According to a report on the luxury goods market by Vietdata, global sales in this sector declined significantly in 2023. Fashion houses worldwide, from France’s LVMH to Italy’s Prada, experienced a slowdown in sales growth.

This gloomy business trend is also evident in the financial results of companies specializing in distributing luxury brands in Vietnam.

|

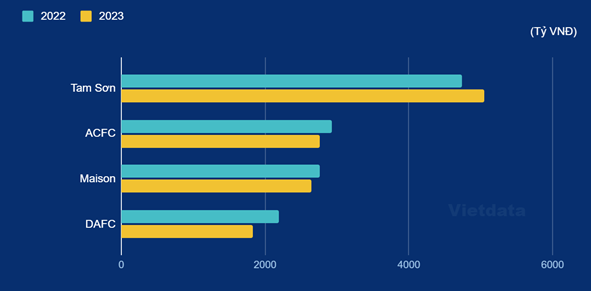

Revenue of companies distributing multiple luxury brands

Source: Vietdata

|

Vietdata provided several explanations for this weak business period. On the one hand, buyers, particularly the global super-rich, faced challenges due to a series of economic and political upheavals. On the other hand, luxury brands were perceived to have increased their prices too rapidly.

The luxury industry is observed to be increasingly focused on attracting super-rich clients, seemingly neglecting the middle class. However, it is worth noting that the middle class, especially in Asia, has been the primary driver of the industry’s growth over the past decade.

The fashion empire of entrepreneur Johnathan Hanh Nguyen

DAFC (Duy Anh Fashion and Cosmetics JSC) and ACFC (Au Chau Fashion and Cosmetics Co., Ltd.) are two of the three units distributing multiple luxury fashion brands under the IPPG (Inter-Pacific Petroleum Group) Corporation, owned by Johnathan Hanh Nguyen. Both DAFC and ACFC experienced gloomy business results in 2023.

Mr. Johnathan Hanh Nguyen, an entrepreneur dubbed the “king of luxury goods” in Vietnam.

|

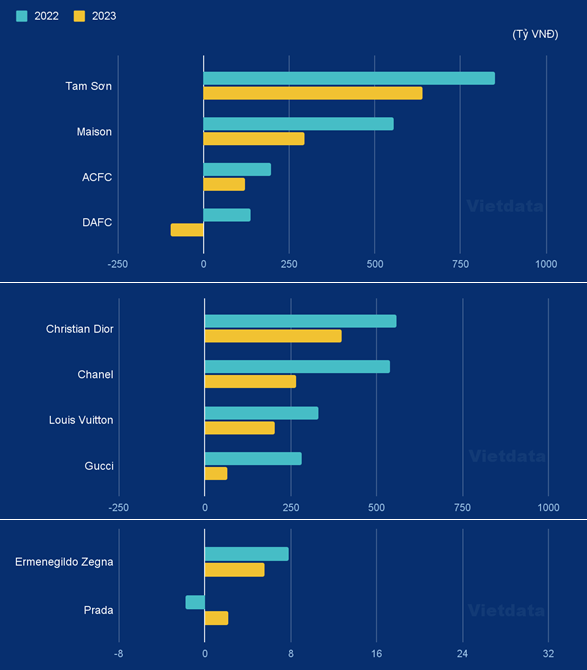

ACFC, with its network of 278 stores in major city centers, distributes 26 international brands, including Mango, Levi’s, Calvin Klein, and Tommy Hilfiger. Notably, in early 2024, ACFC officially brought Sunnies Face, a renowned Filipino cosmetics brand, to the Vietnamese market. Regarding financial performance, ACFC recorded a 5.6% decrease in revenue and a 39% drop in profits in 2023.

Meanwhile, DAFC is known for its luxury goods, boasting over 60 leading global brands. Some of the high-end brands distributed by DAFC include Rolex, Versace, Montblanc, and Burberry.

DAFC’s revenue in 2023 was VND 1.8 trillion, a 16.5% decline. The company even incurred a loss of nearly VND 100 billion, a far cry from the previous year’s profit of over VND 135 billion.

In 2024, the number of brands distributed by DAFC decreased to 38, a 37% reduction. The company had to downsize its business network to 47 stores.

