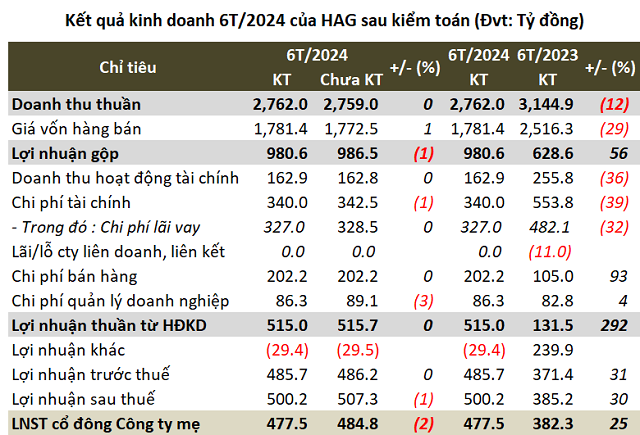

The reviewed financial results of Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG) for the first six months of 2024 remain largely unchanged, with net revenue staying consistent at approximately VND 2,762 billion as per the self-prepared report, a 12% decrease compared to the same period last year. Meanwhile, net profit witnessed a slight decline of 2% from the self-prepared report, totaling over VND 477 billion, marking a 25% increase year-on-year.

In relation to the 2024 plan, which targeted net revenue of VND 7,750 billion and profit after tax of VND 1,320 billion, the company has accomplished 36% and 38% of these goals, respectively, in the first half of the year.

Source: VietstockFinance

|

However, the noteworthy concern arises from the auditor’s doubt about HAG‘s ability to continue as a going concern, attributed to the accumulated loss of over VND 957 billion as of June 30, 2024, and short-term debt exceeding short-term assets by more than VND 350 billion.

| HAG’s Capital Sources from June 30, 2020, to June 30, 2024 |

Additionally, the financial statement notes reveal that as of June 30, 2024, HAG had not made payments for principal and interest installments totaling nearly VND 790 billion and nearly VND 8 billion, respectively, as per the agreed schedule with the bank. However, on July 19, 2024, the Group settled the entire outstanding principal and interest.

Moreover, as of June 30, the Company also had outstanding interest payments on bonds totaling nearly VND 3,278 billion. HAG attributed the delay in payments to pending receipts from debts owed by Hoang Anh Gia Lai International Agriculture Joint Stock Company (HOSE: HNG) and its subsidiaries. The Company has agreed on a three-party debt repayment plan and is in the process of liquidating certain non-profitable assets.

On August 29, Hoang Anh Gia Lai announced the repayment of VND 100 billion in principal for the bond lot with the code HAGLBOND16.26 to BIDV Bank.

|

According to the semi-annual financial report and bond principal and interest payment situation sent to HNX, HAG‘s bond debt stood at VND 4,248 billion at the end of June, a 24% decrease compared to the same period in 2023. Notably, on April 25, 2024, HAG repurchased the entire VND 300 billion lot of HAG2012.300 bonds issued on June 18, 2012. |

Returning to the reviewed financial statements, HAG has provided explanations in response to the auditor’s opinion. The Company stated that as of the date of the reviewed consolidated financial statements for the first six months of 2024, it had formulated business plans for the subsequent 12 months, encompassing anticipated cash flows from the partial liquidation of financial investments, asset disposals, loan recoveries from partners, borrowings from commercial banks, and cash flows generated from ongoing projects.

HAG is also in discussions with lenders to amend terms related to loan and bond covenant violations and is negotiating the restructuring of certain overdue debts. The Group anticipates that its pig and banana businesses will continue to generate substantial cash flows in 2024.

In the stock market, HAG‘s share price dropped by nearly 2% on August 30, settling at VND 10,650 per share, reflecting a 19% decline since the beginning of the year. The average trading volume stood at nearly 12.5 million shares per session.

| HAG Share Price Movement since the Beginning of 2024 |

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.