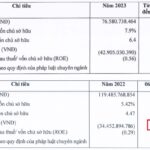

DIC Corporation (stock code: DIG) has released its reviewed financial statement for the first half of 2024, reporting a net revenue of VND 635 billion, a 77% increase from the previous year, despite a decrease of over VND 180 billion from their self-established report.

Their pre-tax profit, however, only reached VND 21.5 billion, a 55% drop from their initial report. When compared to the same period last year, DIC Corp’s profit has plummeted by over 95%. This significant decline can be attributed to a more than fivefold decrease in financial investment income, coupled with soaring expenses.

Source: Fireant – DIG stock fluctuations over time, currently at VND 22,800/share

For the full year 2024, DIC Corp set ambitious goals with a revenue target of VND 2,300 billion and a pre-tax profit of VND 1,010 billion, six times higher than the previous year’s performance. However, after the first half, they have only achieved 28% of their revenue target and a mere 2% of their profit goal.

The company faced similar challenges last year when they fell short of their profit target of VND 1,000 billion. As a result of this news, DIG shares dropped by nearly 2% in the morning session on September 4th, trading at VND 22,800 per share.

DIC Group’s shareholders have endured a series of shocks recently, including the passing of the former Chairman of the Board, Nguyen Thien Tuan, on August 10th. On August 12th, two securities companies, Shinhan Securities and Mirae Asset Securities Vietnam, announced the forced sale of 5.3 million DIG shares previously owned by Mr. Tuan.

Subsequently, the Government Inspectorate released an audit conclusion on the observance of laws during the corporatization and state capital divestment at the Investment and Development Corporation (now DIC Corp). The conclusion stated that the Ministry of Construction’s basis for establishing the enterprise’s corporatization plan, according to Government Decree 187/2004, was incorrect.

The Government Inspectorate also found that Decision 1094/QD-BXD, approving the enterprise’s corporatization value, was made without proper review by the Steering Committee for Corporatization, contrary to the guidelines of the Ministry of Finance and Government Decree 109/2007.

“The limitations, shortcomings, and violations led to the omission of certain procedures: The Investment and Development Corporation did not establish a land use plan and did not determine the value of the location advantage for leased urban land to be included in the enterprise’s value,” the audit conclusion stated.

Additionally, the consulting unit, VIVACO, incorrectly determined the capital investment quota and the original value of two construction works on the land, resulting in a valuation discrepancy of nearly VND 2.5 billion. VIVACO also failed to reassess the land use rights of 25 villas in the Phuong Nam Villa Area, contrary to government regulations.

In the market, after peaking at VND 34,000 per share in mid-April 2024, DIG shares have been on a downward trend, falling to below VND 22,000 per share in mid-August. The stock surged to nearly VND 26,000 per share on August 28th but has since disappointed investors with continuous adjustments, currently trading at VND 22,800 per share.

Compared to the beginning of 2024, the stock has decreased by nearly 15%. Compared to its golden days when it traded above VND 100,000 per share, DIG stock has lost almost five times its value.

Renewable Energy Vietnam: Reducing Losses, Bond Debt Cleared Under SP Group’s Stewardship

The Vietnam Renewable Energy JSC (VRE) has made significant strides in reducing its losses, yet it continues to face a cumulative deficit of over VND 126 billion. A notable achievement for the company was the successful repayment of bond debts in the first half of 2024, shortly after coming under the ownership of SP Group.

The Electric Car Distributor’s Plight: A Record Loss in Vietnam

“Wuling’s Mini EV is now in Vietnam, distributed by TMT Motor. However, the company has hit a rough patch in the first half of 2024, with losses amounting to nearly 100 billion VND. With short-term debts exceeding short-term assets by 120.7 billion VND, the auditing firm has expressed doubts about TMT Motor’s ability to continue operating.”