According to the Director of the Payment Department (State Bank of Vietnam), in the first half of 2024, cashless payment transactions reached 7.83 billion, with a value of VND 134.9 million billion, an increase of nearly 60% in volume and over 35% in value compared to the same period in 2023. Digital banking applications and e-wallets have significantly contributed to this growth.

Among them, MoMo stands out as a leading digital financial platform with unwavering efforts to support Vietnamese people in easily and affordably accessing financial and daily services.

With the relentless and pioneering spirit, the Super App MoMo has built a vast ecosystem with nearly 30 million users and over 300,000 payment acceptance points. It has also become a strategic partner of all banks and financial companies in Vietnam.

A Diverse Financial Ecosystem

In a constantly evolving society with a range of premium services, MoMo remains committed to meeting most of its users’ essential needs in areas such as online shopping, air ticketing, payment for dining and insurance services, money transfer/receipt, and more.

Apart from delivering a perfect experience, what keeps users loyal to MoMo is its super app’s diverse ecosystem beyond just money transfer and payment. It encompasses financial services, e-commerce, entertainment, travel and experiences, shopping, transportation, dining services, charitable donations, and more.

As a devotee of cashless payments, Ms. Ngoc Ha from Hanoi shared that she now only needs her smartphone when going to work, hanging out, or shopping. Among various cashless payment methods, she prefers using MoMo the most. The feature of opening the MoMo app to scan VietQR codes (bank QR codes) has helped her and many others overcome barriers to cashless payments.

Pioneering the Use of AI and Big Data

MoMo takes the lead in the digital finance field through features like eKYC and collaboration with banks, allowing users to open bank accounts directly on the app within just 2-3 minutes. This process reduces partner banks’ costs by 50% compared to traditional procedures.

MoMo’s AI technology speeds up financial institutions’ and banks’ loan approval and processing by 10 to 30 times compared to traditional methods, doubling the approval rate. This makes financial services more accessible and effective for Vietnamese people.

MoMo also utilizes AI chatbots to automatically assist customers, quickly addressing common issues and reducing customer support response time by over 60%, ensuring timely and efficient assistance.

Additionally, MoMo has been a pioneer in applying Big Data and AI technology to score user reliability, personalizing financial services. Users with high “MoMo Trust Scores” gain earlier access to financial services on the app. This approach also encourages healthy spending behaviors, helping Vietnamese build a solid financial foundation.

Unceasing Innovation

MoMo constantly innovates and pioneers the promotion of digital finance by continuously developing new financial products to meet market demands and expand financial access for all customer segments. MoMo not only offers investment opportunities but also serves as a comprehensive financial management platform.

