In the latest filing, Ms. Truong Nguyen Thien Kim has registered to sell 13 million shares of VCI of Vietcap Securities Joint Stock Company with the purpose of “personal needs.” The transaction is expected to be executed from September 4 to October 3 via matching and/or agreement.

Calculated based on the closing market price of the session on August 27 (VND 48,050/share), Ms. Kim could recoup about VND 625 billion if she completes the entire transaction.

Ms. Kim is the wife of Mr. To Hai, who is the CEO and Member of the Board of Directors of Vietcap. Currently, CEO To Hai holds more than 99.1 million VCI shares (a stake of 22.44%). This is the first time Ms. Kim has registered to sell Vietcap’s shares. The last reported transaction was in 2019 when Ms. Kim completed the purchase of 2 million VCI shares.

In addition, two other relatives of Mr. Hai, his mother, Tran Thi Lan, and his sister, To Hong Ha, also previously held shares in VCI but sold their entire holdings in 2021.

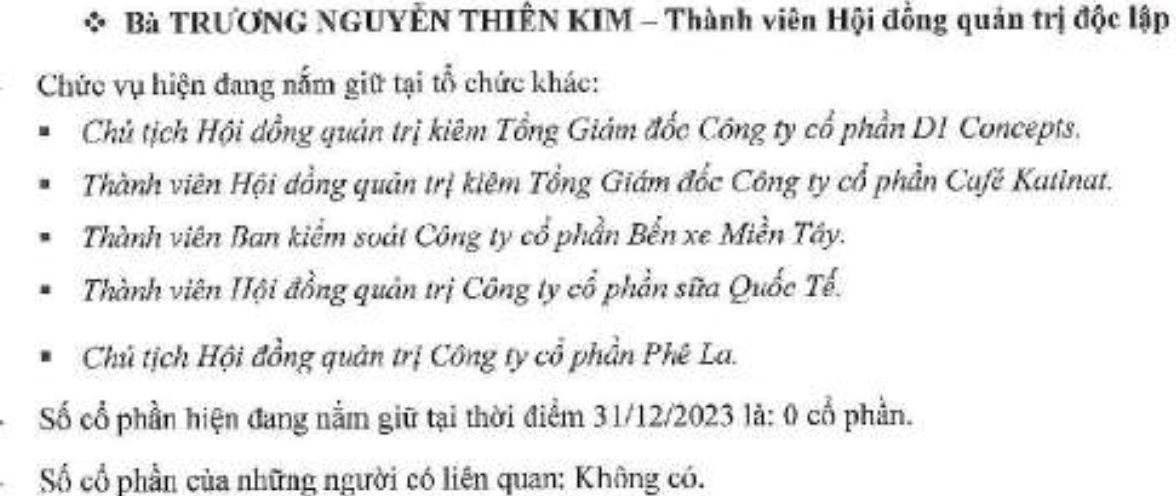

Notably, Ms. Kim is not only known as the wife of the CEO of Vietcap Securities but also holds multiple positions in various other businesses. According to the 2023 Annual Report of Ben Thanh Commercial Services Joint Stock Company (code: BTT) – where Ms. Thien Kim serves as an Independent Member of the Board of Directors, she is also the Chairman of the Board of Directors and General Director of D1 Concepts Joint Stock Company; Member of the Board of Directors and General Director of Cafe Katinat Joint Stock Company; Member of the Supervisory Board of Western Bus Station Joint Stock Company (code: WCS); and Member of the Board of Directors of International Dairy Products Joint Stock Company (code: IDP); and Chairman of the Board of Directors of Phê La Joint Stock Company.

Source: 2023 Annual Report of BTT

At the time of their establishment, Ms. Truong Nguyen Thien Kim held a controlling stake in Cafe Katinat Joint Stock Company and Phê La Joint Stock Company. D1 Concepts is a company that owns many culinary brands such as San Fu Lou, Di Mai, Sorae, CaféDa, and Sens…

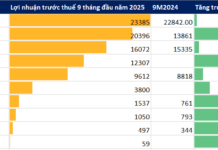

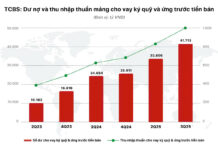

In terms of Vietcap’s business performance, in the first half of 2024, this securities company recorded operating revenue of more than VND 1,700 billion, a sharp increase of 72%. As a result, pre-tax profit reached VND 571 billion, up 170%.

In 2024, Vietcap set a business plan with a revenue target of VND 2,511 billion and a pre-tax profit of VND 700 billion, up 2% and 23%, respectively, compared to the previous year. Thus, after the first half, the company has completed 81% of its profit target.