at 2.5% in its August 21 meeting. For Thailand, a rate cut is seen as a way to stimulate the economy, which has been growing at a slower pace than its potential since the Covid-19 pandemic, according to Moody’s Analytics. The relatively high-interest rate environment in Thailand has dampened private consumption, weak consumer price increases, and the Baht’s recovery has increased the likelihood of a rate cut.

Data released earlier this week showed that Thailand’s gross domestic product (GDP) in Q2 2024 accelerated from a year earlier but decelerated from the previous quarter, and growth was uneven across the economy.

According to a report by Thailand’s National Economic and Social Development Council (NESDC), the country’s GDP grew 2.3% in Q2 2024 from a year earlier, compared to a 1.6% expansion in Q1 2024 and a forecast of 2.1% in a Reuters survey of economists. Compared to the previous quarter, Thailand’s GDP grew 0.8% in Q2 2024, down from a revised 1.2% in Q1 and below the forecast of 0.9%.

**DIVERGENT PATHS FOR ASIAN CENTRAL BANKS**

Moody’s Analytics suggests that if the Fed cuts rates by 0.25 percentage points in September, Asian central banks will be more confident in initiating rate cuts of their own. Adjusting monetary policy in line with the Fed will help maintain stable interest rate differentials, reduce the risk of currency depreciation, and support economies like South Korea and Thailand, “where weak domestic consumption is a concern,” according to the Moody’s report.

Lavanya Venkateswaran, a senior economist at OCBC Bank, predicts that Bank Indonesia (BI) could follow the BSP in cutting rates, with a total reduction of 0.5 percentage points in Q4 2024. At its monetary policy meeting on August 21, 2024, BI kept its key rate unchanged at 6.25%—a decision that was in line with expectations. According to Venkateswaran, as Indonesia prioritizes rupiah stability, BI is likely to move in tandem with the Fed.

According to a report by Capital Economics, if the Indonesian rupiah continues to strengthen against the US dollar, the case for a BI rate cut will become more compelling. However, Capital Economics analysts expect BI to wait until after the Fed cuts rates before initiating its own rate cuts, possibly in October 2024…

*This article was published in the Vietnamese Economic Magazine Issue 35-2024, released on August 26, 2024. To read the original article, please visit: https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam*

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Banks Sacrificing Profits to Support the Economy

In 2023, the question “which bank has the lowest interest rates?” is being talked about more than ever. With the prevailing difficult economic situation affecting individuals and businesses, in line with the directive of the State Bank of Vietnam (SBV), banks have unanimously sacrificed their profits by reducing lending rates and introducing credit packages with interest rates as low as 0%.