Vietnam’s stock market continues its narrow range-bound trend. The index closed slightly higher on August 28, gaining 0.88 points to reach 1,281. Trading volume remained low, with a value of over VND 16,300 billion on the HOSE. Foreign investors’ net selling put pressure on the market, with a net sell value of nearly VND 124 billion, marking the sixth consecutive session of net outflows.

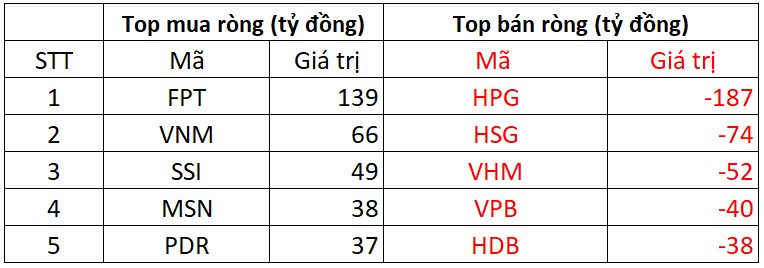

On the HOSE, foreign investors net sold VND 112 billion.

FPT was the most bought stock by foreign investors on the HOSE, with a net buy value of over VND 139 billion. VNM and SSI followed, with net purchases of VND 66 billion and VND 49 billion, respectively. MSN and PDR were also bought, with net values of VND 38 billion and VND 37 billion, respectively.

On the other hand, HPG faced the strongest selling pressure from foreign investors, with net sell value of nearly VND 187 billion. This was the third consecutive session of HPG being the most sold stock on the HOSE. HSG and VHM also witnessed net outflows of VND 74 billion and VND 52 billion, respectively.

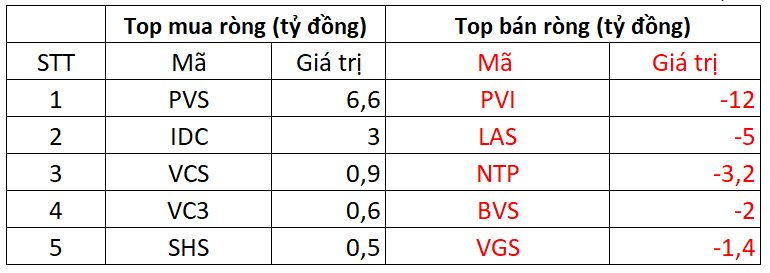

On the HNX, foreign investors net sold VND 16 billion.

PVS was the most bought stock on the HNX by foreign investors, with a net buy value of VND 6 billion. IDC followed, with net purchases of VND 3 billion. Foreign investors also net bought a few billion dong worth of VCS, VC3, and SHS.

On the selling side, PVI faced the highest net selling pressure, with a net sell value of nearly VND 12 billion. LAS, NTP, and BVS also witnessed net outflows of a few billion dong.

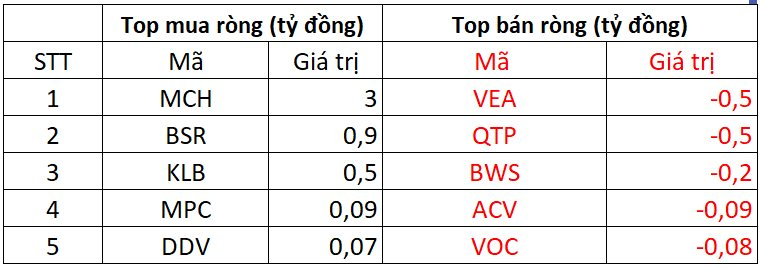

On the UPCOM, foreign investors net bought VND 4 billion.

Conversely, VEA faced net selling pressure from foreign investors, with a net sell value of VND 0.5 billion. Foreign investors also net sold QTP, BWS, and a few other stocks.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.