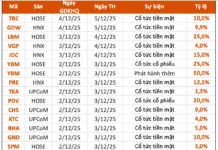

FiinGroup has released a report on the “Income of CEOs, Chairpersons, and Independent Board Members in Public Companies in Vietnam in 2023.” The report was compiled using data from 200 out of 1647 public companies listed or registered for stock trading on 3 exchanges (HOSE, HNX, and UPCoM). The sample includes 15 out of 27 banks, 9 out of 43 securities companies, 3 out of 14 insurance companies, and 173 out of 1563 businesses from other sectors (non-financial).

The criteria for inclusion were companies with a market capitalization of 500 billion VND or more at the end of 2023. The top 30 largest companies were selected from 19 sectors according to the FTSE Russell industry classification (ICB level 2)

The report’s analysis is based solely on data from the public disclosures of these public companies.

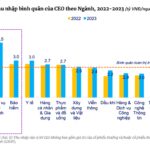

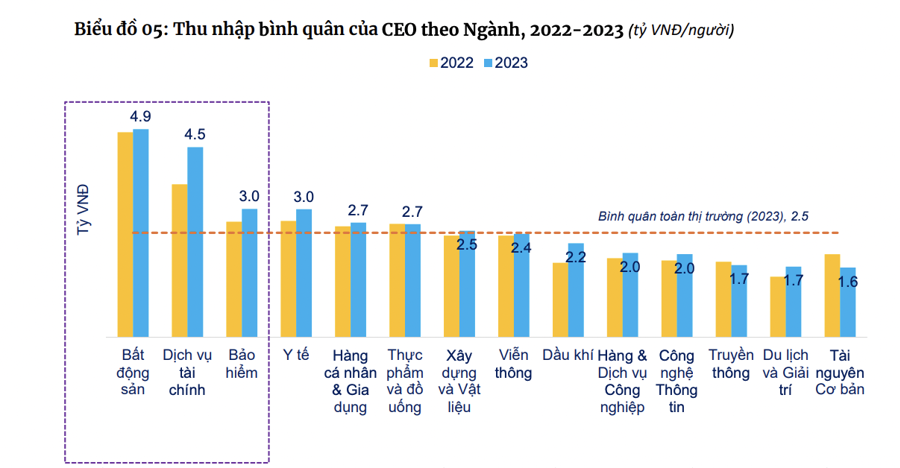

According to the report, the average income of CEOs in public companies in Vietnam, excluding ESOP benefits, was below 2.5 billion VND per year in 2023.

Real Estate, Financial Services (mainly Securities and Insurance), formed the top 3 industries with the highest average CEO income, surpassing the market average. Notably, some companies in the top 15 highest-paying enterprises have foreign CEOs, including Masan (MSN) and Nam Long Real Estate (NLG)

CEOs in state-owned enterprises earned less than half of their private-sector counterparts, despite similar operational efficiency as measured by return on equity (ROE). This disparity arises from the current structure, where the Chairperson of the Board in state-owned enterprises also holds an executive role.

CEOs in large-cap companies enjoyed significantly higher incomes, approximately 52% higher than the market average in 2023. This aligns with the superior operational efficiency observed in this group compared to the other two categories.

While the Information Technology, Banking, and Retail sectors demonstrated better-than-average performance with ROE above 15% in 2023, the average CEO income in these industries remained relatively low. This is because the figure does not account for the value of stock options granted to executives through ESOP programs.

Despite the challenges faced by the Real Estate industry, with declining performance over consecutive years, CEO compensation in this sector remained the highest among all industries.

Looking specifically at 2023, CEO income was not closely linked to company value growth targets in most industries. This is because executive compensation is typically determined in advance, and in Vietnam, company value growth is not commonly used as a KPI or for setting remuneration packages for key executive positions.

In 2023, industries with high rates of achieving post-tax profit plans, such as Oil and Gas, Financial Services (mainly Securities), and Insurance, witnessed substantial increases in the average income of CEOs. On the other hand, amid subdued consumer demand, the Retail and Basic Resources (Steel, Wood, etc.) sectors underperformed in 2023, leading to a decrease in the average income of CEOs compared to the previous year.

