The market closed sideways for the sixth consecutive session, with only one trading day left before the long four-day holiday weekend. The VN-Index ended flat at 1,281 points, with 214 declining stocks outweighing 174 gainers.

A sharp contrast emerged between industry sectors, as news of the State Bank of Vietnam’s decision to relax credit limits for select banks boosted the banking sector index by 0.19%. Several bank stocks witnessed strong gains, including STB, which rose by 3.05%, HDB by 1.11%, VCB by 0.44%, MBB by 0.81%, and ACB by 0.61%. In addition to banks, the real estate sector also edged up by 0.15%, led by a 1.5% increase in VHM. The insurance and telecommunications sectors followed suit, rising by 0.27% and 0.22%, respectively.

On the other hand, a group of top stocks helped maintain market balance, including VHM, VCB, BCM, and STB, collectively contributing 2.84 points to the market. Conversely, the steel sector declined by 0.4%, while the energy sector dropped by 0.98%. Other sectors witnessed negligible changes.

Liquidity remained subdued, with total matched orders across the three exchanges falling to VND15.1 trillion. Foreign investors turned net sellers, offloading VND97 billion worth of shares, with a net sell figure of VND105 billion for matched orders alone.

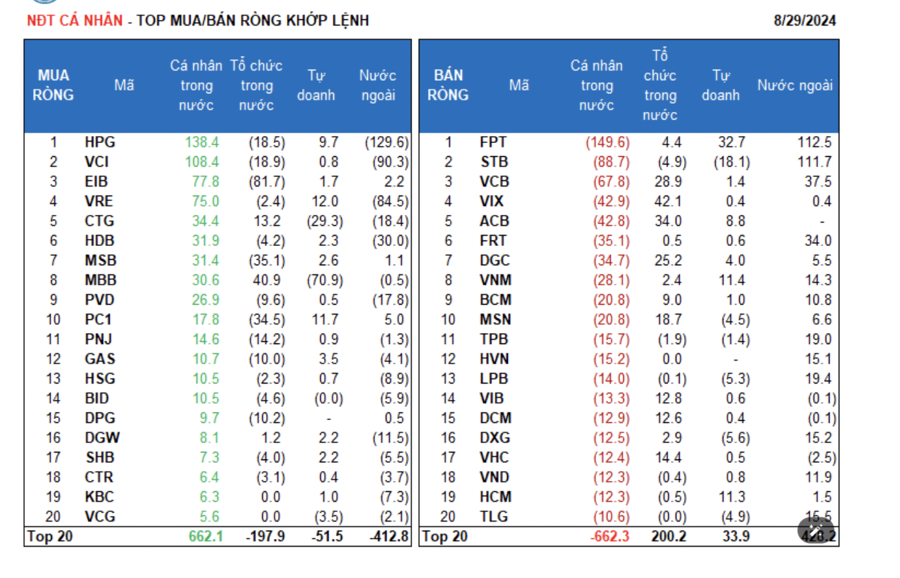

The foreign investors’ net buy list for matched orders included stocks from the information technology and retail sectors, such as FPT, STB, MWG, VCB, FRT, LPB, TPB, TLG, DXG, and HVN. On the other side, they net sold basic resources stocks, with HPG, VCI, VRE, TCB, VPB, HDB, PDR, CTG, and PVD being among the top sold stocks.

Individual investors turned net buyers, purchasing VND24.8 billion worth of shares. However, for matched orders alone, they were net sellers, offloading VND33.9 billion worth of stocks. When considering only matched orders, individual investors bought 11 out of 18 sectors, primarily focusing on basic resources stocks. Their net buy list included HPG, VCI, EIB, VRE, CTG, HDB, MSB, MBB, PVD, and PC1.

On the selling side, they offloaded stocks from the information technology, food and beverage, and retail sectors. FPT, STB, VCB, VIX, ACB, FRT, VNM, BCM, and MSN were among the top sold stocks. Institutional investors bought a net VND140.1 billion worth of shares, with a net buy figure of VND140 billion for matched orders alone.

For matched orders, institutional investors sold 10 out of 18 sectors, with the largest net sell figure observed in the construction and materials sector. EIB, MSB, PC1, VCI, HPG, GMD, PNJ, VHM, DPG, and GAS were among the top sold stocks. On the buying side, they focused on the banking sector, with TCB, VPB, VIX, MBB, ACB, VCB, DGC, FUESSVFL, MSN, and PDR being among their top purchases.

Today’s negotiated transactions totaled VND1,462 billion, a decrease of 13.3% from the previous session, contributing 9.7% to the total trading value. Notable transactions included foreign investors’ deals in PNJ, ACB, FPT, and CMG, along with negotiated trades among domestic individuals in MSB, NAB, HDB, KOS, VHM, and MWG.

A sector-wise breakdown of fund flow allocation revealed an increase in investment in banks, chemicals, textiles, and aviation, while a decrease was observed in real estate, securities, steel, retail, food, construction, software, and electricity.

For matched orders alone, there was an increase in fund allocation to large-cap stocks in the VN30 index and a decrease in allocation to mid-cap stocks in the VNMID index and small-cap stocks in the VNSML index.