A Báo Người Lao Động reporter shared that Mr. Le Hoang from Ho Chi Minh City recently received a call from a bank consultant. The consultant informed him that if he reactivated his credit card, the annual fee would be waived for the next three years. Interestingly, just a month ago, Mr. Hoang had struggled for a week to cancel this very card.

According to Mr. Hoang, at the beginning of 2024, an acquaintance who worked at Bank V. offered him a credit card with a monthly limit of VND 44 million. Out of courtesy, Mr. Hoang agreed to open the card even though he had no intention of using it. The process was simple, requiring only a phone number and a CCCD, and the card arrived within a week.

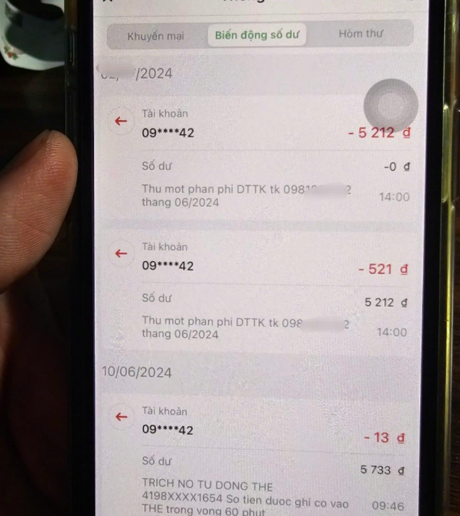

After receiving the card, the acquaintance instructed him to deposit VND 10,000 to activate it, promising that the amount would be refunded. However, he failed to mention that interest would be charged on this amount. More than six months later, the card’s account had deducted the initial VND 10,000 and incurred additional overdue interest and late payment fees, totaling nearly VND 200,000.

Mr. Hoang’s credit card account, which he never used, incurred a penalty fee of nearly VND 200,000 after depositing VND 10,000 to maintain a positive balance.

“I was surprised to be charged a late payment fee even though I hadn’t made any transactions,” said Mr. Hoang. “What’s more, after settling this amount, I went to the bank to close the card, but the staff asked me to call the hotline to register for card cancellation. After requesting the cancellation, the hotline agent scheduled a confirmation call in 3-5 days. It’s much easier to open a card than to close one,” he added in frustration.

Currently, many people find themselves in similar predicaments with credit cards. Some individuals open cards despite having no intention of using them, simply to help bank employees meet their targets.

Mr. Quoc Ngoc from Thu Duc City, Ho Chi Minh City, shared that he, too, spent two weeks struggling to close a credit card issued by a bank headquartered in Hanoi. The reason for this was unexpected notifications of continuous deductions for online transaction fees, even though he had not used the card.

“When I went to the bank branch, the teller asked me to call the hotline to cancel the card, as the bank had changed its policy to not support cancellations at the counter. However, whenever I called, the hotline was always busy, and no one answered after multiple attempts. When someone finally answered, the agent informed me that my account still had VND 600,000 in promotional money, and the balance had not reached zero, so the card could not be canceled. To cancel, I had to use up the promotional amount for shopping or payment services,” Mr. Ngoc complained.

People should only open credit cards if they have a genuine need for spending and payments.

It took another week for the bank to agree to cancel Mr. Ngoc’s card, and only after he firmly stated that he did not wish to use the promotional amount.

In another case, Ms. Bich Thanh from Go Vap District, Ho Chi Minh City, encountered an even more bizarre situation. She helped a friend who worked at a bank open a credit card to meet a sales target, but before she even received the card, the bank notified her of overdue fees and annual fees for the card.

“I told them I hadn’t even seen the card, but the agent asked for the card number to check. In the end, I had to go to the bank branch to get it canceled,” Ms. Thanh said, exasperated.

Financial experts advise that credit cards offer the advantage of spending now and paying later, with an interest-free period of 45-55 days, depending on the card type. However, users should be cautious and make timely payments to avoid high interest and penalty fees. Additionally, it is essential to understand the annual fees associated with different card types, as some cards require the payment of annual fees even if they are not used.

48 Hours Chase for Bank Robbery Suspect in Nghe An

The suspect responsible for the audacious bank robbery in Nghe An has been apprehended after 48 hours on the run. During the interrogation, the perpetrator tried to evade responsibility, but ultimately confessed to the crime.