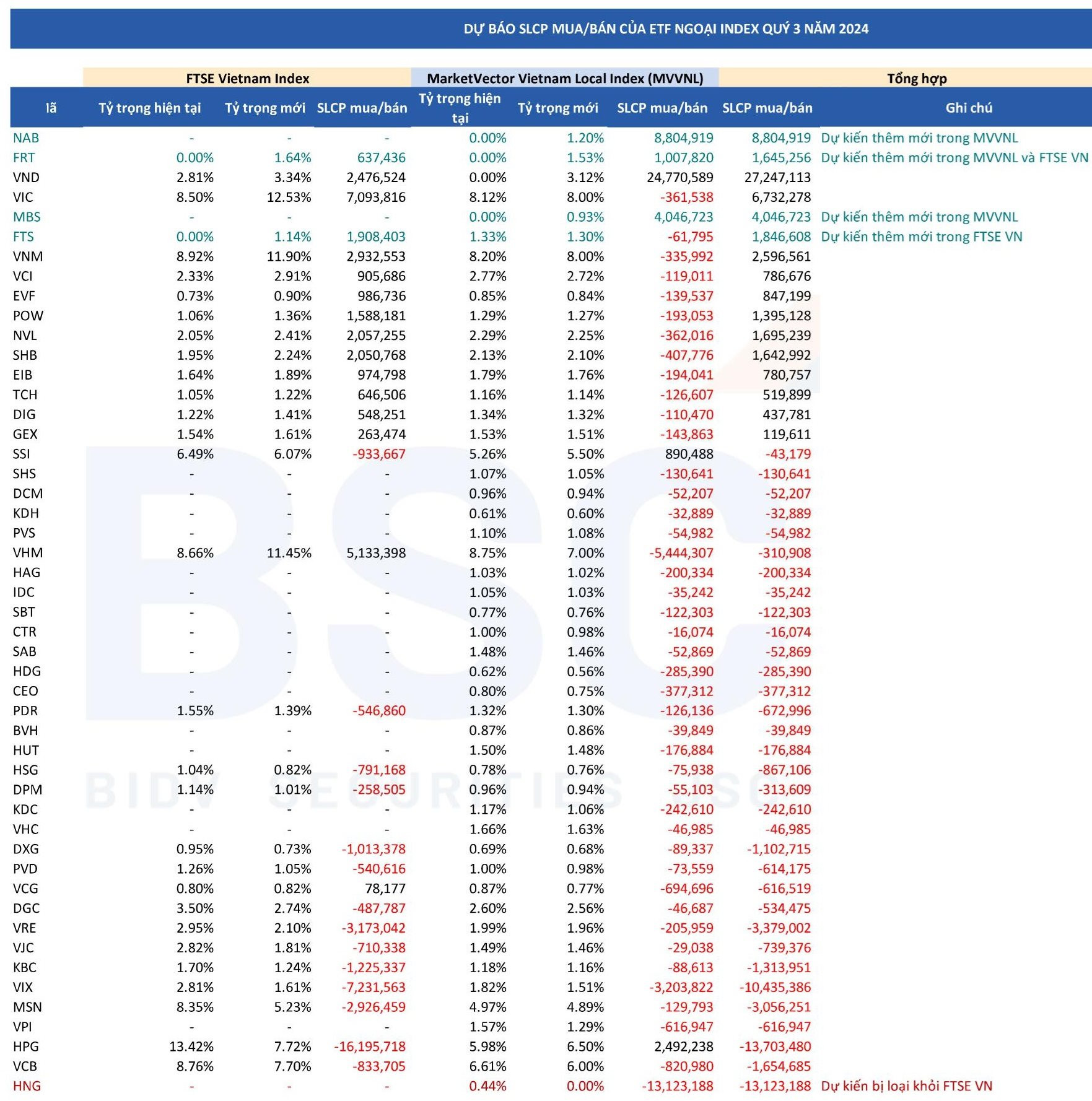

On September 6, 2024, FTSE is expected to announce the constituent stocks of the FTSE Vietnam All-share and FTSE Vietnam Index. On September 13, 2024, MarketVector will announce the MarketVector Vietnam Local Index.

September 20, 2024, is expected to be the final day for the complete restructuring of the ETFs referencing these indices. BSC Securities has just released a forecast of the constituent stocks and the number of stocks to be bought/sold for the ETFs referencing these indices.

Specifically, for the FTSE Vietnam Index (referenced by the FTSE ETF), BSC projects that the index will add two new stocks, FRT of FPT Retail and FTS of FPT Securities, while not excluding any stocks.

In this scenario, the FTSE Vietnam ETF may buy 637,000 FRT shares and 1.9 million FTS shares to add to its portfolio. At the same time, the ETF may also purchase additional shares of VNM (2.9 million shares), VIC (7 million shares), VHM (5.1 million shares), VND (2.4 million shares), etc.

Conversely, the FTSE Vietnam ETF may sell to reduce its holdings in certain stocks such as HPG (-16 million shares), VIX (-7 million shares), VRE (-3 million shares), MSN (-2.9 million shares), etc.

As of August 228, 2024, the scale of the FTSE Vietnam ETF reached $295 million, equivalent to more than 7.3 trillion VND. Year-to-date performance is negative, at nearly -4%.

For the MarketVector Vietnam Local Index (referenced by the VanEck Vectors Vietnam ETF – VNM ETF), BSC projects that the MarketVector Vietnam Local Index will remove HAGL Agrico’s HNG stock and add Nam A Bank’s NAB, FPT Retail’s FRT, and MBS of MB Securities as they are in the top 85% of the accumulated free-float market cap of eligible stocks.

Accordingly, VNM ETF will buy 8.8 million NAB shares, 1 million FRT shares, and more than 4 million MBS shares in this review period. Some codes will also be added, such as VND (24.7 million shares), HPG (2.4 million shares),…

Conversely, VNM will sell all 13 million HNG shares to remove them from the portfolio and also sell some codes such as VHM (-5.4 million shares), VIX (-3.2 million shares),…

As of August 23, 2024, the scale of the VNM ETF portfolio was over $501 million (~12.5 trillion VND), with a year-to-date investment performance of -2.5%.

Bitcoin Hype

Last week, the crypto community in Vietnam was buzzing with an event that some media channels and social networks called a “new era” for cryptocurrencies. Some fund managers predict that from here, Bitcoin will rise to $100,000, $150,000, or even $1.5 million per bitcoin as predicted by fund manager Cathie Wood. So what’s all the fuss about?