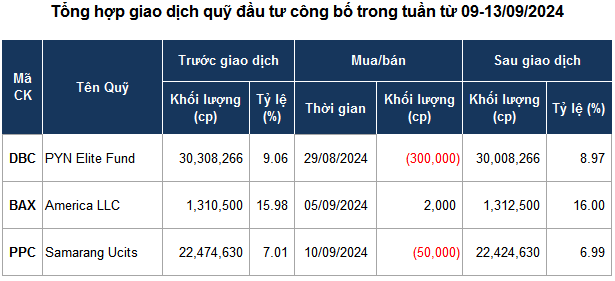

There was only one investment fund that reported transactions made during the past week, with a relatively low volume.

Specifically, the Samarang Ucits – Samarang Asian Prosperity (Luxembourg) fund sold 50,000 PPC shares (Phả Lại Thermal Power Joint Stock Company) during the 10/09 session, reducing its ownership below the 7% threshold to just over 22.4 million shares.

| PPC share price movement from the beginning of 2024 to the 13/09 session |

Three months prior, this foreign fund also reported selling 50,000 PPC shares in the 04/06 session, reducing its capital ownership from 8.01% (25.7 million shares) to 7.99% (25.6 million shares).

Considering the volume of PPC shares before and after the 04/06 and 10/09 transactions, it can be deduced that the foreign fund has net sold a total of 3.25 million PPC shares in the past three months.

The sale of PPC shares by the foreign fund comes as the share price continues its downward spiral after reaching a peak of 17,000 VND/share on 27/06. As of the latest 13/09 session, PPC shares have lost 28% of their value since the peak.

Source: VietstockFinance

|

Failed Divestment: REE Subsidiary Unable to Withdraw from Pha Lai Thermal Power

The REE Energy Company failed to sell any of the 2 million registered PPC shares, thus maintaining its 20.74% ownership stake. Prior to this, REE Energy had been consistently offloading PPC shares.

The Rise of Foreign Shareholders: Unveiling the Growing Ownership in TTC AgriS

Foreign shareholders continue to increase their ownership stake in Thanh Thanh Cong – Bien Hoa Joint Stock Company (TTC AgriS), demonstrating a strong vote of confidence in the company’s “green” business strategy and its capacity for sustainable development. This vote of confidence is a testament to TTC AgriS’s commitment to environmental sustainability and its ability to strike a balance between financial growth and ecological responsibility.