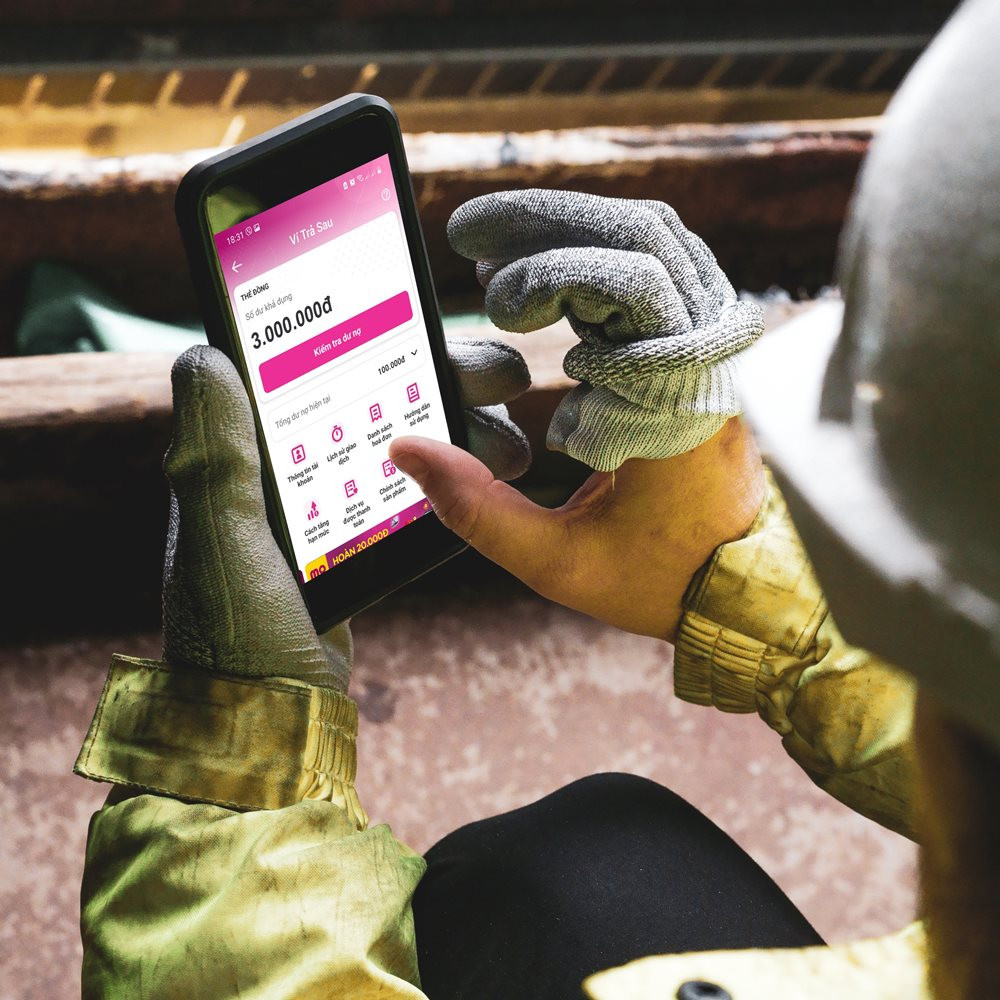

MoMo provides diverse financial products such as Buy Now Pay Later, Fund Certificates, Online Savings, Super-speed Finance, Credit Card Opening, and Loan and Insurance Payment. All these products result from close collaboration between MoMo and financial institutions and banks, offering users convenient and effective financial solutions.

Through innovation, MoMo has made financial products and services, previously exclusive to high-income earners, accessible to everyone, especially middle and low-income customers. Buy Now Pay Later, for instance, employs AI technology to approve loans for young people, enabling them to access credit early and benefit from credit products in their daily lives.

Notably, MoMo has been proactive in collaborating with financial and banking organizations to introduce digital financial services such as lending, savings, and investment. With MoMo, users can view their payment, investment, and, in the future, loan and credit accounts on a single platform. They can also get an overview of their assets, account balances, and debts.

Furthermore, users can easily explore and access new financial products, consider attractive investment opportunities or loan offers, and make informed decisions aligned with their financial health and goals. For instance, customers can save as little as VND 500,000, invest in fund certificates from VND 10,000, or invest in stocks starting with one share.

Evidently, MoMo is becoming an indispensable part of daily life for many Vietnamese, contributing to the country’s digital transformation journey. This is also why the Super App MoMo has been nominated for the “Pioneering Brand in Digital Finance” category at the Better Choice Awards 2024.

Better Choice Awards recognizes and honors the “Innovative Values” of products, services, and achievements that bring practical benefits to consumers, creating a difference by not seeking the “best choice in the segment” but instead focusing on meeting the actual needs of users to help them find the most suitable brands and products.

The award opened for public voting on September 9, 2024, after a press conference at the headquarters of the Ministry of Planning and Investment, 6B Hoang Dieu. The voting will close on September 24, 2024. Cast your vote for your favorite brand to win the nomination at Better Choice Awards 2024 via the website: https://betterchoice.vn/

Unveiling CMC’s AI Transformation Strategy: “Empowering Your AI Journey”

On September 11, in Hanoi, the CMC Technology Group hosted an event to unveil its AI transformation strategy, titled “Enable Your AI-X.”

KienlongBank: Vietnam’s Best Workplace & Customer Service Bank 2024

KienlongBank is proud to announce that it has once again been recognized as one of the “Best Places to Work in Vietnam” for 2024 by World Economic Magazine. This prestigious accolade reflects the bank’s unwavering commitment to creating a positive and rewarding work environment for its employees. In addition, the bank has also been lauded in the “Best Customer Service Bank in Vietnam 2024” category, a testament to its exceptional service and dedication to customer satisfaction.