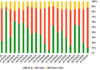

In its March market ranking report, FTSE Russell maintained Vietnam on its watchlist for a potential upgrade (first added in September 2018). The organization expects more aggressive reforms from Vietnam, particularly regarding the 100% margin requirement for foreign investors.

FTSE continuously assesses market classifications. In its latest announcement, the organization stated that three markets (Egypt, Pakistan, and Vietnam) have been placed on its watchlist since March 2024.

Vietnam’s stock market is poised for an upgrade from frontier to emerging market status (EM) by FTSE Russell.

FTSE Russell maintains Vietnam on its watchlist for a potential upgrade in its March 2024 market ranking report.

Vietnam’s Ministry of Finance and State Securities Commission have recently released a draft circular amending regulations to allow foreign institutional investors to purchase securities without pre-funding requirements (Non Pre-funding Solution – NPS) and introducing a roadmap for English disclosure.

This NPS policy addresses FTSE Russell’s upgrade criteria, including settlement counterparty transfer and failed trade processing.

Simultaneously, the English disclosure roadmap mandates that all public and listed companies publish periodic and extraordinary information in English from January 1, 2028, onwards. This initiative enhances transparency and accessibility for foreign investors while also addressing requirements from MSCI.

According to SSI Research, the new circular is expected to be implemented in the fourth quarter of this year, providing a basis for FTSE Russell’s positive assessment in the September 2024 ranking and potentially leading to an upgrade decision for Vietnam in September 2025.

An upgrade to emerging market status could attract up to $1.6 billion in ETF inflows (excluding active fund inflows) and improve the market’s quality and attractiveness to professional foreign institutional investors. It would also help Vietnam’s stock market gain the attention of MSCI.

Vietnam’s Securities Market Development Strategy for 2021-2030 aims to upgrade the country’s stock market from frontier to emerging market status by 2025, in line with the classification standards of international organizations.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.