Tam Son

The founders of Openasia Group: Mr. Christian de Ruty, Ms. Nguyen Thi Nhung, and Mr. Doan Viet Dai Tu. Source: Forbes Vietnam

|

Tam Son International Company, established in 2007, is a member of the Openasia Group. Tam Son is the authorized distributor for renowned international brands such as Hermès, Saint Laurent, Kenzo, Boss, Hugo, Marc Jacobs, and Patek Philippe, with a network of 109 stores for business and product display.

In 2023, despite the challenges faced by the global luxury goods industry, Tam Son’s revenue increased by 6.5%. However, the company’s profit declined by 25%, following the industry’s overall trend.

Maison International Retail

Founder of Maison – Ms. Pham Thi Mai Son.

|

Maison, a long-standing distributor of high-end fashion in Vietnam, currently operates more than 172 stores nationwide, offering 38 prestigious fashion brands, including Puma, Coach, Nike, and MLB.

With its acceleration in 2022, Maison’s revenue scale ranged between VND 2.6 and 2.8 trillion. However, in 2023, Maison was also affected by the negative market sentiment. Consequently, the company’s revenue decreased by 4.2%, and its after-tax profit plummeted by 47% compared to the previous year.

Alongside the aforementioned big four distributors of multiple luxury brands, companies distributing exclusively for a single luxury brand also witnessed a decline in sales. This includes Louis Vuitton Vietnam Co., Ltd., Chanel Vietnam Co., Ltd., Christian Dior Vietnam Co., Ltd., and Gucci Vietnam Co., Ltd.

|

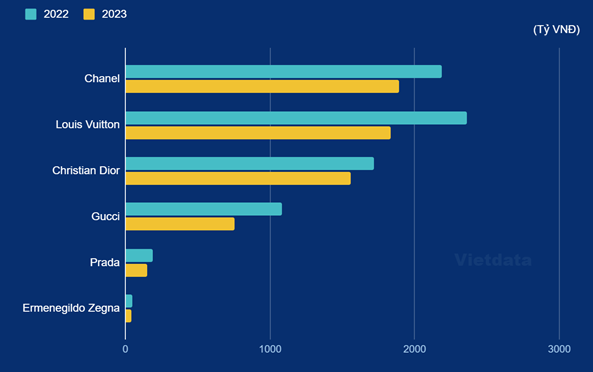

Revenue of companies distributing exclusive luxury brands

Source: Vietdata

|

After dominating the Vietnamese luxury market for two consecutive years (2021-2022), Louis Vuitton unexpectedly lost its top position to Chanel in 2023 due to a more significant decline in revenue compared to its competitor.

On the other hand, Christian Dior performed better than many exclusive brand distributors, with a 9.5% revenue drop in 2023. This entity also recorded the highest after-tax profit in the exclusive distribution segment. Christian Dior currently operates eight stores in Hanoi, Hoi An, and Ho Chi Minh City, including Christian Dior Couture Boutiques and Parfums Christian Dior Boutiques.

|

After-tax profit of luxury goods distribution companies

Source: Vietdata

|

The decline in purchasing power in the luxury market is expected to be short-lived. Citing a recent Savills assessment, Vietdata suggests that the luxury market has hit rock bottom and is showing signs of recovery due to the return of international tourists and decreasing inflation. However, the situation varies across countries and regions.

In Europe, high-end retailers face challenges due to high rental costs and declining sales. Wealthy customers willing to spend large sums on shopping are becoming scarce amid global economic turmoil, especially in the real estate market.

In contrast, Vietnam is considered a potential market for luxury goods, given the growing number of middle-class and super-rich individuals.

According to World Data Lab estimates, Vietnam ranks fifth among nine Asian countries projected to have the most significant number of new middle-class entrants in 2024, with 4 million people.

The middle class in Vietnam currently accounts for approximately 17% of the population, and the Ministry of Labor, Invalids, and Social Affairs expects this proportion to increase to 26% by 2026. This explains the influx of foreign retail brands into Vietnam, according to Vietdata.

Brands Return to Compete for Prime Retail Space in Ho Chi Minh City

Ho Chi Minh City’s retail market is experiencing significant growth, driven by a combination of positive factors. These include: rising income levels and population; continuous improvement in the quality of retail developments; and a growing economy.