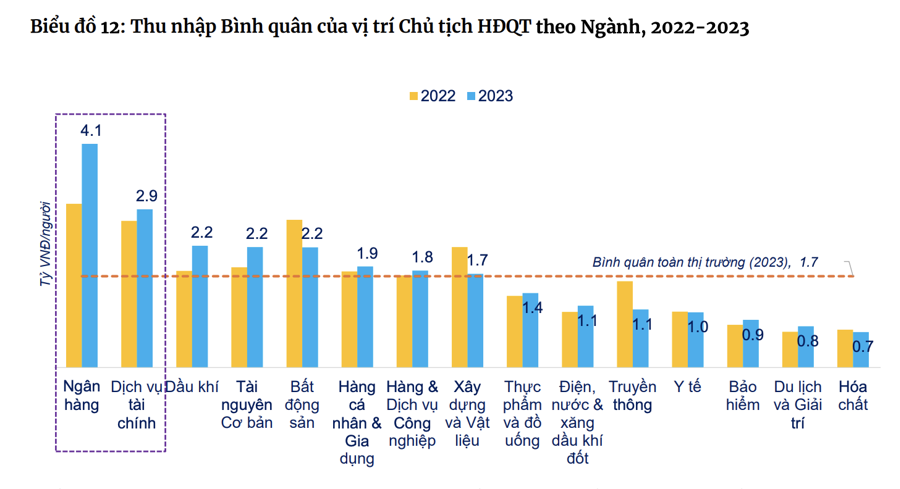

Turning to the Chairperson role, the income of Board Chairpersons was notably higher in the Banking and Financial Services sectors, particularly in Securities companies, and in several other prominent enterprises (including PNJ, VHM, NLG, NTP, and REE). This can be attributed not only to the size and leading positions of these companies but also to the involvement of Board Chairpersons in certain operational tasks, sharing some of the responsibilities typically associated with the CEO role.

A significant correlation was observed between the income of Board Chairpersons and operational efficiency in the Banking industry. Both the average income of Board Chairpersons and the average ROE for the Banking sector were high, influenced by the fact that many bank chairpersons also hold executive roles.

In contrast, despite high operational efficiency (ROE), the Information Technology and Retail sectors exhibited very low average incomes for Board Chairpersons.

Similar to the CEO role, the income of Board Chairpersons in 2023 was not closely tied to company value growth targets in most industries. Executive compensation is typically set in advance, and in Vietnam, company value growth is not a standard KPI for determining remuneration for key executive positions.

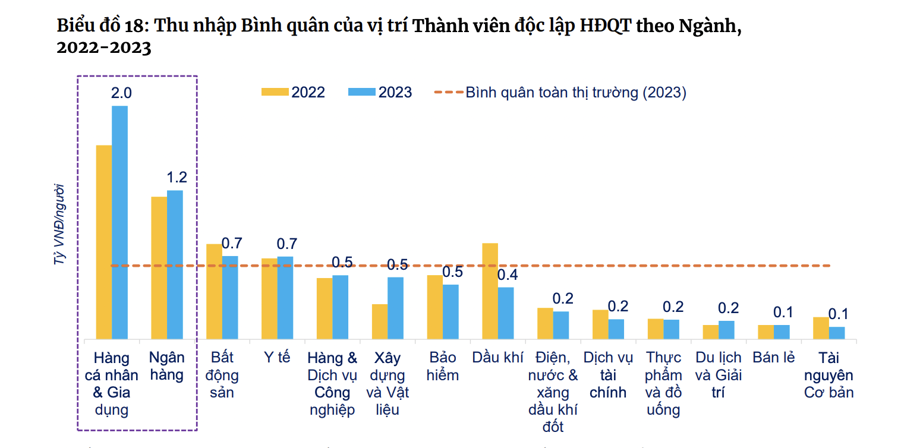

For Independent Board Members, there were significant variations in average income across industries. Specifically, the highest average incomes were found in the Personal Goods sector (PNJ) and the Banking sector, at 2 billion VND and 1.2 billion VND per year, respectively, while the majority of other industries offered compensation ranging from 100 to 500 million VND per year.

Enterprises with higher remuneration packages tend to be industry leaders. Additionally, independent board members who receive higher compensation often take on additional specific roles, such as serving on committees like the Audit Committee or the Strategy Committee, within those enterprises.

The Average Annual Income of Real Estate CEOs Reaches 4.9 Billion VND, Topping 14 Industry Sectors: KBC CEO Leads the Pack with a 17-Billion-VND Payday in 2023

A recent survey by FiinGroup of 200 public companies revealed that CEOs in the real estate industry earned an average of 4.9 billion VND per year, topping the list of 14 sectors. The highest-paid CEO in this industry was Ms. Nguyen Thi Thu Huong of KBC, who took home a impressive 17 billion VND in 2023.

Unveiling the “Massive” Income of Chairpersons and CEOs in the Banking and Real Estate Sectors

The average income of a CEO in the real estate, securities, and insurance industries is an impressive 2.5 billion VND per year. This figure showcases the potential earnings of those at the top of these lucrative sectors. It is a testament to the rewards that come with leadership and expertise in these fields.

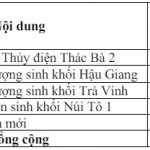

The Fertilizer and Chemical Company Reports Hefty Profits for the First Half

In Q2 of 2024, most fertilizer and chemical companies, including Ca Mau Nitrogenous Fertilizer, Phu My Fertilizer, and the Vinachem group, reported robust profits. Despite a slight dip, Duc Giang Chemical still leads the industry in profitability.